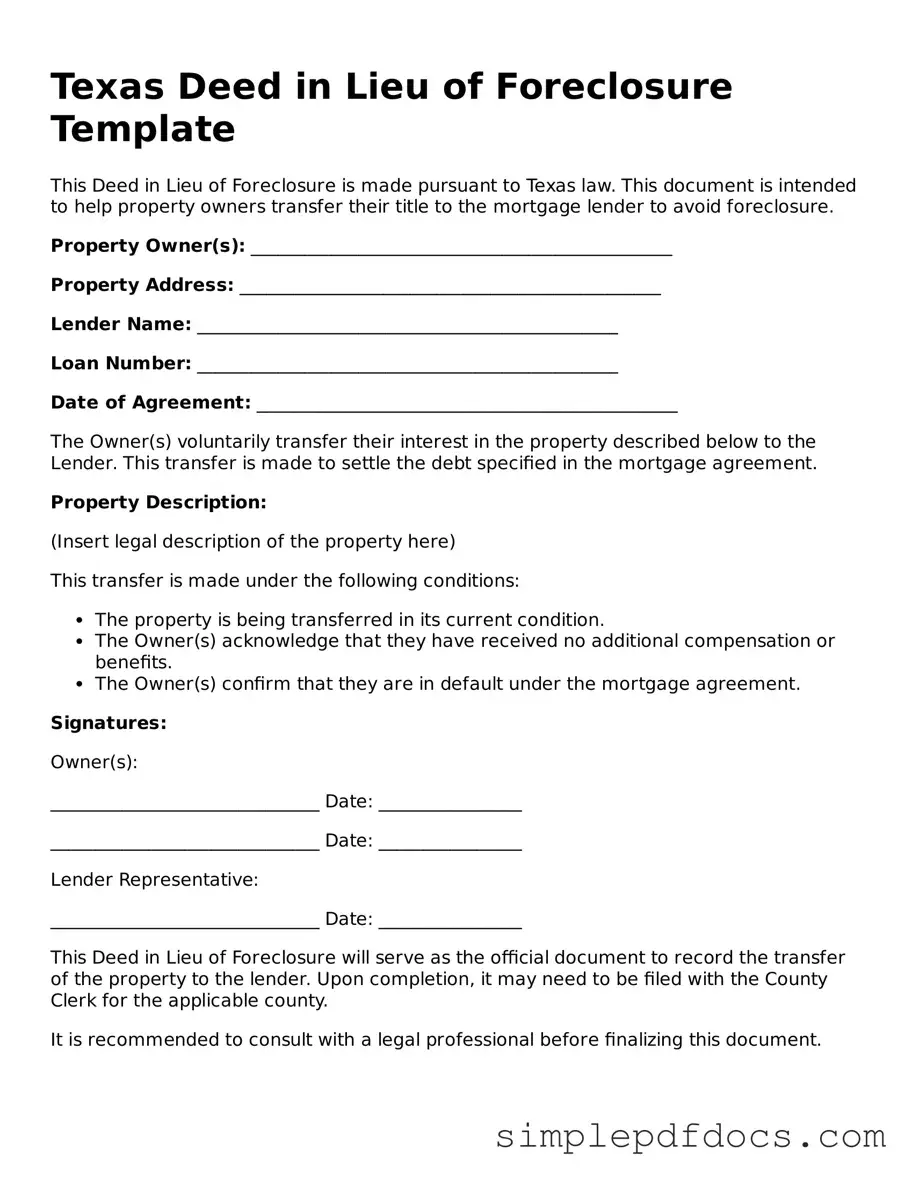

Legal Deed in Lieu of Foreclosure Document for the State of Texas

In the realm of real estate transactions, particularly when facing financial distress, the Texas Deed in Lieu of Foreclosure form serves as a vital tool for homeowners seeking to navigate the complexities of property relinquishment. This legal document allows a borrower to voluntarily transfer ownership of their property back to the lender, thereby avoiding the lengthy and often burdensome process of foreclosure. By executing this deed, homeowners can mitigate the negative impact on their credit score, as it may be viewed more favorably than a foreclosure. The form outlines essential details, including the identification of the parties involved, a description of the property, and the conditions under which the transfer is made. Importantly, it also addresses potential liabilities, ensuring that both the borrower and lender have a clear understanding of their rights and responsibilities post-transfer. Understanding the implications and requirements of the Texas Deed in Lieu of Foreclosure is crucial for homeowners looking to make informed decisions during challenging financial times.

Consider Other Common Deed in Lieu of Foreclosure Templates for Specific States

Pennsylvania Deed in Lieu of Foreclosure - It is often used when a homeowner can no longer afford mortgage payments, but wants to avoid the foreclosure stigma.

In the state of Florida, individuals seeking to express their preferences regarding medical interventions can utilize the Do Not Resuscitate Order form effectively. This essential document, when completed, ensures that medical personnel adhere to the individual's wishes during emergencies, thereby providing vital peace of mind. For more information, you can explore Florida Forms that guide you through the process of creating this important legal directive.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer the title of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | In Texas, the Deed in Lieu of Foreclosure is governed by the Texas Property Code, particularly Chapter 51, which outlines the foreclosure process. |

| Voluntary Process | This option is voluntary and requires the agreement of both the borrower and the lender, making it an alternative to formal foreclosure. |

| Impact on Credit | A Deed in Lieu of Foreclosure may have a less severe impact on the borrower’s credit score compared to a traditional foreclosure, but it still negatively affects creditworthiness. |

| Property Condition | Borrowers typically need to ensure the property is in good condition, as lenders may refuse the deed if significant damage or neglect is present. |

| Tax Implications | There may be tax consequences for the borrower, including potential cancellation of debt income, which should be discussed with a tax professional. |

How to Write Texas Deed in Lieu of Foreclosure

Completing the Texas Deed in Lieu of Foreclosure form is a critical step in the process of transferring property ownership. Ensure all information is accurate and complete to avoid delays. After filling out the form, it will need to be signed and notarized before submission to the appropriate parties.

- Obtain the Texas Deed in Lieu of Foreclosure form. This can be downloaded from a reliable legal resource or obtained from a local courthouse.

- Fill in the Grantor's Information. This includes the full name(s) of the property owner(s) who are transferring the property.

- Provide the Grantee's Information. This is typically the lender or financial institution receiving the property.

- Include the Property Description. Clearly describe the property being transferred, including the address and legal description as found in the original deed.

- State the Consideration. This is often a nominal amount, such as $1, to indicate the transfer of ownership.

- Indicate any Encumbrances on the property. Disclose any existing liens or mortgages that may affect the property.

- Sign the form in the presence of a notary public. All grantors must sign for the transfer to be valid.

- Have the document notarized. This step is essential to authenticate the signatures and validate the deed.

- Submit the completed form to the appropriate county clerk's office for recording. Check with local regulations to ensure compliance.

Once the form is submitted, it will be processed by the county clerk's office. You will receive confirmation once the deed has been officially recorded. Keep a copy for your records.

Dos and Don'ts

When considering a Deed in Lieu of Foreclosure in Texas, it is crucial to approach the process with care and attention. Here are some important dos and don’ts to keep in mind:

- Do ensure that you fully understand the implications of signing a Deed in Lieu of Foreclosure.

- Do consult with a qualified attorney or a housing counselor before proceeding.

- Do gather all necessary documents related to your mortgage and property.

- Do communicate openly with your lender about your intentions and situation.

- Do consider the potential impact on your credit score and future housing options.

- Don't rush into signing the form without reviewing it thoroughly.

- Don't ignore any outstanding debts or obligations related to the property.

- Don't assume that a Deed in Lieu of Foreclosure will absolve you of all liabilities.

- Don't overlook the importance of understanding your rights as a homeowner.

By following these guidelines, you can navigate the process with greater confidence and clarity. Taking the time to educate yourself will empower you to make informed decisions during a challenging time.

Documents used along the form

A Deed in Lieu of Foreclosure can be a practical solution for homeowners facing financial difficulties. However, several other forms and documents often accompany this process. Understanding these documents is crucial for both parties involved in the transaction.

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rates or repayment schedules, aimed at making the mortgage more manageable for the borrower.

- Notice of Default: A formal notification sent to the borrower indicating that they have failed to meet the mortgage obligations, which can lead to foreclosure proceedings.

- Foreclosure Notice: This document informs the borrower that the lender intends to initiate foreclosure, providing details about the impending legal action.

- Operating Agreement: This document is essential for LLCs, outlining governance and operational guidelines. It helps clarify members' rights and responsibilities, which is crucial for avoiding disputes within the company. More information can be found at floridaforms.net/blank-operating-agreement-form/.

- Release of Liability: A document that releases the borrower from further obligations related to the mortgage after the Deed in Lieu is executed, protecting them from future claims by the lender.

- Property Inspection Report: An assessment of the property's condition, often required by the lender to evaluate its value and determine the feasibility of accepting a Deed in Lieu.

- Title Search Report: A review of the property’s title history to ensure there are no outstanding liens or claims that could complicate the transfer of ownership.

- Settlement Statement: A detailed account of all costs and fees associated with the transaction, providing transparency for both the borrower and lender.

- Power of Attorney: A legal document that allows one party to act on behalf of another, which may be necessary if the borrower cannot be present for the signing of the Deed in Lieu.

- Affidavit of Title: A sworn statement by the seller affirming their ownership of the property and disclosing any known issues that could affect the title.

- Release of Mortgage: This document formally removes the mortgage lien from the property title once the Deed in Lieu is executed, ensuring clear ownership for the new title holder.

Each of these documents plays a vital role in the Deed in Lieu of Foreclosure process. Familiarity with them can help both borrowers and lenders navigate this complex situation more effectively.