Legal Lady Bird Deed Document for the State of Texas

The Texas Lady Bird Deed is a unique estate planning tool that offers homeowners a way to transfer their property to beneficiaries while retaining certain rights during their lifetime. This type of deed allows the property owner to maintain control over the property, including the right to live in it, sell it, or modify it, without the need for probate after their death. One of the key features of the Lady Bird Deed is that it can help avoid the lengthy and often costly probate process, ensuring a smoother transition of property ownership. Additionally, it provides protection against creditors, as the property is not considered part of the owner's estate at the time of death. With a Lady Bird Deed, the transfer of property can occur automatically upon the owner's passing, which simplifies matters for the beneficiaries. This deed is particularly popular among Texans for its flexibility and the peace of mind it offers in estate planning. Understanding how to properly execute and utilize a Lady Bird Deed can be crucial for anyone looking to secure their legacy while also providing for their loved ones.

Consider Other Common Lady Bird Deed Templates for Specific States

Ladybird Deed North Carolina - A Lady Bird Deed allows property owners to transfer real estate upon their death without going through probate.

In the process of confirming an individual's employment status, employers often turn to the Florida Employment Verification form, which serves as an essential resource for conducting background checks or assisting with loan applications; for additional information and access to this form, you can visit Florida Forms.

PDF Details

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed is a type of transfer deed that allows property owners in Texas to transfer their property to their beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, specifically Section 5.045. |

| Benefits of a Lady Bird Deed | This deed helps avoid probate, allowing for a smoother transition of property ownership upon the owner's death. |

| Retained Control | Property owners maintain the right to sell, mortgage, or change the property during their lifetime, even after the deed is executed. |

| Tax Benefits | Using a Lady Bird Deed can help preserve the property tax exemption for the owner, as well as provide a step-up in basis for beneficiaries. |

| Who Can Be a Beneficiary? | Beneficiaries can be individuals, organizations, or trusts. There are no restrictions on the number of beneficiaries. |

| Revocability | The deed can be revoked or modified by the property owner at any time, ensuring flexibility in estate planning. |

| Common Misconceptions | Some believe that a Lady Bird Deed is only for elderly individuals, but it can be beneficial for anyone looking to plan their estate effectively. |

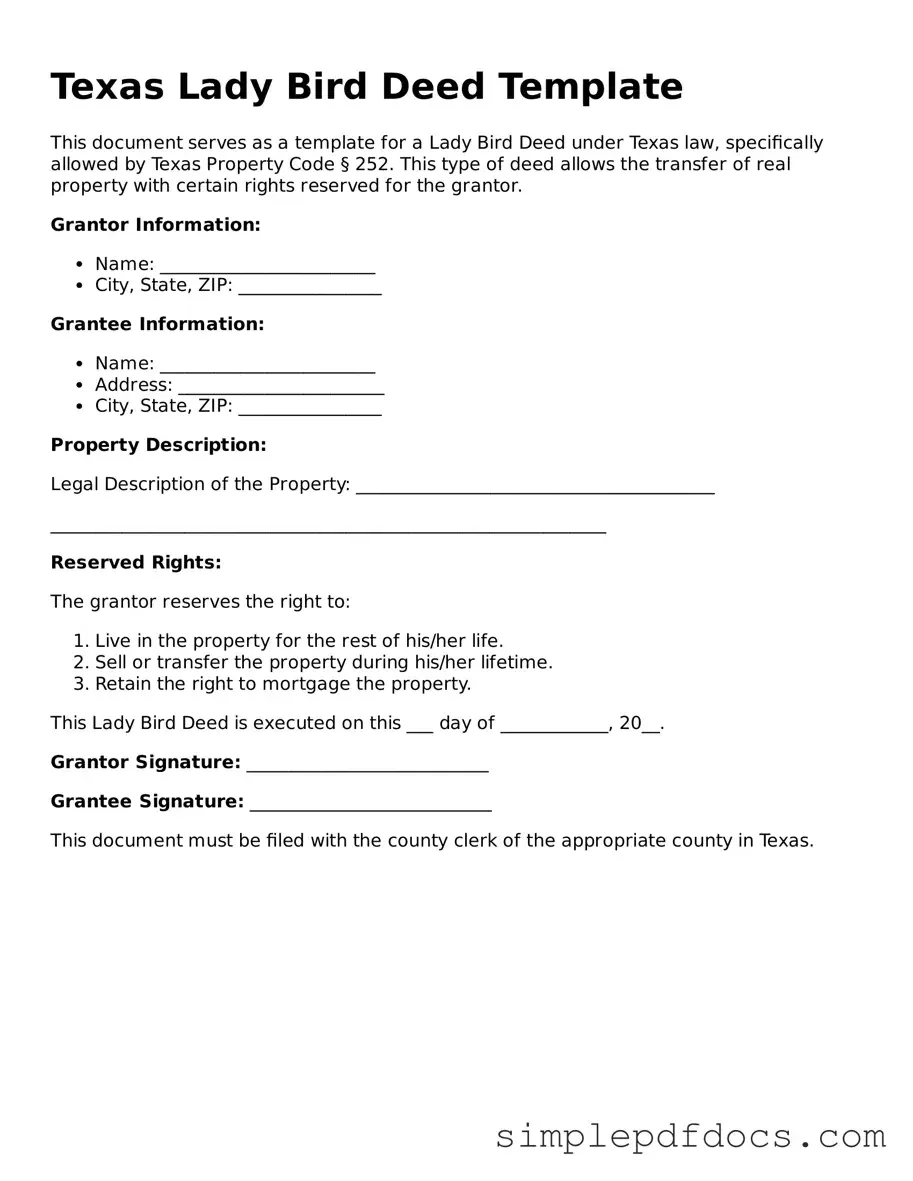

How to Write Texas Lady Bird Deed

Filling out the Texas Lady Bird Deed form is an important step in ensuring that your property is transferred according to your wishes. After completing the form, you will need to sign it in front of a notary public and then file it with the county clerk in the county where the property is located.

- Obtain the Texas Lady Bird Deed form. You can find it online or at a legal stationery store.

- Enter the names of the current property owners at the top of the form.

- Provide the legal description of the property. This can often be found on your property deed or tax records.

- List the names of the beneficiaries who will receive the property upon your passing.

- Specify any conditions or limitations you wish to include regarding the property transfer.

- Sign and date the form in the designated areas.

- Have the form notarized by a licensed notary public.

- File the completed form with the county clerk’s office in the county where the property is located.

Make sure to keep a copy of the filed deed for your records. It’s wise to inform your beneficiaries about the deed and its implications.

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of what you should and shouldn’t do:

- Do ensure that you have the correct legal description of the property.

- Do include the names of all parties involved in the deed.

- Do sign the document in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't forget to check local regulations that may affect the deed's validity.

By following these guidelines, you can help ensure that your Lady Bird Deed is filled out correctly and effectively serves its intended purpose.

Documents used along the form

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights. When preparing this deed, there are several other forms and documents that may be beneficial to consider. Each serves a specific purpose in ensuring a smooth transition of property and addressing various legal needs.

- Will: A legal document that outlines how a person's assets and property should be distributed after their death. It is crucial for ensuring that your wishes are honored regarding your estate.

- Power of Attorney: This document grants someone the authority to make financial or medical decisions on your behalf if you become unable to do so. It is essential for managing affairs when you cannot act for yourself.

- Living Trust: A trust that holds your assets during your lifetime and specifies how they should be distributed after your death. It can help avoid probate and provide greater control over your estate.

- Beneficiary Designation Forms: These forms allow you to designate beneficiaries for specific accounts, such as life insurance or retirement accounts. They ensure that these assets pass directly to the named individuals outside of probate.

- Power of Attorney for a Child: This form allows parents to grant authority to another adult to care for their child(ren) when they are unable to do so due to various reasons, ensuring that the child's needs are met. For more details, visit floridaforms.net/blank-power-of-attorney-for-a-child-form/.

- Affidavit of Heirship: A legal document that establishes the heirs of a deceased person. It is often used when there is no will to determine how the deceased's property should be distributed.

- Quitclaim Deed: This deed transfers ownership of property from one person to another without guaranteeing that the title is clear. It is often used to transfer property between family members or in divorce settlements.

Understanding these documents can help you navigate the complexities of estate planning. Each form plays a vital role in ensuring that your wishes are respected and that your loved ones are cared for in the future.