Legal Transfer-on-Death Deed Document for the State of Texas

The Texas Transfer-on-Death Deed (TODD) is a legal instrument designed to simplify the transfer of real property upon the death of the owner. This deed allows individuals to designate one or more beneficiaries who will receive the property without the need for probate, thus streamlining the estate settlement process. By executing a TODD, property owners retain full control over their property during their lifetime, including the ability to sell, mortgage, or revoke the deed at any time. The form must be properly completed and filed with the county clerk’s office to be valid, ensuring that the transfer takes effect automatically upon the owner's death. Importantly, the TODD does not create any present interest in the property for the beneficiaries, meaning they have no rights to the property until the owner passes away. This form offers a straightforward solution for property owners looking to pass their real estate to heirs while avoiding the complexities and costs associated with traditional probate proceedings.

Consider Other Common Transfer-on-Death Deed Templates for Specific States

Right of Survivorship Deed Pennsylvania - Once activated, beneficiaries assume ownership rights immediately upon the owner's passing.

Ohio Transfer on Death Form - This form is particularly useful for single property owners wishing to avoid probate complications.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. This form simplifies the process, making it faster and more straightforward to shift ownership. For those looking to utilize this document, you can find a blank form at https://floridaforms.net/blank-quitclaim-deed-form.

Problems With Transfer on Death Deeds in Virginia - This option is available for various types of real estate, making it a versatile estate planning tool.

Where Can I Get a Tod Form - This document can provide a clear pathway for property transfer that aligns with the owner's personal preferences.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon the owner's death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Estates Code, Chapter 114. |

| Eligibility | Only individuals who own real property in Texas can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the owner's death by filing a new deed or a revocation document. |

| No Immediate Transfer | The property does not transfer to the beneficiary until the owner's death. |

| Recording Requirement | The deed must be recorded in the county where the property is located to be valid. |

| Form Simplicity | The form does not require witnesses or notarization, making it straightforward to complete. |

| Tax Implications | The transfer does not trigger gift taxes, as the transfer occurs at death. |

| Limitations | Transfer-on-Death Deeds cannot be used for certain types of property, such as community property or property held in a trust. |

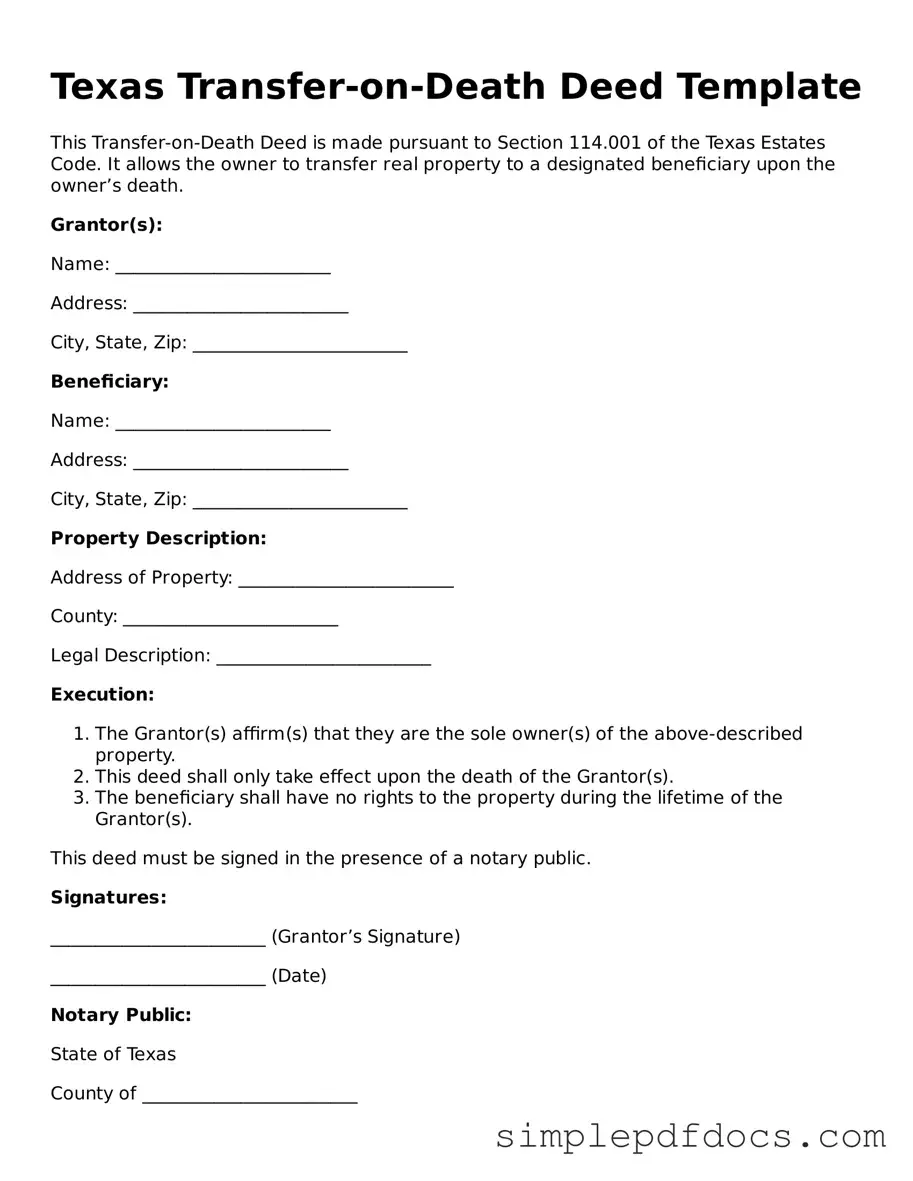

How to Write Texas Transfer-on-Death Deed

After obtaining the Texas Transfer-on-Death Deed form, you will need to fill it out carefully. This document allows you to designate a beneficiary who will receive your property upon your passing, without going through probate. Follow the steps below to complete the form accurately.

- Begin by entering your full name in the designated section. This identifies you as the property owner.

- Provide your current address. This should be the address where you reside.

- Next, describe the property you wish to transfer. Include the legal description, which can usually be found on your property tax statement or deed.

- In the section for beneficiaries, list the full name of the person or persons you want to inherit the property. Make sure to include their relationship to you.

- If you have more than one beneficiary, specify how the property should be divided among them. You can indicate percentages or specific shares.

- Sign the form in the presence of a notary public. Your signature must be notarized to make the deed valid.

- Finally, file the completed deed with the county clerk’s office in the county where the property is located. There may be a filing fee, so check with your local office for details.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure the document is completed correctly. Here is a list of things you should and shouldn't do:

- Do ensure that the property description is accurate and complete.

- Do include the names and addresses of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Do check that the form is filed with the county clerk's office before the property owner's death.

- Don't leave any sections of the form blank; all required information must be filled in.

- Don't forget to review the deed for any errors before submission.

- Don't use vague terms when describing the property; specificity is key.

Documents used along the form

The Texas Transfer-on-Death Deed is a useful tool for property owners who wish to transfer real estate upon their death without going through probate. However, there are several other forms and documents that may be used in conjunction with this deed to ensure a smooth transfer process. Below is a list of common documents often associated with the Transfer-on-Death Deed in Texas.

- Will: A legal document that outlines how a person's assets, including real estate, should be distributed upon their death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and can be used to clarify ownership of property when no will exists.

- Durable Power of Attorney: A legal document that allows one person to act on behalf of another in legal or financial matters. This can be useful if the property owner becomes incapacitated.

- Beneficiary Designation Forms: These forms are used for accounts such as life insurance and retirement accounts to specify who will receive the assets upon the owner's death.

- Deed of Trust: A document that secures a loan on real property. It can be relevant if the property has outstanding debts that need to be settled before transfer.

- Quitclaim Deed: A legal instrument that transfers interest in real property without guaranteeing that the title is clear. This may be used to transfer property between family members.

- Property Tax Exemption Applications: Forms that may be submitted to claim exemptions on property taxes, which can be important for heirs inheriting property.

- FR-44 Florida Form: This form is pivotal for ensuring compliance with Florida's Financial Responsibility Law regarding motor vehicle liability insurance coverage. For more information, refer to Florida Forms.

- Estate Inventory: A detailed list of all assets owned by a deceased person. This can help in the proper distribution of assets according to the will or state law.

- Notice of Death: A formal notification that informs relevant parties of an individual's death. This may be required for certain legal processes following the death.

- Real Estate Purchase Agreement: A contract that outlines the terms of a sale of real estate. This may be relevant if the property is to be sold rather than transferred to heirs.

Each of these documents plays a significant role in the management and transfer of property and assets. When used in conjunction with the Texas Transfer-on-Death Deed, they can help ensure that the property is transferred smoothly and in accordance with the owner's wishes.