Attorney-Approved Vehicle Repayment Agreement Form

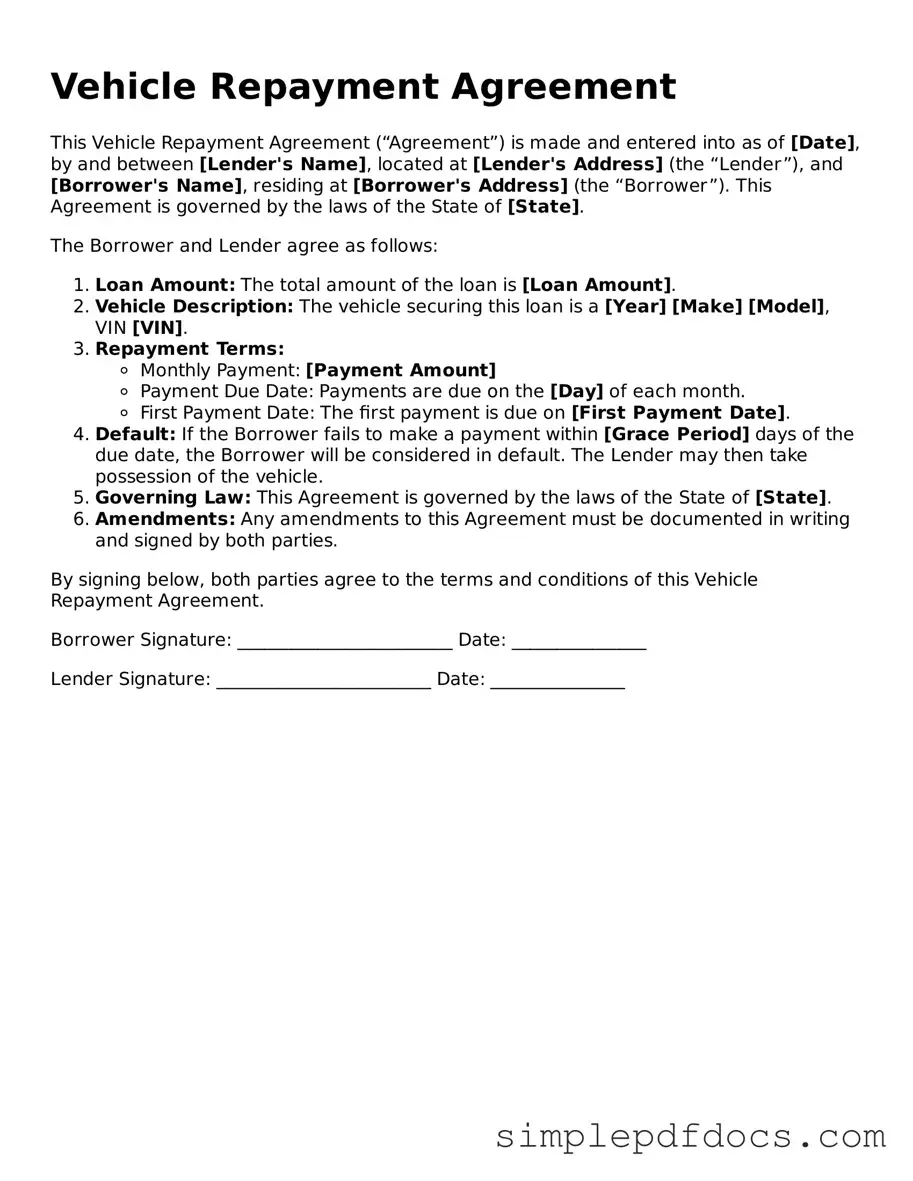

The Vehicle Repayment Agreement form is a crucial document for anyone involved in financing or purchasing a vehicle. This form outlines the terms and conditions under which a buyer agrees to repay a loan or lease for a vehicle. It typically includes essential details such as the total amount financed, the interest rate, and the repayment schedule. Additionally, it specifies the consequences of defaulting on payments, which can include repossession of the vehicle. Clear communication of these terms is vital for both the lender and the borrower, as it helps to prevent misunderstandings and disputes. By establishing a formal agreement, both parties can ensure that their rights and responsibilities are clearly defined, paving the way for a smoother transaction. Understanding the key components of this form is essential for anyone looking to navigate the complexities of vehicle financing effectively.

Check out Other Documents

Contractor Intent to Lien Letter Template - Completing this form accurately helps protect contractors' interests in construction projects.

For those looking to ensure a proper transaction, the process can be simplified with a well-prepared efficient Georgia Tractor Bill of Sale form that outlines the essential elements of the sale, making it a vital resource for buyers and sellers alike.

Affidavit Death of Joint Tenant California - It can aid in expediting the transfer of property ownership among survivors.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms and conditions under which a borrower agrees to repay a loan for a vehicle. |

| Key Components | This form typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. |

| State-Specific Variations | Each state may have its own version of the form, governed by state laws that dictate the terms of vehicle financing and consumer protection. |

| Legal Compliance | Using this form ensures compliance with applicable state laws, which may include the Uniform Commercial Code (UCC) and specific vehicle financing regulations. |

| Importance of Clarity | Clear terms in the Vehicle Repayment Agreement help prevent misunderstandings between lenders and borrowers, fostering a better financial relationship. |

How to Write Vehicle Repayment Agreement

Completing the Vehicle Repayment Agreement form is an important step in managing your vehicle repayment process. After filling out this form, you will need to submit it to the appropriate party for review and approval. This ensures that all terms and conditions are clearly understood and agreed upon.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your current address, including the city, state, and zip code.

- Next, fill in your contact information, including your phone number and email address.

- Identify the vehicle by entering the make, model, year, and Vehicle Identification Number (VIN).

- Clearly state the total amount owed on the vehicle.

- Indicate the repayment terms, including the payment amount and due date.

- Sign and date the form at the bottom to confirm your agreement to the terms outlined.

Once you have completed all the steps, review the form for accuracy before submitting it. Keeping a copy for your records is also advisable, as it may be needed for future reference.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it's important to follow certain guidelines to ensure accuracy and completeness. Here are some things to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about your vehicle and repayment terms.

- Do check for any required signatures before submitting the form.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't submit the form without reviewing it for errors.

- Don't forget to include any supporting documents that may be required.

Documents used along the form

The Vehicle Repayment Agreement form is an essential document for individuals entering into a vehicle financing arrangement. However, several other forms and documents are often used in conjunction with this agreement to ensure clarity and legal compliance. Below is a list of these important documents.

- Loan Application Form: This document collects personal and financial information from the borrower. It helps lenders assess creditworthiness and determine the terms of the loan.

- Promissory Note: A legally binding contract in which the borrower agrees to repay the loan amount, detailing the repayment schedule, interest rate, and consequences of default.

- Vehicle Release of Liability Form: This essential document officially transfers responsibility from the seller to the buyer and ensures that the seller is no longer liable for future incidents involving the vehicle. For more information, visit https://smarttemplates.net/fillable-vehicle-release-of-liability/.

- Bill of Sale: This document serves as proof of purchase for the vehicle. It includes details about the buyer, seller, vehicle identification number (VIN), and sale price.

- Title Transfer Document: This form is necessary to transfer ownership of the vehicle from the seller to the buyer. It ensures that the new owner is legally recognized and can register the vehicle.

- Insurance Verification Form: Lenders often require proof of insurance before finalizing a loan. This form confirms that the borrower has adequate coverage for the financed vehicle.

- Credit Report Authorization: This document allows the lender to access the borrower's credit history. It is a critical step in evaluating the risk associated with the loan.

Each of these documents plays a vital role in the vehicle financing process. Understanding their purpose can help borrowers navigate their agreements more effectively and ensure all legal requirements are met.