Fill Your Stock Transfer Ledger Form

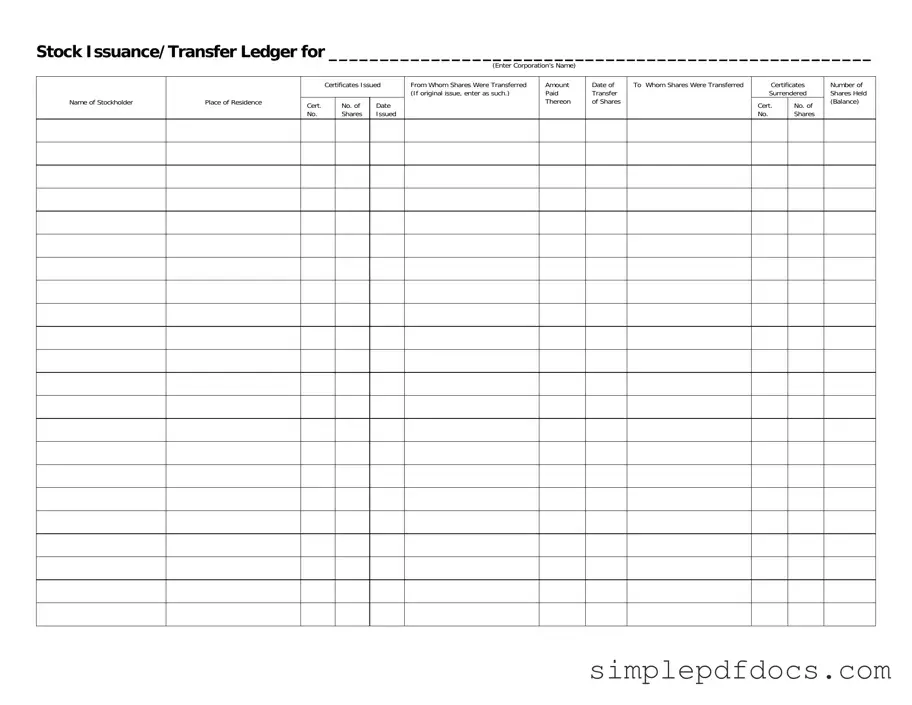

The Stock Transfer Ledger form plays a crucial role in the management of a corporation's stock transactions. This document serves as an official record, detailing the issuance and transfer of shares among stockholders. Each entry includes vital information such as the corporation's name, the stockholder's details, and the certificates issued. The form captures the certificate numbers and the dates on which shares were issued, ensuring transparency in ownership. It also tracks from whom the shares were transferred, making it clear whether the shares are part of an original issue or a subsequent transfer. Additionally, the ledger records the amount paid for the shares, providing a clear financial trail. When shares change hands, the form notes the date of transfer and identifies the new stockholder. Certificates surrendered during the transfer process are documented, along with the corresponding certificate numbers. Finally, the ledger reflects the balance of shares held, giving a complete picture of stock ownership at any given time. This comprehensive approach not only aids in maintaining accurate records but also supports compliance with regulatory requirements, making it an essential tool for corporations and their shareholders alike.

More PDF Templates

Puppy Health Record - Each entry aids in keeping your puppy on track for a healthy life.

When parents find themselves in situations where they cannot be present for their children, utilizing a legal tool like the Florida Power of Attorney for a Child form becomes essential. This document empowers another adult to make decisions and manage the care of the children, ensuring their well-being during times of absence. To access this important form, visit floridaforms.net/blank-power-of-attorney-for-a-child-form.

Da Form 1380 May 2019 - The form serves as a record for both paid and non-paid training sessions.

Annual Physical Examination Form Pdf - For women, document GYN exam results along with the date performed.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to record the issuance and transfer of stock shares within a corporation. |

| Content | This form includes essential details such as the corporation's name, stockholder information, certificates issued, and transfer details. |

| Stockholder Information | It requires the name and place of residence of each stockholder involved in the transaction. |

| Transfer Details | The form captures who the shares were transferred from and to, along with the amount paid for the shares. |

| Governing Laws | In many states, the use of a Stock Transfer Ledger is governed by corporate laws, such as the Delaware General Corporation Law. |

| Record Keeping | Maintaining this ledger is crucial for accurate record-keeping and compliance with state regulations regarding stock ownership. |

How to Write Stock Transfer Ledger

Filling out the Stock Transfer Ledger form is an essential step in documenting stock transactions accurately. After completing this form, it will serve as a record of stock issuance and transfer, ensuring all parties involved have clear and reliable information regarding ownership changes.

- Begin by entering the name of the corporation in the designated space at the top of the form.

- In the section labeled "Name of Stockholder," write the full name of the stockholder involved in the transaction.

- Next, indicate the "Place of Residence" of the stockholder. This should include the city and state.

- For "Certificates Issued," list the number of stock certificates that are being issued for the transaction.

- In the "Cert. No. of Date" field, provide the certificate number and the date of issuance.

- In the "No. Shares Issued From Whom" section, specify the name of the individual or entity from whom the shares were transferred. If it is the original issue, write "original issue."

- Document the "Amount Paid Thereon," indicating the monetary value paid for the shares being transferred.

- In the "Date of Transfer of Shares" field, enter the date on which the transfer takes place.

- For "To Whom Shares Were Transferred," write the name of the individual or entity receiving the shares.

- In the "Certificates Surrendered" section, provide the certificate number of the shares being surrendered as part of the transfer.

- Next, indicate the "Cert. No. of No. Shares" for the surrendered certificates.

- Finally, calculate and enter the "Number of Shares Held (Balance)" to reflect the remaining shares held by the stockholder after the transfer.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are five things you should do and five things you should avoid.

- Do enter the full name of the corporation accurately at the top of the form.

- Do provide complete and correct information for each stockholder, including their place of residence.

- Do list the certificates issued along with their corresponding certificate numbers and dates.

- Do indicate clearly from whom the shares were transferred, especially if it's an original issue.

- Do ensure that the amount paid and the date of transfer are filled in correctly.

- Don't leave any fields blank; every section must be completed to avoid delays.

- Don't use abbreviations or nicknames for stockholders; use their full legal names.

- Don't forget to surrender the certificates; this must be noted on the form.

- Don't mix up the certificate numbers or dates, as this can cause confusion.

- Don't overlook updating the number of shares held after the transfer is recorded.

Documents used along the form

The Stock Transfer Ledger form is an essential document for corporations that manage the issuance and transfer of stock. However, it often works in conjunction with other forms and documents that help streamline the process and maintain accurate records. Here’s a look at some of the key documents commonly used alongside the Stock Transfer Ledger.

- Stock Certificate: This document serves as proof of ownership for shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the company's name. Stock certificates are often issued when shares are first purchased and may need to be surrendered when shares are transferred.

- Shareholder Agreement: This is a contract among the shareholders of a corporation outlining their rights and responsibilities. It often includes provisions regarding the transfer of shares, voting rights, and how profits will be distributed. This agreement helps prevent disputes and ensures that all shareholders are on the same page.

- Board Resolution: When shares are transferred or issued, the board of directors typically must approve the action. A board resolution documents this approval, providing a formal record that can be referenced in the future. It ensures that all corporate actions comply with internal governance policies.

- Stock Transfer Agreement: This document outlines the terms and conditions under which shares are being transferred from one party to another. It includes details such as the number of shares, the purchase price, and any warranties or representations made by the seller. Having a clear agreement helps protect both parties involved in the transaction.

- Form 2553 (for S Corporations): If a corporation elects to be taxed as an S Corporation, this IRS form must be filed. It allows the corporation to pass income, losses, and credits directly to shareholders, avoiding double taxation. Understanding this form is crucial for tax compliance and shareholder benefits.

- Employment Verification Form: This is a document used to confirm an individual's employment status, essential for background checks and loan applications. Employers can find the necessary document at Florida Forms, which aids in navigating the verification process effectively.

- Annual Report: Corporations are often required to file annual reports with the state. This document provides an overview of the corporation's activities, financial status, and any changes in ownership or structure. It is essential for maintaining good standing with state authorities.

These documents play vital roles in the stock transfer process, ensuring that everything is documented clearly and legally. By understanding these forms, shareholders and corporations alike can navigate the complexities of stock ownership with confidence and clarity.