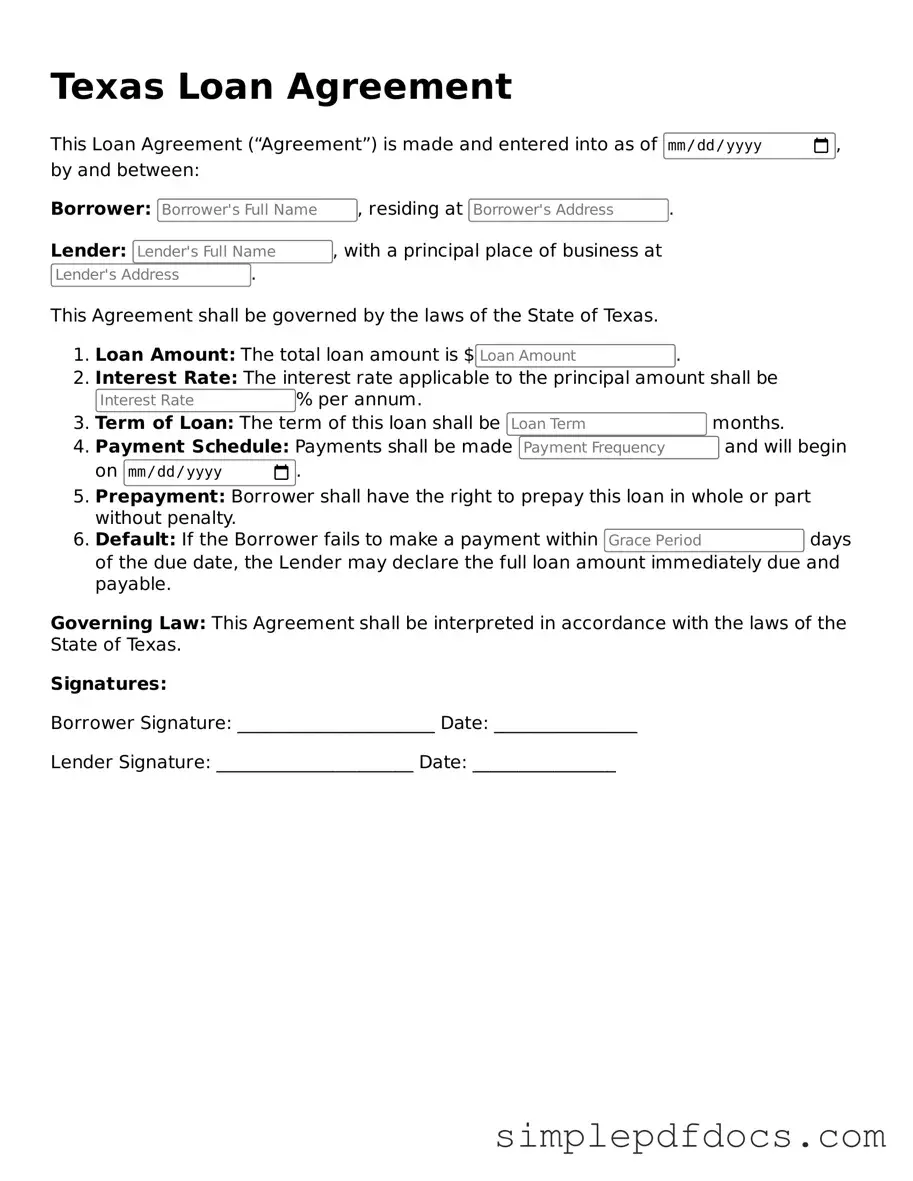

Legal Loan Agreement Document for the State of Texas

The Texas Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions agreed upon by the borrower and the lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. Furthermore, it delineates the rights and responsibilities of both parties, ensuring clarity and mutual understanding. In addition to these fundamental components, the form may address collateral requirements, default provisions, and the legal jurisdiction governing the agreement. By providing a structured framework for the loan transaction, the Texas Loan Agreement form helps to protect the interests of both the lender and borrower, thereby facilitating a smoother financial exchange. Understanding the various elements of this document is vital for anyone involved in a lending arrangement within the state of Texas.

Consider Other Common Loan Agreement Templates for Specific States

Promissory Note New York - Includes disclosures about potential fees.

In situations where parents are unable to provide care for their child(ren), such as during travel or illness, the Florida Power of Attorney for a Child form becomes essential. This legal document enables parents to appoint a trusted adult to make important decisions on behalf of their child, ensuring their well-being in the parents' absence. To learn more about this critical form, visit floridaforms.net/blank-power-of-attorney-for-a-child-form, which outlines the necessary steps and considerations for completing this important task.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement is governed by the Texas Business and Commerce Code. |

| Parties Involved | The agreement typically involves a lender and a borrower. |

| Loan Amount | The form specifies the total amount of money being loaned. |

| Interest Rate | The document outlines the interest rate applicable to the loan. |

| Repayment Terms | It details the schedule and method of repayment. |

| Default Clauses | The agreement includes terms regarding default and consequences. |

| Collateral Requirements | Any collateral securing the loan is described within the document. |

| Governing Jurisdiction | Disputes are typically resolved in Texas courts. |

| Signatures | The agreement requires signatures from both parties to be valid. |

How to Write Texas Loan Agreement

Completing the Texas Loan Agreement form requires careful attention to detail. This form outlines the terms of a loan between two parties. Ensure that all information is accurate and complete to avoid any misunderstandings in the future.

- Begin by writing the date at the top of the form. This should be the date when the agreement is being signed.

- Identify the lender. Fill in the lender's full name and address in the designated section.

- Next, provide the borrower's information. Include the borrower's full name and address as well.

- Specify the loan amount. Clearly write the total amount being borrowed in both numerical and written form.

- Outline the interest rate. Indicate the annual interest rate that will apply to the loan.

- Detail the repayment terms. Specify how long the borrower has to repay the loan and the frequency of payments (e.g., monthly, bi-weekly).

- Include any additional terms. If there are specific conditions or clauses that need to be included, write them in the appropriate section.

- Both parties should sign and date the agreement. Ensure that each party has a copy of the signed document for their records.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are six important dos and don'ts:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about your financial status.

- Do sign and date the form in the designated areas.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't rush through the process; take your time to ensure everything is correct.

Documents used along the form

When entering into a loan agreement in Texas, several other forms and documents may be necessary to ensure clarity and legal compliance. These documents serve various purposes, from establishing the terms of the loan to protecting the rights of both parties involved. Understanding these documents can help borrowers and lenders navigate the loan process more effectively.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rate, and repayment schedule. It serves as a formal acknowledgment of the debt.

- Employment Verification Form: This document is essential for confirming an individual's employment status and is often required during lending processes. Understanding this form's role can greatly benefit both lenders and borrowers. For more information, visit Florida Forms.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what the collateral is and the rights of the lender in case of default. It protects the lender's interests by providing a claim to the collateral.

- Disclosure Statement: This document provides important information about the loan terms, including fees and interest rates. It ensures that borrowers are fully informed before agreeing to the loan.

- Loan Application: This form collects necessary information from the borrower, such as financial history and creditworthiness. It helps lenders assess the risk involved in granting the loan.

- Loan Modification Agreement: If changes to the original loan terms are needed, this document outlines the new terms and conditions agreed upon by both parties. It is crucial for formalizing any adjustments.

- Repayment Schedule: This document provides a detailed plan for loan repayment, including due dates and amounts. It helps borrowers keep track of their obligations and ensures timely payments.

- Default Notice: In the event of missed payments, this notice informs the borrower of the default and the potential consequences, including legal action. It serves as a formal communication of the lender's intent.

- Release of Lien: Once the loan is fully paid, this document releases the lender's claim on any collateral. It is essential for clearing the borrower's title and confirming the loan's conclusion.

Each of these documents plays a significant role in the loan process. By understanding their functions, borrowers and lenders can work together more effectively, ensuring a smoother transaction and reducing the potential for disputes. Proper documentation is key to a successful lending relationship.