Attorney-Approved Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TOD Deed) is a valuable estate planning tool that allows individuals to transfer real property to designated beneficiaries without the need for probate. This form enables property owners to maintain control over their assets during their lifetime while ensuring a smooth transition to heirs upon their death. One of the key features of a TOD Deed is that it can be revoked or modified at any time before the owner's passing, providing flexibility in estate planning. Beneficiaries named in the deed do not acquire any rights to the property until the owner dies, which helps avoid complications during the owner’s lifetime. Additionally, the TOD Deed is typically straightforward to complete, requiring essential information such as the property description and the names of the beneficiaries. This approach not only simplifies the transfer process but also minimizes the administrative burden on loved ones after the owner’s death. Understanding the nuances of the Transfer-on-Death Deed can empower individuals to make informed decisions about their estate, ensuring that their wishes are honored and their heirs are supported.

State-specific Transfer-on-Death Deed Forms

More Transfer-on-Death Deed Types:

California Corrective Deed - This document supports transparency and trust in property ownership.

Having a Florida Durable Power of Attorney is essential for anyone looking to safeguard their financial and legal interests. This document allows the principal to designate an agent who can act on their behalf, ensuring that their decisions are carried out even in times of incapacitation. For those seeking to create this important document, resources such as Florida Forms can provide valuable assistance in understanding and fulfilling the necessary steps.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| State-Specific Forms | Each state has its own Transfer-on-Death Deed form. Check your state's requirements for the correct version. |

| Governing Laws | The laws governing Transfer-on-Death Deeds vary by state. For example, California's law is found in the California Probate Code. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed. This designation is crucial for the transfer to occur. |

| Revocation | A Transfer-on-Death Deed can be revoked or changed at any time before the owner's death, provided the owner follows state guidelines. |

| No Immediate Transfer | The property does not transfer to the beneficiary until the owner passes away. Until then, the owner retains full control. |

| Tax Implications | Beneficiaries may face tax implications upon the transfer of property. Consulting a tax professional is advisable. |

| Filing Requirements | Most states require the deed to be filed with the county recorder's office to be valid. Check local regulations for specifics. |

| Limitations | Not all types of property can be transferred using a Transfer-on-Death Deed. For example, some states may restrict this for certain properties. |

How to Write Transfer-on-Death Deed

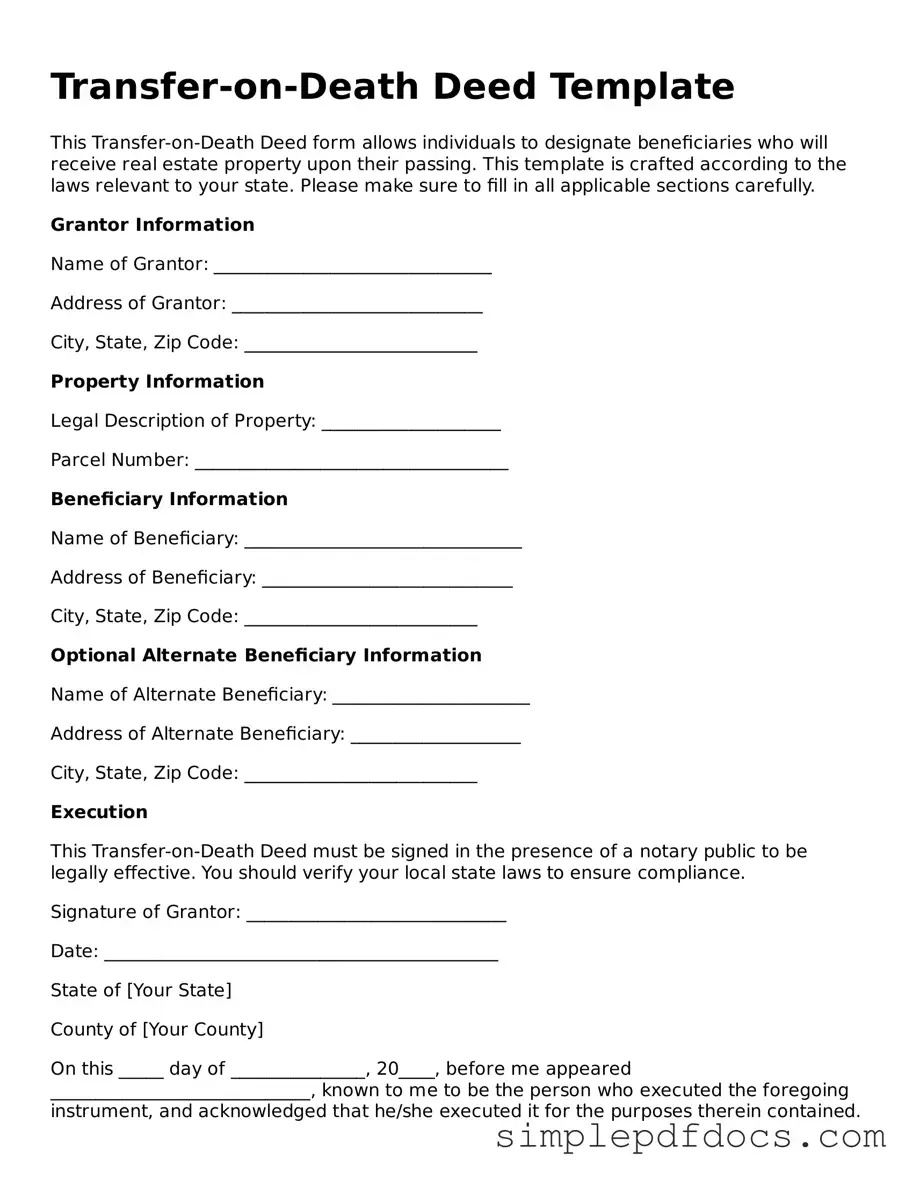

Filling out a Transfer-on-Death Deed form is a straightforward process. This document allows you to designate a beneficiary who will receive your property upon your passing, without going through probate. After completing the form, you will need to sign it in front of a notary public and then record it with your local county office to ensure it is valid.

- Obtain the Transfer-on-Death Deed form from your local county office or an online legal resource.

- Enter your full name and address as the current property owner at the top of the form.

- Provide a legal description of the property you wish to transfer. This may include the property address and any parcel number.

- List the full name and address of the beneficiary you are designating to receive the property.

- Specify whether the transfer should occur upon your death or under specific conditions.

- Sign the form in the presence of a notary public. Ensure that the notary verifies your identity and witnesses your signature.

- Make copies of the completed and notarized form for your records.

- File the original Transfer-on-Death Deed with your local county recorder’s office to make it effective.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure accuracy and validity. Below is a list of things you should and shouldn't do:

- Do ensure that the property is clearly identified, including the legal description.

- Do include the names and addresses of all beneficiaries.

- Do sign the form in the presence of a notary public.

- Do check your state’s specific requirements for Transfer-on-Death Deeds.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to date the deed when signing it.

- Don't use vague language when describing the property.

- Don't neglect to file the deed with the appropriate county office.

- Don't assume that a verbal agreement with beneficiaries is sufficient; all details must be in writing.

Documents used along the form

A Transfer-on-Death Deed (TOD) allows individuals to transfer property to a designated beneficiary upon their death, bypassing the probate process. While the TOD deed itself is a crucial document, several other forms and documents may accompany it to ensure a smooth transfer of property and to clarify intentions. Below is a list of commonly used documents that may be relevant in conjunction with a Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can provide additional instructions and context regarding the transfer of property, including any specific wishes that may not be covered by the TOD deed.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the owner's death. They work in tandem with a TOD deed to ensure that all assets are directed to the intended beneficiaries.

- Access-A-Ride NYC Application Form: This document is used by eligible individuals to enroll in the Commuter Benefits Program Access-A-Ride/Paratransit plan, allowing for pre-tax deductions for transportation services. To complete the application, individuals must provide proof of eligibility and submit the form to their agency's Transit Benefit Coordinator. For more information, you can refer to NY Templates.

- Power of Attorney: This document grants someone the authority to make decisions on behalf of another individual. It can be useful for managing property and financial matters while the individual is still alive, ensuring that their wishes are respected.

- Affidavit of Heirship: This legal document is used to establish the heirs of a deceased person. It can help clarify ownership of property when the deceased did not leave a will or other clear instructions.

- Property Title Documents: These documents prove ownership of the property being transferred. They are essential for establishing the validity of the Transfer-on-Death Deed and ensuring that the beneficiary can take full ownership without disputes.

- Estate Inventory: This document lists all assets and liabilities of the deceased. It can help beneficiaries understand the overall estate and how the property transferred via the TOD deed fits into the larger picture.

Understanding these accompanying documents can provide clarity and assurance to individuals considering a Transfer-on-Death Deed. By ensuring that all necessary forms are in place, individuals can facilitate a smoother transition of property to their chosen beneficiaries.