Legal Lease Agreement Document for the State of Texas

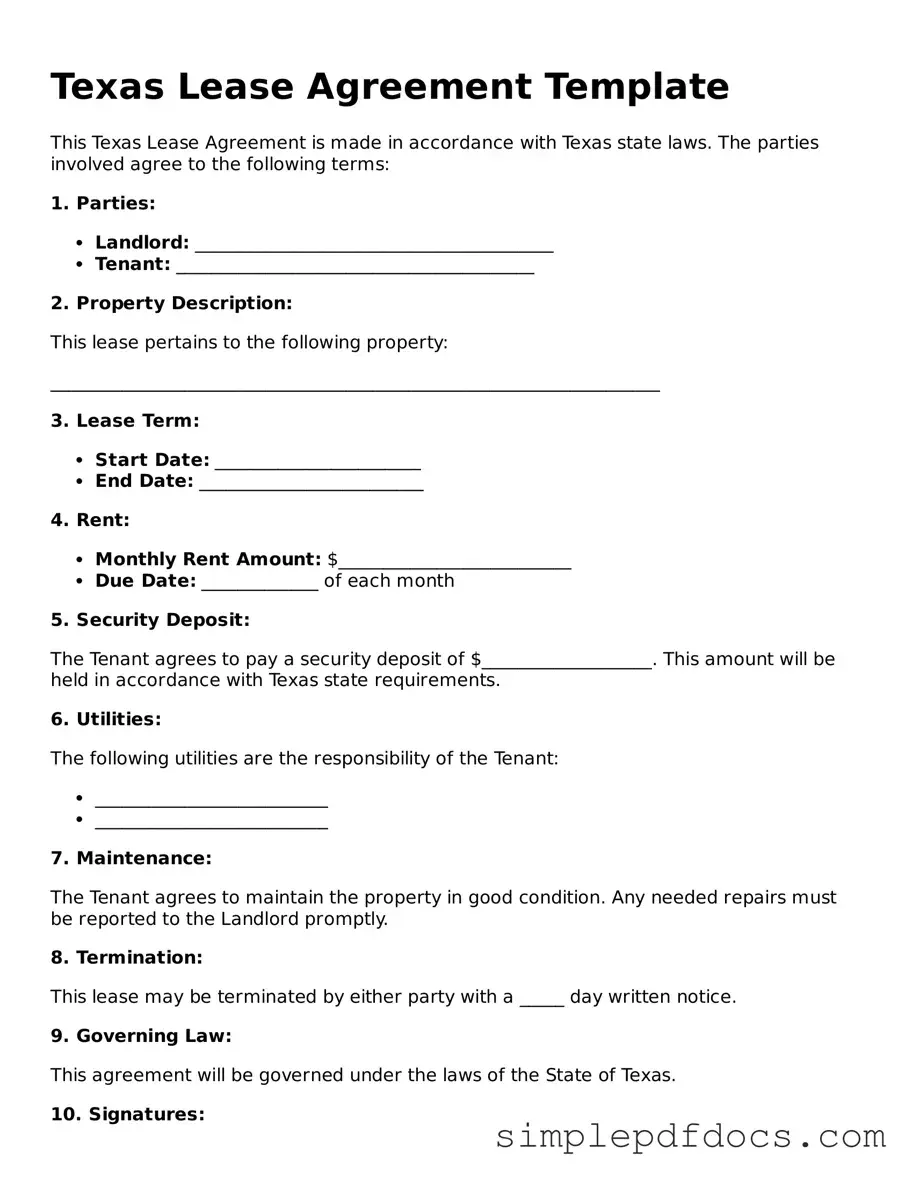

When renting a property in Texas, having a solid lease agreement is essential for both landlords and tenants. This legal document outlines the terms of the rental arrangement, ensuring that both parties understand their rights and responsibilities. A Texas Lease Agreement typically includes crucial details such as the duration of the lease, the amount of rent due, and the security deposit requirements. It also specifies rules regarding maintenance, repairs, and the use of the property. Additionally, the agreement may address issues like late fees, pet policies, and procedures for terminating the lease. By clearly laying out these aspects, the lease helps to prevent misunderstandings and disputes, creating a smoother rental experience for everyone involved.

Consider Other Common Lease Agreement Templates for Specific States

Free Lease Agreement Pa - It may address the handling of lease violations and corresponding penalties.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. This form simplifies the process, making it faster and more straightforward to shift ownership. For those seeking to utilize this form, additional resources can be found at https://floridaforms.net/blank-quitclaim-deed-form.

Free Lease Print Out - It may require tenants to obtain renters’ insurance for personal belongings.

Rental Agreement Free Template - It is advisable for both tenants and landlords to keep a copy of the signed agreement for reference.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Lease Agreement is governed by the Texas Property Code. |

| Parties Involved | The lease agreement typically involves a landlord (lessor) and a tenant (lessee). |

| Lease Duration | Leases can be for a fixed term or month-to-month, depending on the agreement. |

| Security Deposit | Landlords may require a security deposit, which is typically refundable at lease end. |

| Rent Payment Terms | The agreement specifies the amount of rent and payment due dates. |

| Maintenance Responsibilities | It outlines the responsibilities of both parties regarding property maintenance. |

| Termination Conditions | Conditions for terminating the lease are clearly stated in the agreement. |

| Dispute Resolution | The lease may include provisions for resolving disputes between the landlord and tenant. |

How to Write Texas Lease Agreement

Filling out the Texas Lease Agreement form requires careful attention to detail. Each section of the form must be completed accurately to ensure clarity and compliance with state laws. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the names of the landlord and tenant. Make sure to include full legal names.

- Provide the complete address of the rental property, including any unit number.

- Specify the lease term. Indicate the start and end dates of the lease.

- Detail the rent amount. Clearly state the monthly rent and the due date.

- Include the security deposit amount. This is typically one month’s rent, but confirm the specific amount.

- Outline the utilities that are included in the rent. List any that the tenant is responsible for as well.

- Describe the maintenance responsibilities of both the landlord and tenant.

- Indicate any rules regarding pets, smoking, or other specific property policies.

- Sign and date the form at the bottom. Ensure both parties do this to validate the agreement.

Dos and Don'ts

When filling out the Texas Lease Agreement form, it is essential to approach the process with care and attention to detail. Here are seven important dos and don'ts to consider:

- Do read the entire lease agreement thoroughly before filling it out.

- Do provide accurate and up-to-date information about all parties involved.

- Do clarify any terms or conditions you do not understand with the landlord or property manager.

- Do ensure that the lease term, rental amount, and payment due dates are clearly stated.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore any clauses that seem unusual; ask for clarification if needed.

Documents used along the form

When entering into a rental arrangement in Texas, several documents complement the Texas Lease Agreement. These forms help clarify responsibilities, establish terms, and protect the rights of both landlords and tenants. Below is a list of commonly used documents that often accompany the lease agreement.

- Rental Application: This form collects personal and financial information from potential tenants. It helps landlords assess the suitability of applicants based on their credit history, rental history, and income.

- Florida Sales Tax Form: It is crucial for landlords and property managers in Florida to understand their sales tax obligations, and they can find helpful information and resources on filling out the Florida Forms related to sales tax reporting.

- Background Check Authorization: This document allows landlords to conduct background checks on applicants. It typically requires the tenant's consent to verify their criminal history and creditworthiness.

- Move-In/Move-Out Checklist: This checklist outlines the condition of the property at the time of move-in and move-out. It helps prevent disputes regarding security deposits by documenting any existing damages.

- Security Deposit Receipt: This receipt serves as proof of the security deposit paid by the tenant. It details the amount and the conditions under which the deposit may be withheld or returned.

- Pet Agreement: If pets are allowed, this document specifies the terms and conditions regarding pet ownership, including any additional fees or restrictions.

- Lease Addendum: An addendum is a document that modifies or adds to the original lease agreement. It may address specific issues such as subletting or alterations to the property.

- Notice to Quit: This notice is used to inform tenants of their need to vacate the property. It is often required before eviction proceedings can begin.

- Utility Agreement: This form outlines the responsibilities of the landlord and tenant regarding the payment of utilities. It clarifies which utilities are included in the rent and which are the tenant's responsibility.

- Rental Payment Receipt: A receipt provided to tenants upon payment of rent. It serves as proof of payment and can be important for both parties' records.

These documents work in tandem with the Texas Lease Agreement to create a clear and comprehensive rental experience. By utilizing these forms, both landlords and tenants can establish expectations and protect their interests throughout the leasing process.