Legal Promissory Note Document for the State of Texas

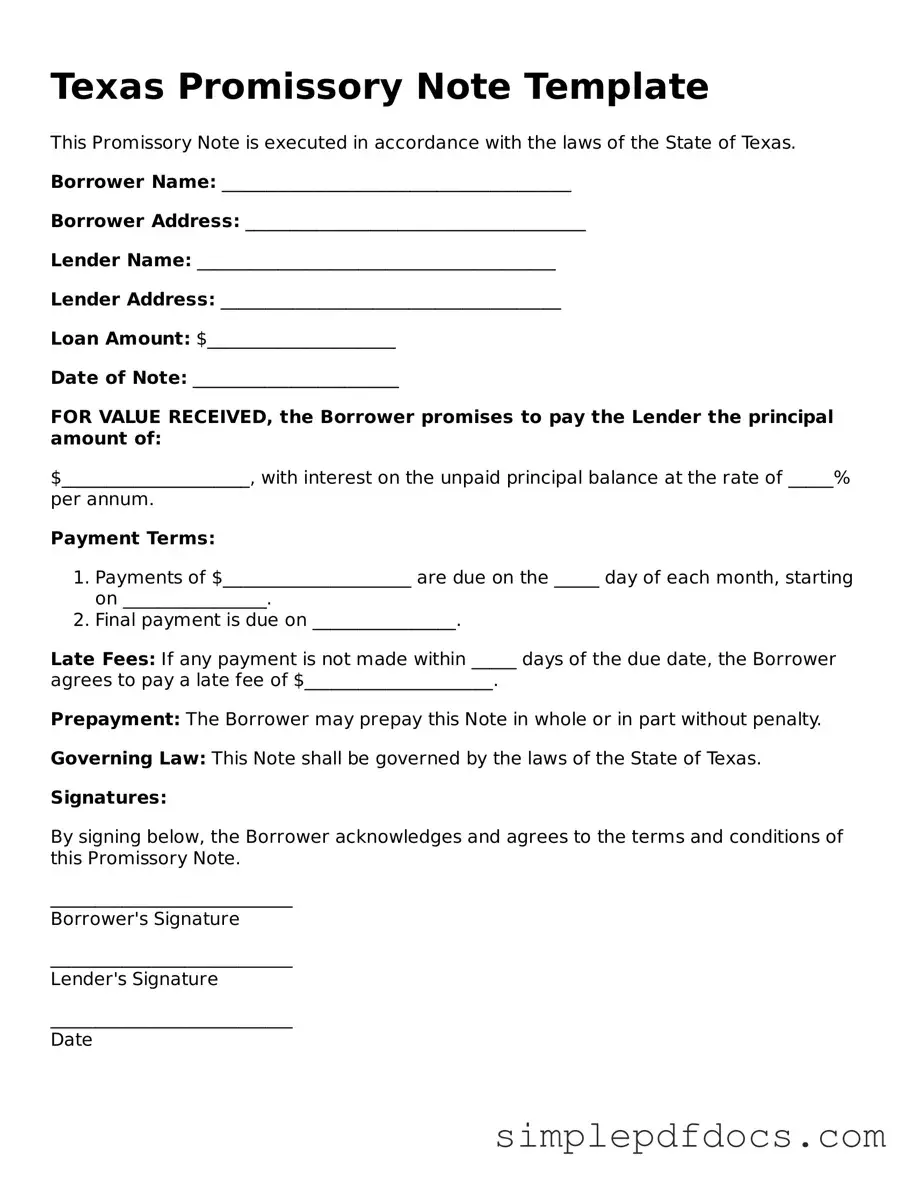

The Texas Promissory Note form serves as a critical financial instrument in various lending scenarios across the state. It outlines the borrower's promise to repay a specified amount of money to the lender, detailing essential terms such as the loan amount, interest rate, payment schedule, and maturity date. This form can be used for personal loans, business financing, or real estate transactions, making it versatile for different financial needs. Additionally, it includes provisions for late fees and default consequences, ensuring both parties understand their obligations and rights. By clearly stating the terms and conditions, the Texas Promissory Note helps to minimize misunderstandings and disputes, promoting a transparent lending process. Whether used for formal agreements or informal loans among friends and family, this document is foundational in establishing a clear record of the financial arrangement.

Consider Other Common Promissory Note Templates for Specific States

Personal Loan Promissory Note - A promissory note should clearly identify what happens if the borrower dies before the loan is paid.

Create a Promissory Note - Allows for repayment flexibility through installment options.

For those interested in securing their rental agreements effectively, our guide on how to create a comprehensive Residential Lease Agreement is invaluable. This document ensures that both landlords and tenants understand their rights and responsibilities during the rental process. For more details, visit our Residential Lease Agreement page.

Free Promissory Note Template Ohio - This form simplifies the process of borrowing and lending money between individuals or entities.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Sections 3.101 to 3.605. |

| Essential Elements | To be valid, the note must include the amount owed, the interest rate (if any), the due date, and the signatures of the parties involved. |

| Types of Notes | Promissory notes in Texas can be secured or unsecured, depending on whether collateral is involved. |

| Interest Rates | Texas law allows for a maximum interest rate of 18% per year unless otherwise agreed upon in writing. |

| Enforcement | If the borrower defaults, the lender has the right to take legal action to enforce the note and recover the owed amount. |

| Modification | Any changes to the terms of a promissory note must be documented in writing and signed by both parties to be enforceable. |

How to Write Texas Promissory Note

Once you have the Texas Promissory Note form in hand, it's important to fill it out accurately. This form serves as a written promise to pay back a specific amount of money under agreed terms. Completing it correctly ensures that both parties understand their obligations and protects their interests.

- Begin by entering the date at the top of the form. This should be the date when the note is being created.

- Next, fill in the name and address of the borrower. This identifies who is responsible for repaying the loan.

- Then, provide the name and address of the lender. This is the individual or entity that is lending the money.

- Specify the principal amount of the loan. This is the total sum of money that the borrower agrees to repay.

- Indicate the interest rate. This is the percentage that will be added to the principal amount over time.

- Outline the repayment schedule. Clearly state when payments are due and how much will be paid in each installment.

- Include any late fees or penalties for missed payments, if applicable. This helps establish consequences for non-compliance.

- Sign and date the form at the bottom. The borrower must sign to acknowledge the terms, and the lender may also sign for validation.

- Make copies of the completed form for both the borrower and the lender. Keep these copies for your records.

Dos and Don'ts

When filling out the Texas Promissory Note form, it is important to follow certain guidelines to ensure that the document is valid and enforceable. Below are four recommendations on what to do and what to avoid.

- Do provide clear and accurate information about the borrower and lender, including full names and addresses.

- Do specify the loan amount and the interest rate clearly to avoid any confusion later.

- Do include the repayment terms, such as the payment schedule and any late fees, to ensure both parties understand their obligations.

- Do sign and date the document in the presence of a witness or notary if required, to add an extra layer of authenticity.

- Don't leave any blank spaces on the form, as this may lead to misunderstandings or disputes.

- Don't use vague language; be specific in your terms to prevent ambiguity.

- Don't ignore state laws regarding interest rates and loan terms, as this could render the note unenforceable.

- Don't forget to keep a copy of the signed note for your records, as it serves as proof of the agreement.

Documents used along the form

In Texas, a Promissory Note is a crucial document that outlines the terms of a loan agreement between a borrower and a lender. However, it is often accompanied by other forms and documents that help clarify the agreement and protect the interests of both parties. Below are five commonly used documents in conjunction with a Texas Promissory Note.

- Security Agreement: This document outlines the collateral that secures the loan. It specifies what assets the lender can claim if the borrower defaults on the loan, providing an additional layer of security for the lender.

- Loan Agreement: This is a comprehensive document that details the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan. It serves as a broader framework that encompasses the Promissory Note.

- Guaranty Agreement: In situations where a third party agrees to take responsibility for the loan if the borrower defaults, a Guaranty Agreement is used. This document provides assurance to the lender that there is an additional party liable for the debt.

- Disclosure Statement: This document outlines important information about the loan, including any fees, the annual percentage rate (APR), and the total cost of the loan. It ensures that borrowers are fully informed about the terms before signing the Promissory Note.

- Marriage Application: The Florida Forms provide essential documentation for couples intending to marry in Florida, ensuring they meet all necessary legal requirements before their wedding day.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments over time. It shows how much of each payment goes toward the principal and how much goes toward interest, helping borrowers understand their financial obligations.

These documents collectively enhance the clarity and enforceability of the loan agreement. Understanding each of these forms can help borrowers and lenders navigate their financial transactions with greater confidence.