Fill Your Tax POA dr 835 Form

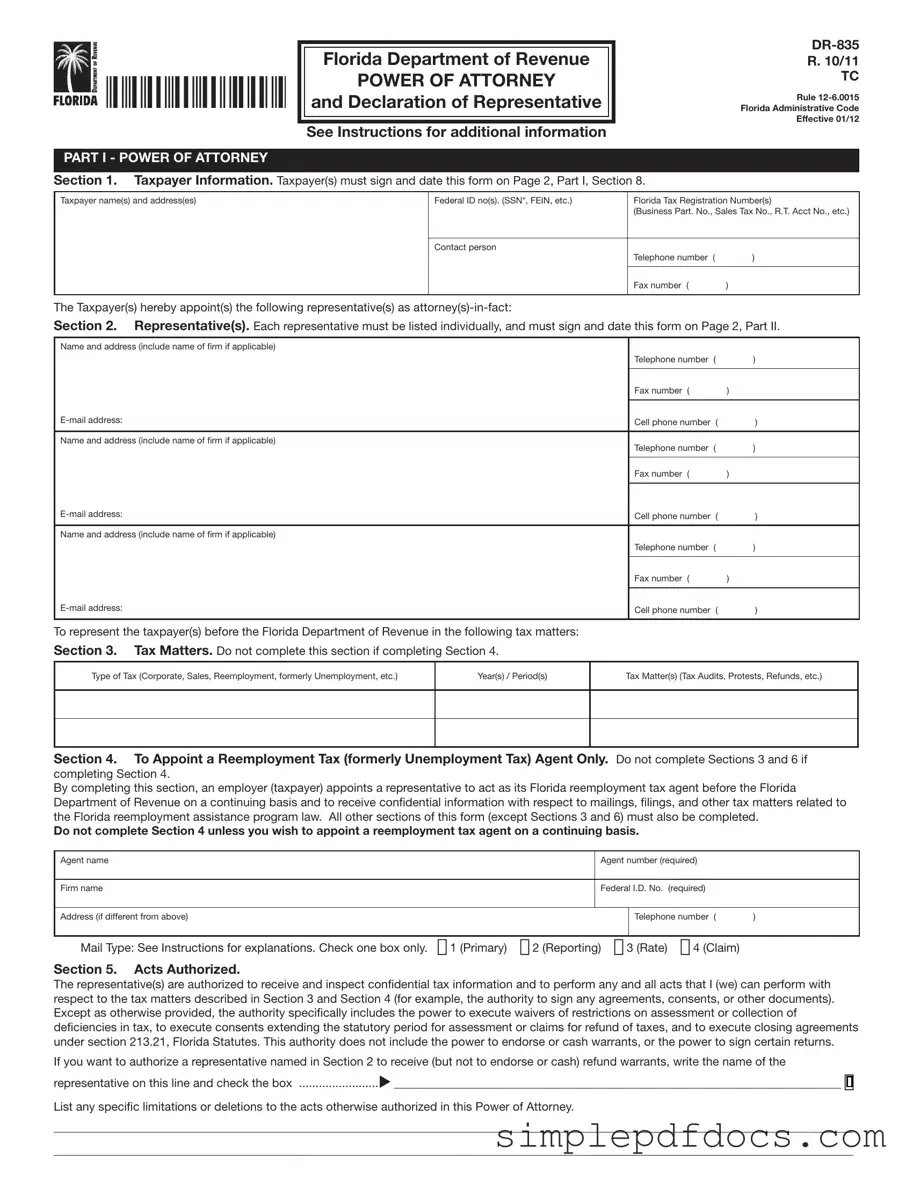

The Tax Power of Attorney (POA) DR 835 form plays a crucial role in the realm of tax administration, allowing individuals to designate someone else to act on their behalf in matters related to their taxes. This form is essential for taxpayers who may not have the time or expertise to navigate the complexities of tax regulations and filings. By completing the DR 835, a taxpayer grants specific powers to an appointed representative, enabling them to communicate directly with the tax authorities, receive confidential information, and make decisions regarding tax obligations. The form not only streamlines the process of managing tax affairs but also ensures that the designated representative has the authority to handle various tax-related issues, such as responding to audits, negotiating settlements, or filing appeals. Understanding the nuances of the DR 835 form is vital for both taxpayers and their representatives, as it outlines the scope of authority granted and the responsibilities that come with it. Moreover, the proper execution of this form can prevent misunderstandings and disputes with tax authorities, ultimately leading to a more efficient resolution of tax matters.

More PDF Templates

Dmv Odometer Disclosure Statement - Buyers are encouraged to validate the mileage against the vehicle history report.

The process of establishing a business in Florida begins with the completion of the Florida Articles of Incorporation form, a crucial legal document that outlines essential details about the corporation, including its name, purpose, and structure. To ensure compliance and avoid any ambiguities, it is advisable to familiarize yourself with the necessary requirements through resources like Florida Forms.

Daycare Receipt Template - Both parties should retain a copy of this receipt for verification.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Tax POA DR 835 form is used to authorize a representative to act on behalf of a taxpayer in tax matters. |

| Governing Law | This form is governed by the Internal Revenue Code and applicable state tax laws. |

| Eligibility | Any individual or business entity can complete this form to designate a representative. |

| Submission | The completed form must be submitted to the relevant tax authority to grant the representative access to the taxpayer's information. |

How to Write Tax POA dr 835

Filling out the Tax POA DR 835 form is an important step in authorizing someone to represent you in tax matters. Once you complete the form, it will be submitted to the appropriate tax authority, allowing your designated representative to act on your behalf. Follow these steps to ensure that you fill out the form correctly.

- Begin by downloading the Tax POA DR 835 form from the official tax authority website.

- Read the instructions carefully to understand the requirements and sections of the form.

- Fill in your personal information in the designated fields, including your name, address, and Social Security number.

- Provide the name and contact information of the person you are designating as your representative.

- Specify the tax matters for which you are granting authority. This could include income tax, sales tax, or other relevant areas.

- Indicate the tax years or periods that the authorization covers. Be specific to avoid any confusion.

- Sign and date the form in the appropriate sections. This confirms your consent for the representative to act on your behalf.

- Make a copy of the completed form for your records before submitting it.

- Submit the original form to the appropriate tax authority, following their guidelines for submission.

After submission, your designated representative will be able to communicate with the tax authority regarding your tax matters. Keep an eye out for any correspondence that may come your way, as it may involve important information regarding your tax situation.

Dos and Don'ts

When filling out the Tax POA DR 835 form, it’s important to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do double-check all entries for spelling and numerical accuracy.

- Do sign and date the form in the designated areas.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank.

- Don’t use correction fluid or tape on the form.

- Don’t submit the form without verifying your identity.

- Don’t forget to check the submission deadlines.

Following these guidelines will help you navigate the form-filling process with confidence and ease.

Documents used along the form

When dealing with tax matters, several forms and documents may accompany the Tax POA (Power of Attorney) DR 835 form. Understanding these documents can help streamline the process and ensure everything is in order. Below is a list of commonly used forms that you might encounter.

- Form 2848: This is the IRS Power of Attorney and Declaration of Representative form. It allows you to authorize someone to represent you before the IRS.

- Form 4506: This form is used to request a copy of your tax return. It can be essential for verifying your income or for other tax-related purposes.

- Form 1040: This is the standard individual income tax return form. It’s crucial for reporting personal income and calculating your tax liability.

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld. It’s important for filing your tax return accurately.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Freelancers and independent contractors often receive these.

- Form 4868: This is the application for an automatic extension of time to file your tax return. It can provide additional time if you need it.

- Georgia Notice to Quit Form: To ensure compliance with eviction processes, refer to the Georgia Notice to Quit form guidelines which outline the necessary steps for landlords and tenants.

- Form 8862: This form is used to claim the Earned Income Credit after disallowance. It’s important for those who have previously been denied this credit.

- Form 941: Employers use this form to report income taxes, Social Security tax, or Medicare tax withheld from employee paychecks.

- Form 1065: This is the U.S. Return of Partnership Income form. Partnerships use it to report their income, deductions, and other tax-related information.

- Form 1120: Corporations use this form to report their income, gains, losses, deductions, and credits. It’s essential for corporate tax filings.

Having these forms at hand can make your tax process smoother. Each document serves a specific purpose and can help clarify your financial situation with the IRS or other tax authorities. Make sure you understand each one and gather them as needed.