Legal Operating Agreement Document for the State of Texas

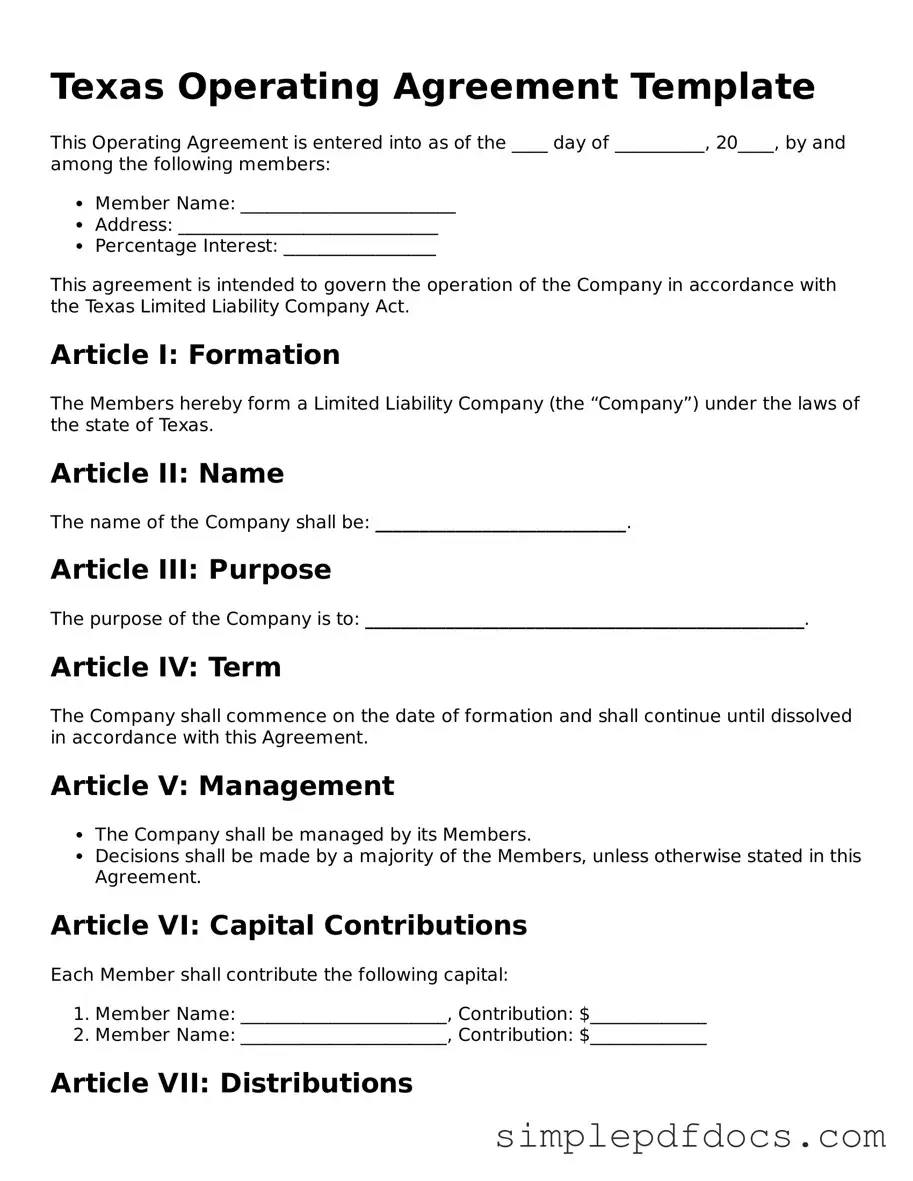

When forming a Limited Liability Company (LLC) in Texas, one essential document is the Texas Operating Agreement form. This form serves as the backbone of your LLC's internal structure, outlining the rights and responsibilities of members, the management framework, and the procedures for decision-making. It includes key aspects such as member contributions, profit distribution, and the process for adding or removing members. Additionally, the agreement addresses how disputes will be resolved, ensuring that all members understand their roles and obligations. By establishing clear guidelines, the Operating Agreement helps prevent misunderstandings and conflicts down the line. Understanding this document is crucial for anyone looking to form an LLC in Texas, as it not only protects individual interests but also enhances the overall stability and credibility of the business.

Consider Other Common Operating Agreement Templates for Specific States

How to Write an Operating Agreement - It's a private document and not required to be filed with the state.

The Florida Horse Bill of Sale form is a legal document that serves as proof of the sale and transfer of ownership of a horse. This form is essential for both buyers and sellers, as it outlines important details about the horse, including its description and the terms of the sale. For those in need of such documentation, resources are available through Florida Forms, making it easier to ensure a clear and enforceable agreement, protecting their interests in the transaction.

How to Register an Llc - It serves to establish the policies for making business decisions.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | The Texas Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in Texas. |

| Governing Law | This agreement is governed by the Texas Business Organizations Code, specifically Title 3, Chapter 101. |

| Purpose | The primary purpose is to define the roles, responsibilities, and rights of the members and managers of the LLC. |

| Flexibility | Texas law allows for considerable flexibility in how members can structure their agreement, accommodating various business needs. |

| Member Contributions | The agreement typically details the capital contributions of each member, including cash, property, or services. |

| Dispute Resolution | Many agreements include provisions for resolving disputes among members, which may involve mediation or arbitration. |

| Amendments | Members can amend the Operating Agreement as needed, but such changes must be documented and agreed upon by all members. |

How to Write Texas Operating Agreement

Once you have the Texas Operating Agreement form ready, you can begin filling it out. This form is essential for outlining the management structure and operational guidelines of your business. Follow these steps carefully to ensure that all necessary information is accurately provided.

- Title the document. At the top of the form, write “Operating Agreement” followed by the name of your LLC.

- Enter the date. Clearly state the date on which the agreement is being executed.

- List members. Include the names and addresses of all members involved in the LLC.

- Define management structure. Specify whether the LLC will be managed by members or by appointed managers.

- Outline voting rights. Detail how voting will be conducted among members, including any specific voting percentages.

- State capital contributions. Document the initial capital contributions made by each member.

- Describe profit distribution. Explain how profits and losses will be distributed among members.

- Include provisions for changes. Note how amendments to the agreement can be made in the future.

- Signatures. Ensure that all members sign and date the document to validate the agreement.

Dos and Don'ts

When filling out the Texas Operating Agreement form, following certain guidelines can help ensure accuracy and compliance. Here are eight key dos and don'ts:

- Do read the entire form carefully before starting.

- Do include all required information, such as member names and addresses.

- Do ensure the agreement reflects the actual operations and management structure of the business.

- Do consult with a legal professional if you have questions about specific clauses.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be clear and precise in your descriptions.

- Don't rush through the process; take your time to avoid mistakes.

- Don't forget to have all members sign and date the agreement.

Documents used along the form

When forming a limited liability company (LLC) in Texas, an Operating Agreement is a crucial document that outlines the management structure and operational procedures of the business. However, several other forms and documents are often used in conjunction with the Texas Operating Agreement to ensure compliance and proper management. Below is a list of these essential documents.

- Certificate of Formation: This document is filed with the Texas Secretary of State to officially create the LLC. It includes basic information such as the company name, registered agent, and the purpose of the business.

- Bylaws: While not required for LLCs, bylaws can be useful for outlining the internal rules and regulations governing the company’s operations, similar to a corporation's governing document.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They detail the member's ownership percentage and can be issued to each member as part of the company's records.

- ATV Bill of Sale Form: For those involved in the sale of all-terrain vehicles, our required ATV Bill of Sale documentation facilitates legally compliant ownership transfers.

- Operating Procedures: This document provides a detailed outline of the day-to-day operations of the LLC, including procedures for meetings, decision-making, and financial management.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They can cover a range of topics, from approving new members to authorizing significant expenditures.

- Tax Identification Number (EIN) Application: An EIN is necessary for tax purposes and is required for opening a business bank account. This application is submitted to the IRS.

- Bank Account Resolution: This document authorizes specific individuals to open and manage the LLC's bank account. It ensures that only designated members have access to the company’s funds.

- Annual Report: Texas requires LLCs to file an annual report to maintain good standing. This report provides updated information about the business and its members.

- Non-Disclosure Agreement (NDA): If the LLC plans to share sensitive information with partners or employees, an NDA can protect confidential information from being disclosed to outsiders.

These documents work together to establish a solid foundation for the LLC, ensuring that all members understand their roles and responsibilities while complying with Texas laws. Having these forms in place can help prevent misunderstandings and legal issues down the line.