Legal Articles of Incorporation Document for the State of Texas

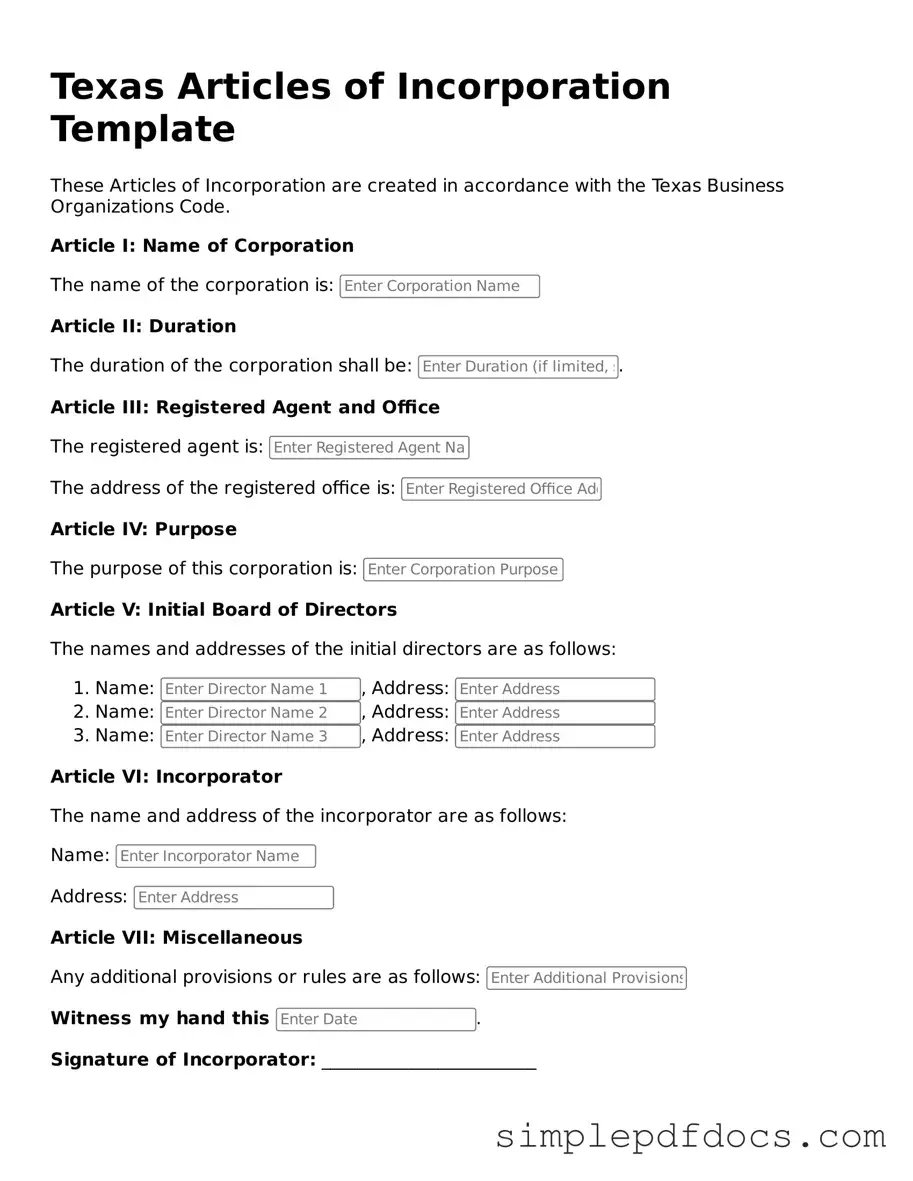

The Texas Articles of Incorporation form serves as a foundational document for individuals and groups seeking to establish a corporation in the state of Texas. This form outlines essential information about the corporation, including its name, duration, and the address of its registered office. Additionally, it requires the identification of the corporation's initial directors and the purpose for which the corporation is formed. The form also includes provisions for the number of shares the corporation is authorized to issue, which is crucial for potential investors and stakeholders. Filing this document with the Texas Secretary of State is a critical step in the incorporation process, as it grants the corporation legal status and the ability to operate within the state. Understanding the components and requirements of the Texas Articles of Incorporation is vital for anyone looking to navigate the complexities of business formation in Texas.

Consider Other Common Articles of Incorporation Templates for Specific States

Pennsylvania Corporation Commission - Establishes a corporate identity for legal purposes.

When preparing to transfer property, it is essential to understand the implications of using a Florida Quitclaim Deed form, which is a legal document utilized for transferring interest in real estate without any guarantees about the title. This type of deed is frequently used among family members or close friends, especially when the property is not being sold at its market value, thus ensuring a quicker and more straightforward transition of ownership. For those looking for a reliable template, you can find one at floridaforms.net/blank-quitclaim-deed-form.

How to Incorporate in Nc - Failure to file the articles may result in losing legal protections associated with incorporation.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Business Organizations Code governs the Articles of Incorporation in Texas. |

| Purpose of Incorporation | Articles of Incorporation serve to officially create a corporation in Texas. |

| Filing Requirement | Filing the Articles of Incorporation with the Texas Secretary of State is mandatory for incorporation. |

| Information Required | The form requires basic information such as the corporation's name, registered agent, and purpose. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Duration of Existence | The Articles can specify a perpetual existence or a limited duration for the corporation. |

| Initial Directors | Information about the initial directors of the corporation must be included in the filing. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the state. |

| Amendments | Changes to the Articles can be made through amendments, which also require filing with the Secretary of State. |

How to Write Texas Articles of Incorporation

After you complete the Texas Articles of Incorporation form, you will need to submit it to the Texas Secretary of State. This step is crucial for officially establishing your corporation. Make sure to have all necessary information ready to ensure a smooth process.

- Begin by downloading the Texas Articles of Incorporation form from the Texas Secretary of State's website.

- Fill in the name of your corporation. Ensure it complies with Texas naming rules.

- Provide the duration of your corporation. Most corporations choose perpetual duration.

- Enter the address of your corporation’s registered office. This must be a physical address in Texas.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- Include the names and addresses of the initial directors. Typically, at least one director is required.

- State the number of shares your corporation is authorized to issue. Specify any classes of shares if applicable.

- Sign and date the form. This must be done by an incorporator.

- Review the form for any errors or missing information before submitting.

Once the form is complete, you can file it online or by mail. Be prepared to pay the required filing fee. After processing, you will receive confirmation of your corporation's formation.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should and shouldn't do.

- Do provide accurate and complete information about your corporation, including its name and address.

- Do ensure that the name of your corporation complies with Texas naming requirements.

- Do include the names and addresses of the initial directors.

- Do specify the purpose of the corporation clearly.

- Do review the form for any errors before submission.

- Don't use a name that is already taken or too similar to an existing corporation.

- Don't leave any required fields blank.

- Don't forget to sign and date the form before submission.

- Don't submit the form without the required filing fee.

- Don't overlook the importance of consulting legal advice if needed.

Documents used along the form

When forming a corporation in Texas, several other documents and forms are typically required in addition to the Texas Articles of Incorporation. These documents help ensure compliance with state laws and facilitate the smooth operation of the corporation. Below is a list of commonly used forms and documents.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the responsibilities of directors and officers, the process for holding meetings, and how decisions are made.

- Initial Report: This document may be required to provide initial information about the corporation's structure, including the names and addresses of directors and officers.

- Employer Identification Number (EIN): Issued by the IRS, this number is necessary for tax purposes and is required to open a business bank account.

- Florida Vehicle POA Form 82053: This legal document allows an individual to authorize another person to act on their behalf in vehicle-related matters. For more information on this document, you can visit Florida Forms.

- Certificate of Formation: While similar to the Articles of Incorporation, this document specifically outlines the corporation's purpose and structure and is filed with the Texas Secretary of State.

- Shareholder Agreement: This agreement outlines the rights and obligations of shareholders, including how shares can be transferred and how disputes will be resolved.

- Business License: Depending on the type of business and location, a specific license or permit may be required to operate legally.

- Operating Agreement: For corporations with multiple owners, this document details the management structure and operating procedures, similar to a partnership agreement.

- Annual Franchise Tax Report: Texas corporations must file this report annually to comply with state tax regulations, detailing the corporation's revenue and other financial information.

Each of these documents plays a crucial role in the establishment and operation of a corporation in Texas. Ensuring that all necessary forms are completed and filed correctly can help avoid legal complications and promote effective governance.