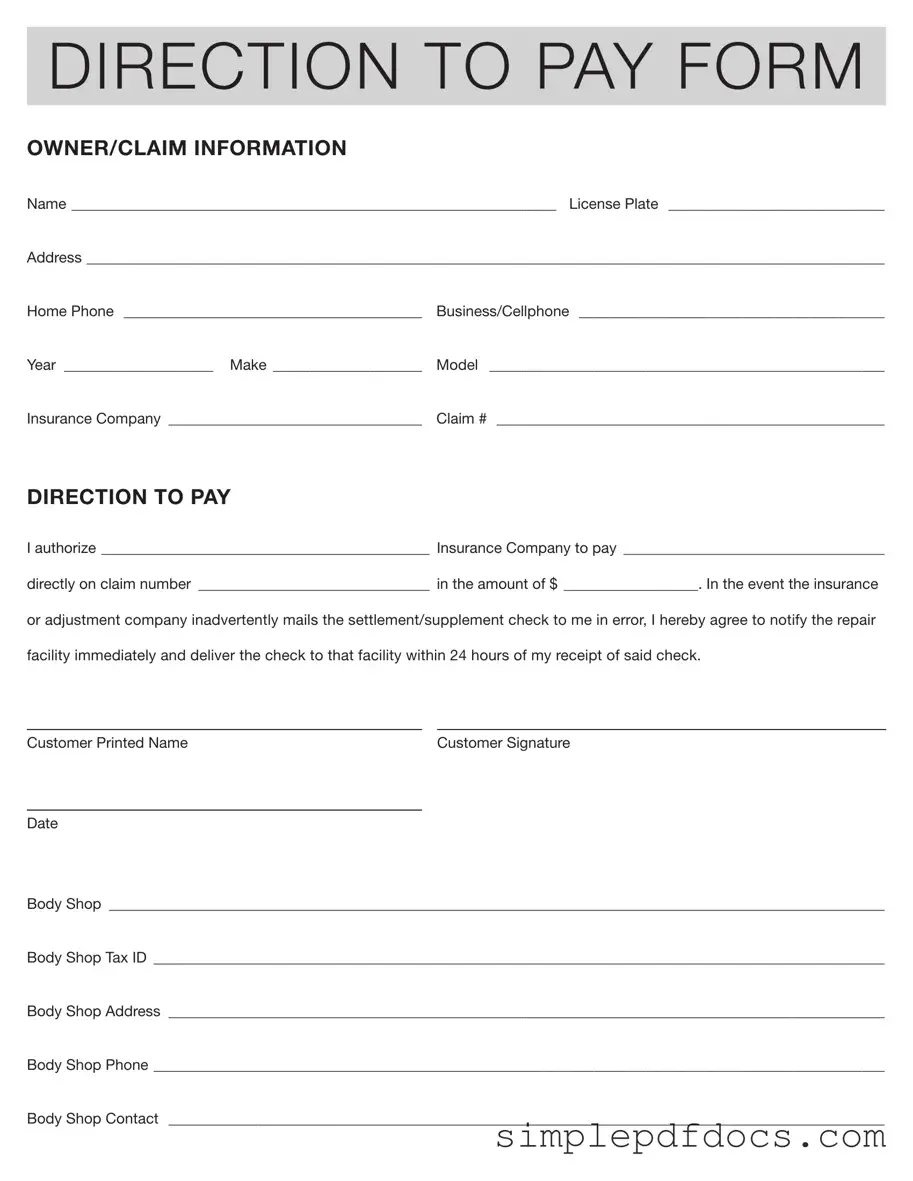

Fill Your Authorization And Direction Pay Form

When navigating the often complex landscape of insurance claims, the Authorization And Direction Pay form serves as a crucial tool for both claimants and repair facilities. This form facilitates a streamlined process by allowing the claimant to authorize their insurance company to directly pay the repair shop for services rendered. By filling out the form, the owner provides essential information, including their name, contact details, and specifics about the vehicle involved in the claim. Additionally, the form requires the claimant to specify the insurance company and claim number, ensuring that all parties are aligned in the payment process. Importantly, the form also includes a directive that obligates the claimant to promptly return any misdirected checks to the repair facility within 24 hours. This ensures that the repair shop receives timely payment, allowing them to proceed with necessary repairs without delay. Furthermore, the form captures vital details about the body shop, such as its tax ID, address, and contact information, which helps maintain clear communication among all involved parties. Overall, the Authorization And Direction Pay form is designed to simplify the payment process, fostering cooperation between claimants, insurance companies, and repair facilities.

More PDF Templates

Dr312 - The form serves as proof that the estate is not subject to Florida estate tax under Chapter 198.

A Florida Commercial Lease Agreement is a legally binding document that outlines the terms and conditions under which a property owner leases commercial space to a tenant. This agreement typically includes details such as rental amount, duration of the lease, and responsibilities of both parties. For more information and resources on this process, you can visit Florida Forms. Understanding this form is essential for both landlords and tenants to ensure a clear and mutually beneficial rental relationship.

Free Printable D1 Form - Current identity documentation is crucial for verifying your application.

4562 Form Instructions - Schedule C is designed for sole proprietorships or single-member LLCs to detail their business activities.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Authorization and Direction to Pay form allows a vehicle owner to direct an insurance company to pay a repair facility directly for services rendered. |

| Claim Information | This form requires essential information such as the owner's name, license plate number, and claim number to ensure accuracy and proper processing. |

| Insurance Company Role | The form specifies the insurance company responsible for the claim, ensuring that the right entity is instructed to make the payment. |

| Owner's Responsibility | If the insurance company mistakenly sends the check to the vehicle owner, they must notify the repair facility and deliver the check within 24 hours. |

| Body Shop Information | Details about the body shop, including its name, address, tax ID, and contact information, are required to facilitate payment processing. |

| Signature Requirement | The form must be signed by the vehicle owner, confirming their authorization for the insurance payment to be directed to the repair facility. |

| Governing Law | In many states, the use of this form is governed by state insurance regulations, which may vary. It's important to check local laws for specific requirements. |

How to Write Authorization And Direction Pay

Once you have the Authorization And Direction Pay form ready, you will need to fill it out carefully. This form is essential for directing payments related to your insurance claim. Follow these steps to ensure that all information is accurately provided.

- Begin by entering your Name in the designated space.

- Fill in your License Plate number.

- Provide your Address in the appropriate field.

- Enter your Home Phone number.

- If applicable, include your Business/Cellphone number.

- Indicate the Year of your vehicle.

- Write down the Make of your vehicle.

- Specify the Model of your vehicle.

- List your Insurance Company name.

- Provide your Claim # in the specified area.

- In the DIRECTION TO PAY section, write the name of the insurance company you are authorizing to pay.

- Next, fill in the name of the recipient who will receive the payment directly.

- Enter the claim number again in the provided space.

- Specify the amount to be paid.

- Read the agreement about notifying the repair facility in case of receiving a check in error.

- Print your Customer Printed Name in the space provided.

- Sign the form in the Customer Signature area.

- Write the Date of signing the form.

- Fill in the Body Shop name and address.

- Provide the Body Shop Tax ID.

- Enter the Body Shop Phone number.

- Finally, list the Body Shop Contact person.

Dos and Don'ts

When filling out the Authorization and Direction Pay form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are six things you should and shouldn't do:

- Do provide accurate and complete information in all fields.

- Don't leave any sections blank; missing information can delay processing.

- Do double-check the claim number and the amount you are authorizing for payment.

- Don't forget to sign and date the form; your signature is essential for authorization.

- Do notify the repair facility immediately if you receive the settlement check by mistake.

- Don't ignore the requirement to deliver any mistakenly received checks to the repair facility within 24 hours.

Documents used along the form

The Authorization and Direction Pay form is a crucial document in the claims process, facilitating direct payment from an insurance company to a repair facility. However, several other forms and documents may accompany this form to ensure a smooth transaction and proper documentation. Below is a list of commonly used forms that may be relevant in conjunction with the Authorization and Direction Pay form.

- Claim Form: This document is completed by the policyholder to formally report a loss to the insurance company. It provides essential details about the incident, including the date, location, and nature of the claim.

- Notice to Quit Form: This form is vital for landlords wishing to formally notify tenants of a lease violation or the non-renewal of their tenancy. For further details, you can refer to https://floridaforms.net/blank-notice-to-quit-form/.

- Proof of Loss: This document serves as a declaration by the claimant, detailing the extent of the damages or losses incurred. It is often required by the insurance company to process the claim efficiently.

- Repair Estimate: A detailed estimate provided by the repair facility outlining the costs associated with the necessary repairs. This document helps the insurance company determine the amount to be paid out.

- Assignment of Benefits (AOB): This document allows the policyholder to transfer their rights to receive benefits from the insurance company directly to the repair facility. It simplifies the claims process by enabling the repair shop to deal directly with the insurer.

- Release of Liability: This form is signed by the policyholder, releasing the insurance company from any further claims related to the incident after payment has been made. It protects the insurer from future disputes regarding the claim.

- Vehicle Title or Registration: This document proves ownership of the vehicle involved in the claim. It may be necessary for the insurance company to verify ownership before processing payments.

- Insurance Policy Document: This is the actual policy that outlines the coverage terms, limits, and conditions. It is essential for understanding what is covered under the policyholder's insurance plan.

- Identity Verification Documents: These may include a driver’s license or another form of identification. They are often required to verify the identity of the claimant and ensure that the correct individual is processing the claim.

By understanding these additional forms and documents, individuals can navigate the claims process more effectively. Each document plays a specific role, contributing to the overall efficiency and clarity of the transaction between the policyholder, insurance company, and repair facility.