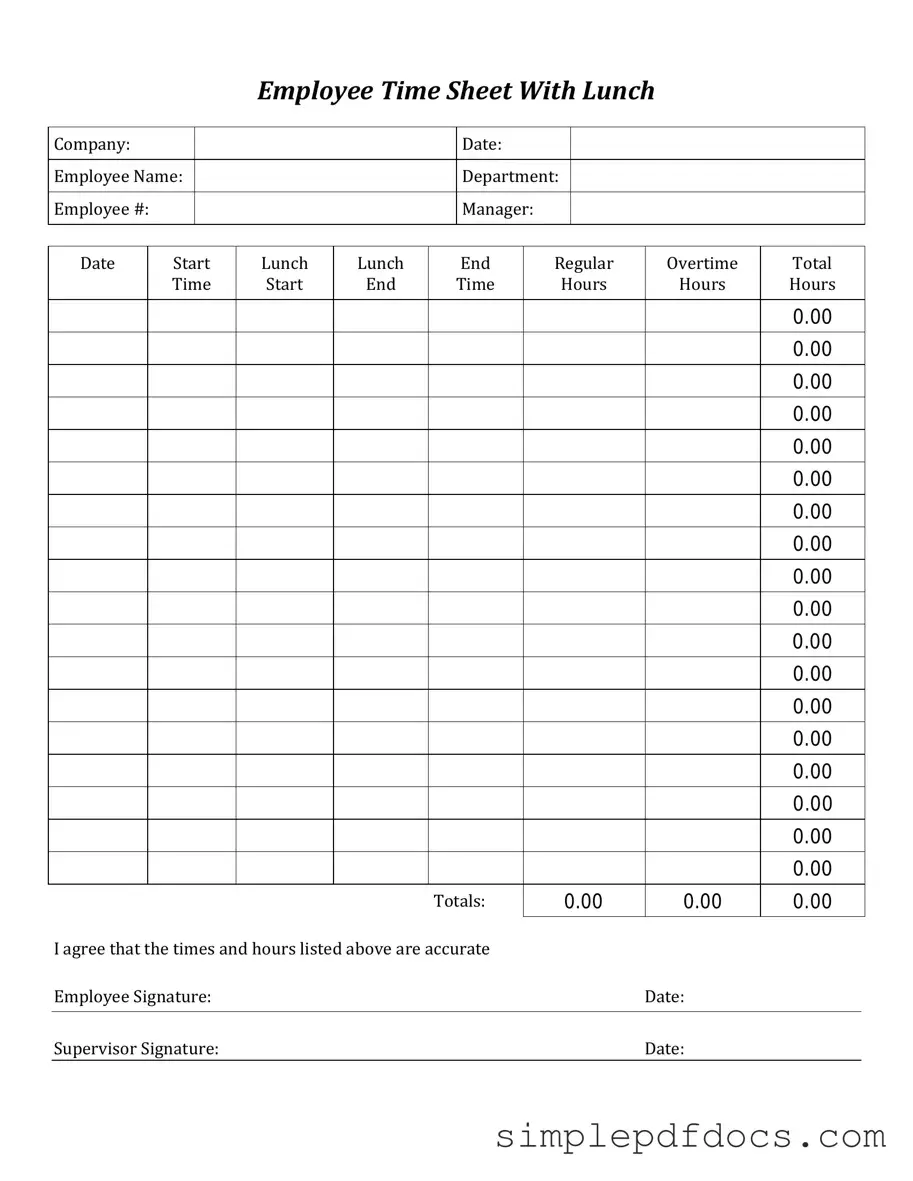

Fill Your Time Card Form

The Time Card form serves as a crucial tool for tracking employee hours and ensuring accurate payroll processing. It provides a structured way for workers to record their daily start and end times, as well as any breaks taken throughout the day. By using this form, employers can maintain clear records of attendance, which is essential for compliance with labor laws and regulations. Each entry on the Time Card reflects not only the hours worked but also any overtime, making it easier to calculate wages accurately. Additionally, this form often includes spaces for employees to note any specific tasks or projects they worked on, offering valuable insights into productivity. Overall, the Time Card form is not just a simple record; it plays a vital role in fostering transparency and accountability in the workplace.

More PDF Templates

Dr-835 - Taxpayers can use this form to allow someone else to handle tax-related issues for them.

In addition to understanding the requirements of the FR-44, individuals seeking to navigate the process can find helpful resources at Florida Forms, which provide guidance on the completion and submission of necessary paperwork to ensure compliance with state regulations.

Availability Form - Specify your available days and hours for us.

Imm5707 Canada - Use black ink to ensure readability during processing.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Time Card form is used to track employee hours worked, ensuring accurate payroll processing. |

| Employee Identification | Each Time Card must include the employee's name and identification number for proper record-keeping. |

| Weekly Submission | Employees are typically required to submit their Time Cards on a weekly basis to facilitate timely payroll. |

| Overtime Calculation | The form should clearly indicate hours worked over 40 in a week, as these may qualify for overtime pay under the Fair Labor Standards Act (FLSA). |

| State-Specific Requirements | Some states have specific regulations regarding time tracking; for example, California requires accurate reporting of all hours worked. |

| Signature Requirement | Most Time Cards require the employee's signature to verify the accuracy of reported hours. |

| Record Retention | Employers must retain Time Card records for a minimum of three years to comply with federal labor laws. |

| Digital vs. Paper | Time Cards can be maintained in either digital or paper format, but must be accessible for audits. |

| Adjustments | Any adjustments to hours worked must be documented and approved to ensure transparency and accuracy. |

| Impact on Benefits | Accurate Time Card submissions can affect eligibility for benefits, as hours worked may determine full-time status. |

How to Write Time Card

Completing the Time Card form is essential for accurately recording work hours. Follow these steps to ensure all necessary information is provided correctly.

- Begin by entering your name in the designated field at the top of the form.

- Fill in your employee ID number, if applicable.

- Indicate the pay period by writing the start and end dates.

- Record your daily hours worked for each day of the week in the corresponding boxes.

- If applicable, note any overtime hours in the specified section.

- Calculate the total hours worked for the pay period and write this number in the total hours box.

- Sign and date the form at the bottom to confirm accuracy.

Once you have completed these steps, submit the form to your supervisor or the designated department for processing.

Dos and Don'ts

When filling out the Time Card form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check your hours before submitting.

- Do use the correct project codes for your tasks.

- Do submit your Time Card on time to avoid delays in payment.

- Do ensure your supervisor has approved your hours.

- Do keep a copy of your submitted Time Card for your records.

- Don’t falsify hours worked; this can lead to serious consequences.

- Don’t forget to include breaks if applicable.

- Don’t submit a Time Card with missing signatures.

- Don’t use a different format than what is provided.

Documents used along the form

When managing employee hours and payroll, the Time Card form is just one piece of the puzzle. Several other forms and documents often accompany it to ensure accurate record-keeping and compliance with labor laws. Below is a list of these essential documents, each serving a unique purpose in the payroll process.

- Employee Information Form: This document collects essential details about the employee, such as their name, address, Social Security number, and tax information. It serves as a foundational record for payroll processing.

- W-4 Form: Employees complete this IRS form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account. It streamlines the payment process and can enhance employee satisfaction.

- Overtime Authorization Form: When employees work beyond their scheduled hours, this document ensures that their overtime is pre-approved. It helps maintain transparency and compliance with labor regulations.

- Leave Request Form: Employees use this form to formally request time off, whether for vacation, illness, or personal reasons. It helps employers track employee absences and manage workloads effectively.

- Pay Stub: This document provides a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period. It serves as a record for both the employer and employee regarding compensation.

- Trailer Bill of Sale Form: For ensuring ownership transfer is documented properly, refer to the Georgia trailer bill of sale requirements for a clear understanding of the process.

- Time-Off Balance Sheet: This sheet tracks the amount of paid time off (PTO) or sick leave an employee has accrued and used. It helps both employees and employers manage leave entitlements accurately.

Understanding these documents can help streamline payroll processes and ensure compliance with regulations. Keeping organized records not only benefits employers but also supports employees in managing their work-life balance effectively.