Legal Quitclaim Deed Document for the State of Texas

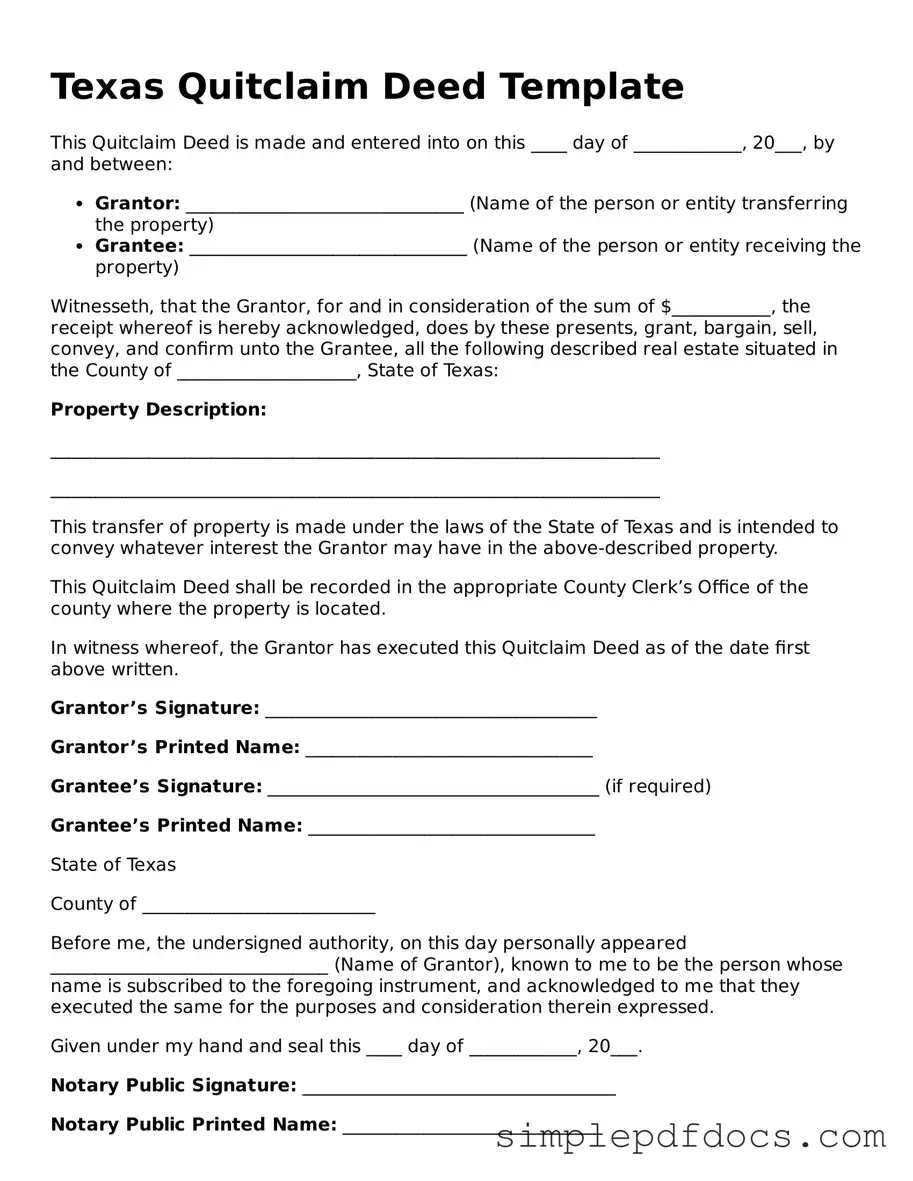

The Texas Quitclaim Deed form serves as a crucial tool for property owners looking to transfer their interest in real estate without making any warranties about the title. This straightforward document allows the granter to relinquish their rights to the property, effectively passing them on to the grantee. Unlike other types of deeds, a quitclaim deed does not guarantee that the granter has clear title or even any title at all. Instead, it simply conveys whatever interest the granter may have, if any. This form is commonly used in situations such as transferring property between family members, settling divorce agreements, or clearing up title issues. Understanding how to properly complete and file this form is essential for ensuring that the transfer is legally recognized and that both parties are clear on their rights and responsibilities. By utilizing the Texas Quitclaim Deed, individuals can facilitate property transfers efficiently, though they should be aware of its limitations and consider seeking legal advice when necessary.

Consider Other Common Quitclaim Deed Templates for Specific States

Ohio Quit Claim Deed Template - Available in most states with specific local filing requirements.

Quitclaim Deed North Carolina - A Quitclaim Deed might have tax implications that should be considered.

Printable Quit Claim Deed Form - It can be an excellent tool for straightforward property changes.

For those looking to navigate the paperwork involved in vehicle transactions, the streamlined ATV Bill of Sale documentation is a vital resource that ensures both buyers and sellers are protected and informed throughout the process.

Quit Claim Deed Form Pennsylvania - A no-frills way to document a transfer of property interest.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed transfers ownership of real estate without guaranteeing the title's validity. |

| Governing Law | The Texas Property Code governs the use and execution of quitclaim deeds in Texas. |

| Use Case | This form is often used among family members or in situations where the parties know each other well. |

| Execution Requirements | The deed must be signed by the grantor and may require notarization to be legally effective. |

How to Write Texas Quitclaim Deed

After obtaining the Texas Quitclaim Deed form, it is important to complete it accurately to ensure a smooth transfer of property rights. Follow these steps to fill out the form correctly.

- Identify the Grantor: Write the full name of the person transferring the property. Include their address for clarity.

- Identify the Grantee: Enter the full name of the person receiving the property. Provide their address as well.

- Describe the Property: Include a detailed description of the property being transferred. This should include the address and any legal description if available.

- Consideration: State the amount of money exchanged for the property, if applicable. If the transfer is a gift, you may note "for love and affection."

- Sign the Document: The Grantor must sign the form in the presence of a notary public. Ensure the signature is clear and matches the name provided.

- Notarization: Have the notary public complete their section, verifying the identity of the Grantor and witnessing the signature.

- File the Deed: Submit the completed Quitclaim Deed to the county clerk's office in the county where the property is located. There may be a filing fee.

Dos and Don'ts

When filling out a Texas Quitclaim Deed form, it's essential to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly. Accuracy is crucial for legal documents.

- Do include the complete legal description of the property. This helps avoid any confusion about what is being transferred.

- Do sign the deed in front of a notary public. A notary’s signature adds legitimacy to the document.

- Do provide the date of the transfer. This establishes a clear timeline for the transaction.

- Don't leave any sections blank. Each part of the form needs to be filled out to avoid delays.

- Don't forget to check for any local requirements. Some counties may have additional rules.

- Don't use outdated forms. Always download the most current version of the Quitclaim Deed.

- Don't overlook the need for witnesses if required. Some transactions may necessitate additional signatures.

By following these guidelines, you can help ensure that your Quitclaim Deed is filled out correctly and is legally binding.

Documents used along the form

When transferring property in Texas, the Quitclaim Deed is an important document. However, it often works alongside other forms and documents that help ensure the transaction is smooth and legally sound. Below is a list of commonly used documents in conjunction with a Texas Quitclaim Deed.

- Property Survey: A property survey outlines the boundaries of the property. It shows the exact dimensions and location of the land, which is crucial for both the buyer and seller.

- Title Search Report: This report reveals the history of ownership and any liens or encumbrances on the property. It helps confirm that the seller has the right to transfer the property.

- Affidavit of Heirship: Used when property is inherited, this document establishes the heirs of a deceased property owner. It helps clarify ownership without going through probate.

- Bill of Sale: This document is used to transfer personal property associated with the real estate, such as appliances or furniture, from the seller to the buyer.

- Closing Statement: Also known as a settlement statement, this document outlines all costs and fees involved in the transaction. It ensures both parties understand their financial obligations.

- Property Transfer Tax Form: In Texas, this form is necessary for reporting the transfer of property for tax purposes. It helps ensure compliance with local tax regulations.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide important information about rules, fees, and regulations that govern the community.

- Articles of Incorporation Form: To establish a corporation in New York, refer to our necessary Articles of Incorporation form guidelines which outline essential documentation for your business setup.

- Warranty Deed (if applicable): While a Quitclaim Deed transfers ownership without guarantees, a Warranty Deed offers assurances about the title. It may be used in cases where the seller wants to provide additional security to the buyer.

- Power of Attorney: If the seller cannot be present for the transaction, a Power of Attorney allows someone else to act on their behalf. This document must be properly executed to be valid.

Having these documents ready can help facilitate a successful property transfer. It is wise to consult with a professional to ensure everything is in order before finalizing the transaction.