Fill Your Texas residential property affidavit T-47 Form

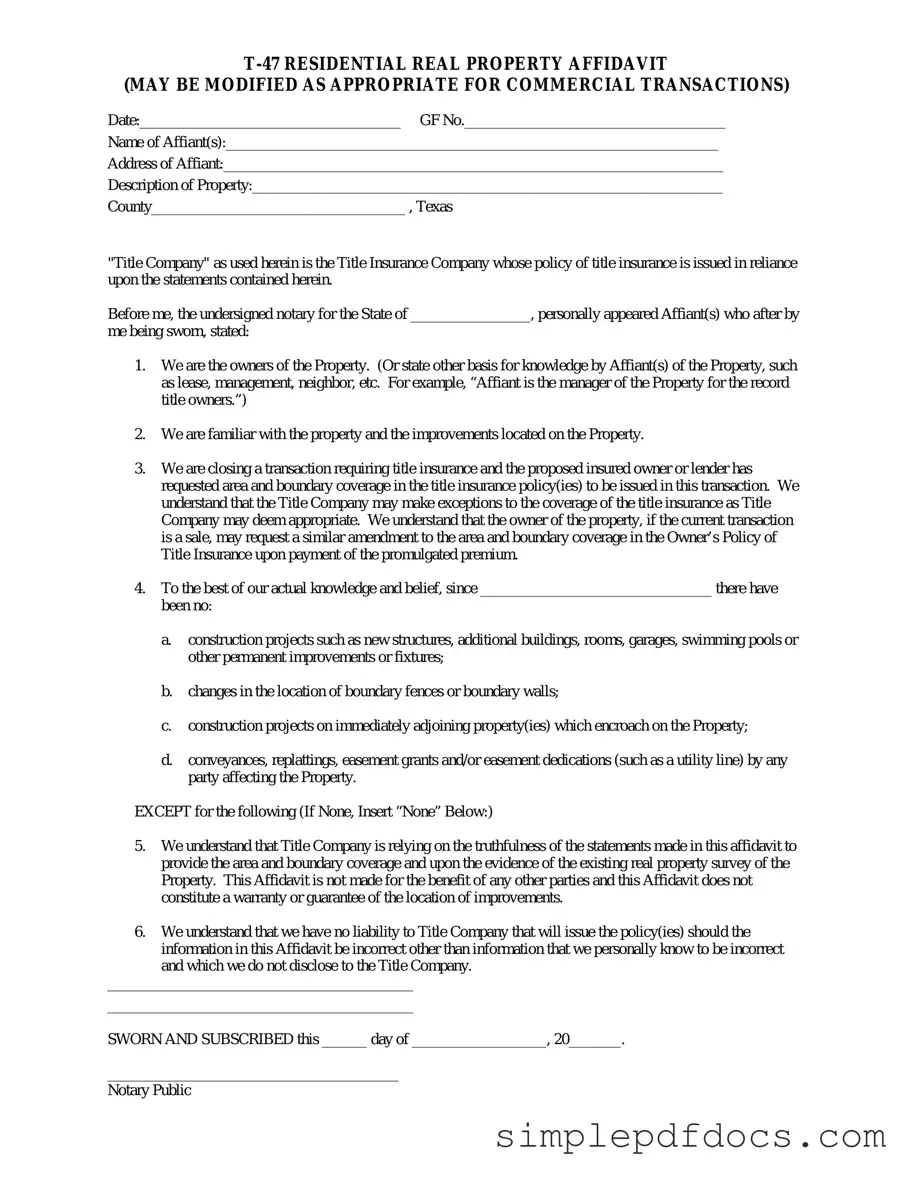

The Texas residential property affidavit T-47 form plays a crucial role in real estate transactions, particularly when it comes to clarifying property boundaries and ownership. This form is often utilized by sellers to affirm that the property being sold has not undergone any significant alterations since the last survey was conducted. By providing essential details about the property, such as its legal description and any existing easements, the T-47 form helps to ensure transparency and protect all parties involved in the transaction. Additionally, it serves as a vital tool for title companies, enabling them to issue clear title insurance policies. Understanding the nuances of this affidavit can significantly impact the sale process, making it essential for both buyers and sellers to familiarize themselves with its requirements and implications. Whether you are a seasoned real estate professional or a first-time homebuyer, grasping the importance of the T-47 form can streamline the transaction and mitigate potential disputes down the line.

More PDF Templates

Bracket Pdf - The format of the bracket is visually straightforward and intuitive.

A Florida Do Not Resuscitate Order (DNRO) form is a legal document that allows individuals to express their wishes regarding resuscitation efforts in the event of a medical emergency. By completing this form, a person can ensure that healthcare providers respect their decision to forgo life-saving measures. Understanding the importance of this document, along with resources like Florida Forms, can provide peace of mind during challenging times.

Security Guard How to Write a Security Incident Report - The daily activity report is crucial for maintaining a comprehensive overview of site safety and security.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The T-47 form is used to affirm the status of a property in Texas, particularly regarding its ownership and any encumbrances. |

| Governing Law | This form is governed by Texas Property Code, specifically Section 12.001. |

| Who Uses It | Homeowners, buyers, and lenders commonly use the T-47 form during real estate transactions. |

| Required Information | The form requires details such as the property's legal description, owner’s name, and any existing liens. |

| Notarization | The T-47 must be notarized to be considered valid in Texas. |

| Filing Requirement | It is typically filed with the county clerk's office where the property is located. |

| Impact on Title Insurance | Submitting the T-47 can affect title insurance policies by clarifying property ownership and encumbrances. |

| Expiration | The T-47 form does not expire but should be updated if any changes occur in property ownership or status. |

How to Write Texas residential property affidavit T-47

Filling out the Texas residential property affidavit T-47 form is an important step in documenting property ownership and ensuring clarity in real estate transactions. After completing the form, it will be necessary to submit it to the appropriate authority for recording. Here are the steps to fill out the form correctly:

- Start by entering the property owner's name in the designated section. Make sure to include both first and last names.

- Provide the property address, including the street number, street name, city, state, and zip code.

- In the next section, indicate the legal description of the property. This information can usually be found on the property deed or tax records.

- Fill in the date of acquisition of the property. This is the date when you officially took ownership.

- Next, state the type of ownership you have, such as fee simple or leasehold.

- If applicable, include any mortgage information related to the property, including the lender's name and loan number.

- Sign and date the form at the bottom. Ensure that your signature matches the name you provided at the top.

- Finally, have the form witnessed or notarized as required. This step may vary based on local regulations.

Dos and Don'ts

When filling out the Texas residential property affidavit T-47 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information to avoid delays.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this can lead to processing issues.

- Don't use white-out or erasers; if you make a mistake, simply cross it out and initial the change.

Documents used along the form

The Texas residential property affidavit T-47 form is an important document in real estate transactions, particularly when it comes to clarifying the ownership and status of a property. Along with the T-47 form, there are several other documents that are commonly used to ensure a smooth transaction. Below is a list of these forms and a brief description of each.

- Property Deed: This document serves as the official record of ownership for a property. It includes details such as the names of the parties involved, the legal description of the property, and any encumbrances or liens.

- Title Insurance Policy: This policy protects the buyer and lender from potential issues related to the title of the property, such as undiscovered liens or ownership disputes.

- Closing Disclosure: This form outlines the final terms of the loan, including the costs and fees associated with the transaction. It must be provided to the buyer at least three days before closing.

- Seller's Disclosure Notice: This document requires the seller to disclose any known issues with the property, such as structural problems or past flooding, ensuring transparency in the sale.

- Power of Attorney for a Child: In situations requiring temporary decision-making for your child, consider utilizing the beneficial Power of Attorney for a Child form to ensure their needs are effectively managed.

- Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, contingencies, and responsibilities of both the buyer and seller.

- Loan Estimate: Provided by the lender, this document gives an estimate of the loan terms, including interest rates, monthly payments, and closing costs, helping buyers understand their financial obligations.

- Property Survey: A survey provides a detailed map of the property, showing its boundaries, any structures, and easements, which is crucial for understanding property lines.

- Affidavit of Heirship: This document is used when a property owner passes away without a will, establishing the heirs' rights to the property and facilitating the transfer of ownership.

- IRS Form 1099-S: This form is used to report the sale of real estate to the IRS, ensuring that any capital gains taxes are properly accounted for.

These documents work together to create a comprehensive picture of the property transaction. Understanding each form can help both buyers and sellers navigate the complexities of real estate deals in Texas.