Legal Durable Power of Attorney Document for the State of Texas

The Texas Durable Power of Attorney form is a crucial legal document that enables individuals to designate a trusted person, known as an agent, to manage their financial and legal affairs in the event they become incapacitated. This form provides a framework for decision-making, allowing the appointed agent to handle a wide range of responsibilities, from managing bank accounts to making real estate transactions, ensuring that the principal's interests are protected even when they are unable to act on their own behalf. Importantly, the durable aspect of the power of attorney means that it remains effective even if the principal loses the capacity to make decisions. Texas law outlines specific requirements for creating a valid Durable Power of Attorney, including the necessity for the principal to be of sound mind at the time of signing and the inclusion of certain statutory language. Furthermore, the form can be tailored to grant broad or limited powers, depending on the principal's preferences. Understanding the nuances of this form is essential for anyone considering this important legal tool, as it not only facilitates the management of one’s affairs but also provides peace of mind for both the principal and their loved ones.

Consider Other Common Durable Power of Attorney Templates for Specific States

Ohio Power of Attorney Requirements - This document helps ensure that your financial responsibilities continue to be met.

How to Get Power of Attorney in Nc - Keeping your Durable Power of Attorney document up to date is essential as life circumstances change.

Durable Power of Attorney Form Pa - The document can specify the powers granted, making it very flexible.

For those navigating the complexities of establishing a business, understanding the New York Articles of Incorporation requirements is imperative. This document serves as the foundation for corporate structure and governance, ensuring compliance with state regulations.

What Is Statutory Power of Attorney - Establishing this legal authority now can prevent complications for your family later.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Durable Power of Attorney is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by the Texas Estates Code, specifically Title 2, Chapter 752, which outlines the requirements and rules for creating a durable power of attorney in Texas. |

| Durability | The "durable" aspect means that the power of attorney remains effective even if the principal becomes mentally or physically incapacitated, ensuring continuity in decision-making. |

| Revocation | The principal has the right to revoke the durable power of attorney at any time, as long as they are mentally competent, by providing a written notice to the agent and any relevant third parties. |

| Agent's Authority | The agent's authority can be broad or limited, depending on how the document is drafted. It can cover financial matters, real estate transactions, and other legal affairs, or it can be restricted to specific tasks. |

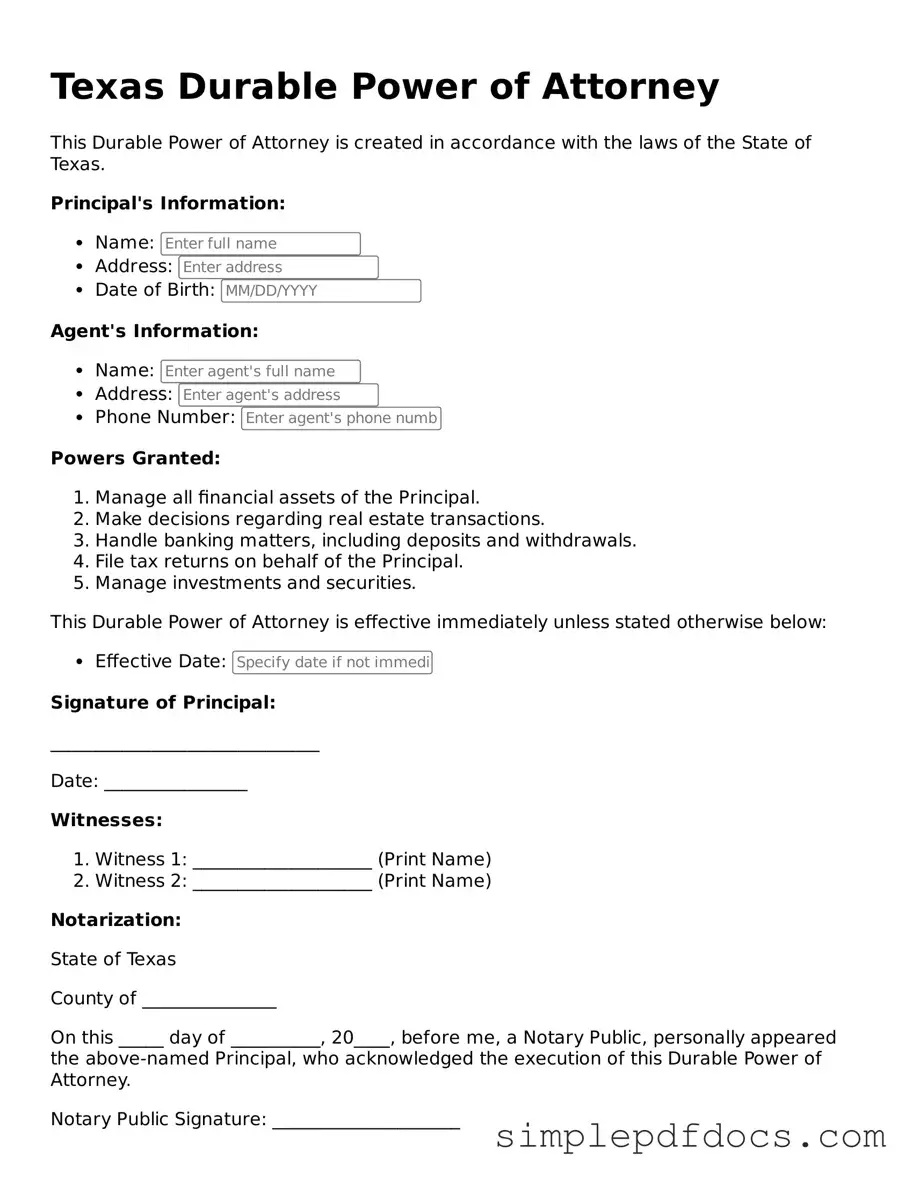

How to Write Texas Durable Power of Attorney

Filling out the Texas Durable Power of Attorney form is a crucial step in ensuring that your financial and legal matters are managed according to your wishes, especially if you become unable to make decisions for yourself. It is important to complete this form carefully to avoid any complications in the future. Follow these steps to fill out the form accurately.

- Obtain the Texas Durable Power of Attorney form. You can find it online or through legal resources.

- Begin with your personal information. Write your full name, address, and date of birth at the top of the form.

- Identify the agent. This is the person you are appointing to act on your behalf. Include their full name, address, and relationship to you.

- Specify the powers you are granting. Clearly indicate which financial and legal decisions your agent can make on your behalf. You can choose to grant broad or limited powers.

- Include any specific instructions or limitations you want to place on your agent's authority. This could include conditions under which the agent can act or specific actions they are not permitted to take.

- Sign and date the form in the presence of a notary public. Ensure that your signature matches the name you provided at the beginning of the document.

- Have your agent sign the form as well, acknowledging their acceptance of the responsibilities involved.

- Make copies of the completed form. Keep the original in a safe place and provide copies to your agent and any relevant institutions, such as banks or healthcare providers.

Once you have completed these steps, the form will be ready for use. Ensure that you keep it updated and review it periodically to reflect any changes in your circumstances or wishes.

Dos and Don'ts

When filling out the Texas Durable Power of Attorney form, it's essential to follow certain guidelines to ensure the document is valid and effective. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before filling it out.

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you want to grant your agent.

- Do sign the form in the presence of a notary public.

- Don't leave any blank spaces on the form.

- Don't forget to discuss your decisions with your agent beforehand.

Following these steps will help ensure your Durable Power of Attorney is completed correctly. Take action today to secure your future decisions.

Documents used along the form

When preparing a Texas Durable Power of Attorney, it is often beneficial to consider additional forms and documents that can complement this legal instrument. These documents can help ensure that your financial and healthcare decisions are well-organized and clearly articulated. Below are five commonly used forms that may accompany the Durable Power of Attorney.

- Medical Power of Attorney: This document allows you to designate someone to make healthcare decisions on your behalf if you become unable to do so. It is crucial for ensuring your medical preferences are honored.

- Living Will: A living will outlines your wishes regarding end-of-life medical treatment. It specifies the types of medical interventions you do or do not want, providing guidance to your loved ones and healthcare providers.

- Horse Bill of Sale - This legal document serves as proof of ownership transfer for a horse and is vital for both buyers and sellers. For more information, visit Florida Forms.

- HIPAA Release Form: This form grants permission for healthcare providers to share your medical information with designated individuals. It is essential for ensuring that your agents can make informed decisions regarding your care.

- Will: A will outlines how you want your assets distributed after your death. It can also name guardians for minor children. Having a will ensures that your wishes are followed and can help avoid family disputes.

- Trust Document: A trust allows you to place assets into a legal entity managed by a trustee for the benefit of your beneficiaries. This can help avoid probate and provide more control over how your assets are distributed.

Considering these additional documents can enhance your overall estate planning strategy. Each serves a unique purpose and can help safeguard your interests and those of your loved ones.