Legal Gift Deed Document for the State of Texas

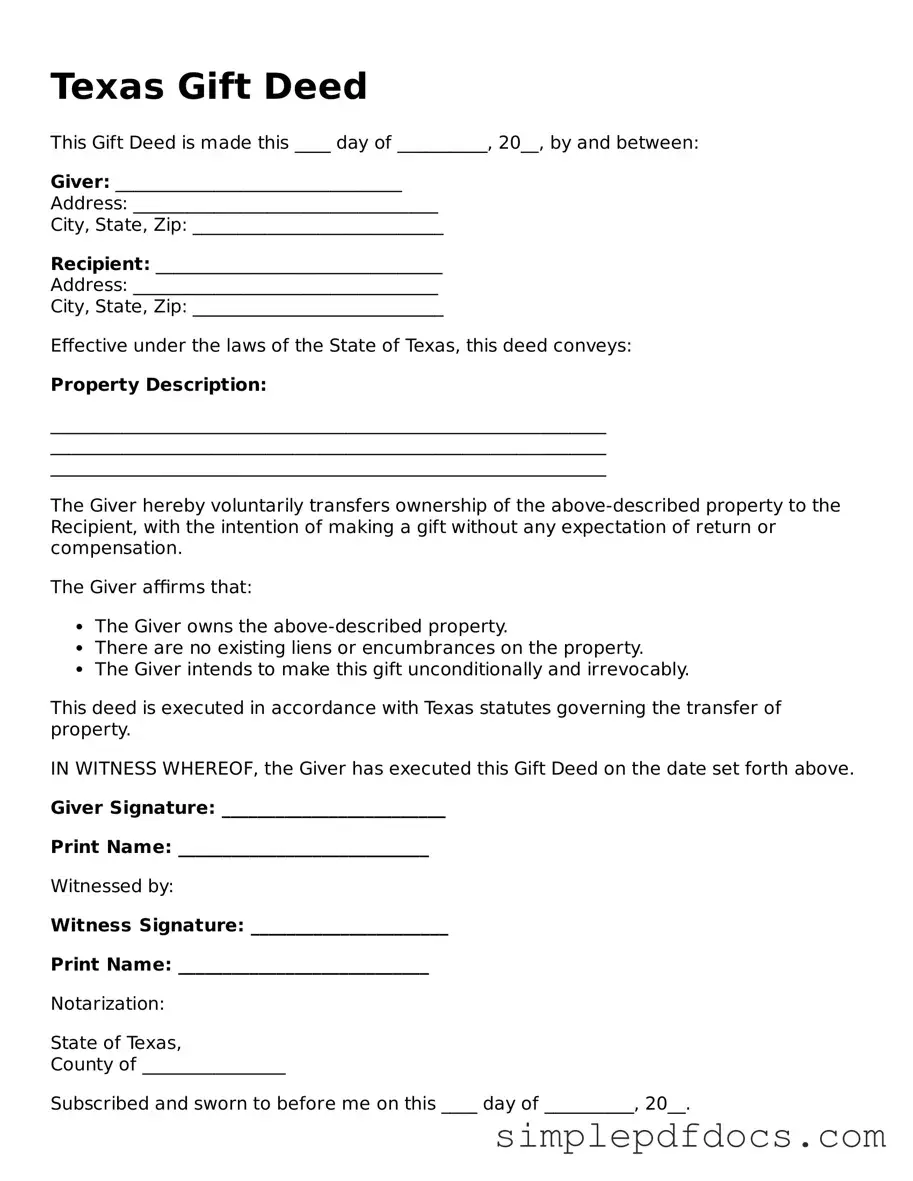

The Texas Gift Deed form serves as a vital legal instrument for individuals wishing to transfer property ownership without the exchange of money. This document is particularly important in situations where a property owner desires to gift real estate to a family member, friend, or charitable organization. By utilizing this form, the donor can clearly outline the intent to make a gift, ensuring that the transfer is both legally binding and properly documented. The Texas Gift Deed includes essential elements such as the identification of the parties involved, a detailed description of the property being gifted, and the acknowledgment of the donor's intent. Additionally, the form typically requires signatures from both the donor and the recipient, along with a notary public to validate the transaction. Understanding the nuances of this form can help individuals navigate the complexities of property transfers while avoiding potential disputes or misunderstandings in the future.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, specifically Section 5.021. |

| Requirements | The deed must be in writing, signed by the donor (the person giving the gift), and must be notarized. |

| Consideration | Unlike a sale, no monetary consideration is required for a gift deed; it is purely a voluntary transfer. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient, including potential gift tax obligations. |

| Recording | To ensure legal validity and public notice, the gift deed should be recorded in the county where the property is located. |

| Revocation | Once executed and delivered, a gift deed generally cannot be revoked unless specific conditions are met. |

How to Write Texas Gift Deed

Filling out the Texas Gift Deed form requires careful attention to detail. Once completed, the form will need to be signed and notarized before being filed with the appropriate county office. Follow these steps to ensure accuracy and compliance.

- Begin by downloading the Texas Gift Deed form from a reliable source.

- Enter the full names of the grantor (the person giving the gift) and the grantee (the person receiving the gift) at the top of the form.

- Provide the current address of both the grantor and the grantee in the designated fields.

- Clearly describe the property being gifted. Include the address and any legal descriptions, if available.

- Specify the date of the gift. This is typically the date you are filling out the form.

- Include any additional terms or conditions of the gift, if applicable.

- Both the grantor and grantee must sign the form. Ensure that the signatures are dated.

- Find a notary public to witness the signatures. They will need to notarize the document.

- Make copies of the completed and notarized form for your records.

- File the original Gift Deed with the county clerk's office in the county where the property is located.

Dos and Don'ts

When filling out the Texas Gift Deed form, it’s important to follow certain guidelines. Here’s a list of things you should and shouldn’t do:

- Do ensure that the names of both the donor and the recipient are clearly printed.

- Do provide a complete legal description of the property being gifted.

- Do sign the form in front of a notary public to validate the deed.

- Do keep a copy of the completed deed for your records.

- Don’t leave any sections blank; fill in all required information.

- Don’t use incorrect or informal language when describing the property.

- Don’t forget to check for any local requirements that may apply to your situation.

By following these guidelines, you can help ensure that your Texas Gift Deed is completed correctly and is legally binding.

Documents used along the form

When completing a Texas Gift Deed, several other forms and documents can help ensure the process goes smoothly. These documents serve various purposes, from verifying the transfer of ownership to providing necessary legal protections. Here’s a look at some commonly used forms alongside the Texas Gift Deed.

- Affidavit of Gift: This document is a sworn statement confirming that a gift was made. It typically includes details about the donor, recipient, and the property being gifted. This affidavit can be useful for clarifying intentions and preventing disputes.

- Motorcycle Bill of Sale: This document is essential for recording the sale of a motorcycle in Texas and can be filled out conveniently online at https://texasformspdf.com/.

- Property Transfer Form: This form is often required by local authorities to officially record the transfer of property ownership. It ensures that the transaction is documented in public records, which is important for future reference and legal protection.

- Title Insurance Policy: While not mandatory, obtaining title insurance can protect the recipient from any future claims or issues related to the property. This policy provides peace of mind, ensuring that the title is clear and free of liens or disputes.

- IRS Form 709: If the value of the gift exceeds a certain amount, the donor may need to file this federal gift tax return. It documents the gift for tax purposes and helps ensure compliance with IRS regulations.

Understanding these additional forms can greatly enhance the gifting process. By preparing the right documents, you can ensure a smooth transfer and safeguard against potential future issues. Always consider consulting with a legal professional for personalized advice tailored to your specific situation.