Attorney-Approved Single-Member Operating Agreement Form

In the world of business, especially for those who operate as sole proprietors or single-member limited liability companies (LLCs), having a solid foundation is crucial for success. The Single-Member Operating Agreement serves as a vital document that outlines the internal workings of the business, providing clarity and structure. This agreement details the management structure, financial arrangements, and operational procedures, ensuring that the owner has a clear roadmap for decision-making. It also serves to protect the owner’s personal assets by reinforcing the separation between personal and business liabilities. Moreover, the agreement can address important aspects such as profit distribution, member responsibilities, and the process for dissolving the business if necessary. By formalizing these elements, the Single-Member Operating Agreement not only enhances the credibility of the business but also provides a layer of legal protection, making it an essential tool for any single-member LLC. Understanding the nuances of this document can empower business owners to navigate their entrepreneurial journey with confidence and clarity.

More Single-Member Operating Agreement Types:

How to Create an Operating Agreement for an Llc - It may specify the process for member buyouts if one member wishes to exit the business.

The New York Operating Agreement is an important legal tool for LLCs that provides a clear framework for governance. To learn more, you can read about the comprehensive New York Operating Agreement form requirements at comprehensive New York Operating Agreement.

PDF Details

| Fact Name | Description |

|---|---|

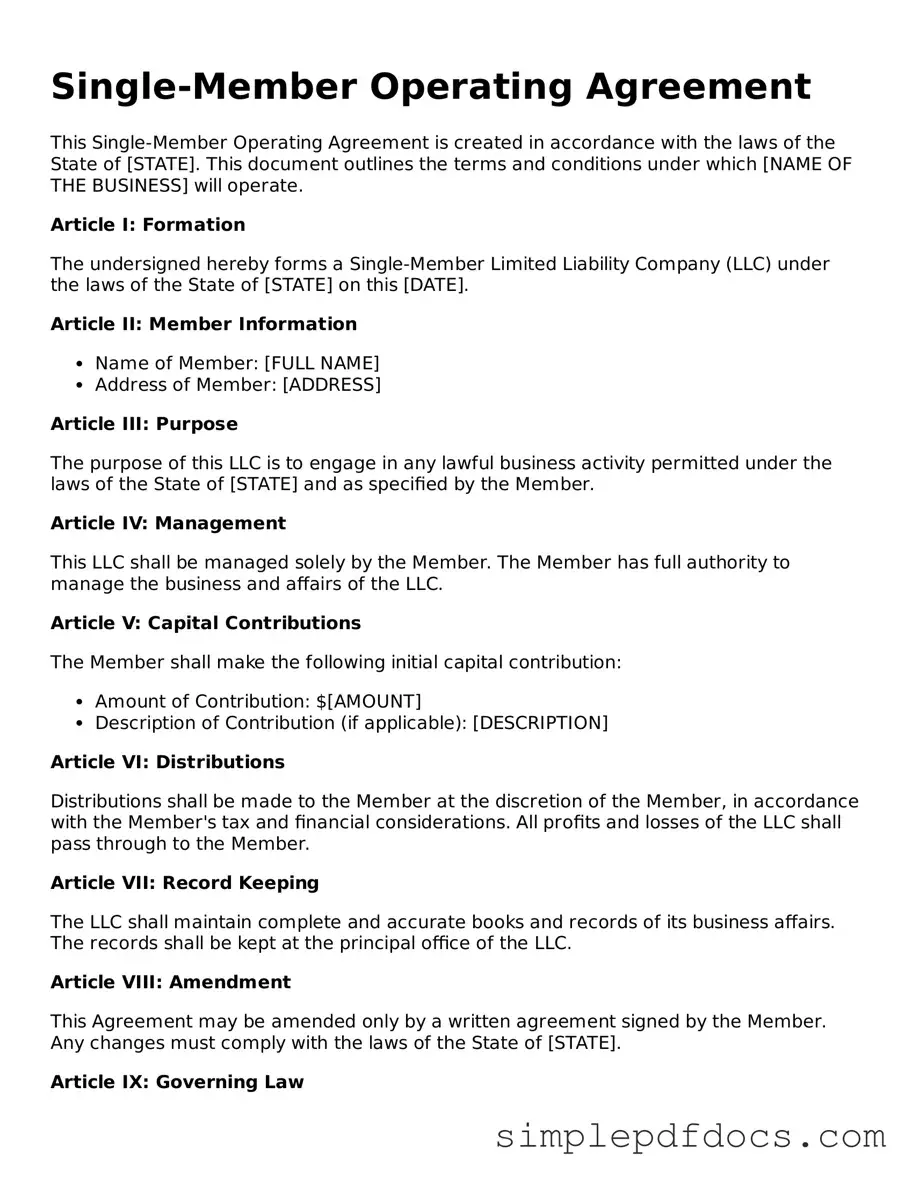

| Definition | A Single-Member Operating Agreement outlines the management structure and operating procedures for a single-member LLC. |

| Legal Requirement | While not required by law, having an operating agreement is highly recommended for legal protection and clarity. |

| State-Specific Laws | Governing laws vary by state. For example, in Delaware, it falls under Title 6, Chapter 18 of the Delaware Code. |

| Liability Protection | It helps maintain the limited liability status of the LLC, protecting personal assets from business debts. |

| Flexibility | The agreement allows the owner to customize the management and operational procedures according to their preferences. |

How to Write Single-Member Operating Agreement

Filling out the Single-Member Operating Agreement form is a straightforward process that requires attention to detail. Once completed, this document will serve as a foundational agreement for your business operations.

- Begin by entering your name as the sole member of the LLC at the top of the form.

- Next, provide the name of your LLC in the designated section.

- Fill in the principal office address of your LLC. This should be a physical address where your business is located.

- Indicate the date when the agreement will take effect.

- Specify the purpose of your LLC in the appropriate field. Keep this concise and clear.

- Outline the management structure. Since you are the sole member, you may indicate that you will manage the LLC.

- Include any additional provisions or rules that you wish to establish for your LLC. This can cover decision-making processes, profit distribution, and other operational details.

- Sign and date the document at the bottom. Ensure that your signature is clear and legible.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it is essential to approach the task with care and attention to detail. Here are some guidelines to help you navigate the process effectively.

- Do provide accurate and complete information about your business. This includes the business name, address, and the owner's details.

- Do clearly outline the purpose of your business. A well-defined purpose can help clarify your goals and intentions.

- Do specify the management structure. Even as a single-member entity, it is beneficial to indicate how decisions will be made.

- Don't leave any sections blank. Incomplete forms may lead to confusion or delays in processing.

- Don't use vague language. Be precise in your descriptions to avoid any potential misunderstandings.

- Don't forget to sign and date the agreement. An unsigned document may not be legally binding.

By adhering to these guidelines, you can ensure that your Single-Member Operating Agreement is both comprehensive and clear, setting a solid foundation for your business endeavors.

Documents used along the form

A Single-Member Operating Agreement is an essential document for a single-member LLC, outlining the management structure and operational guidelines. Along with this agreement, several other forms and documents may be necessary to ensure proper compliance and organization. Below is a list of related documents that are often used in conjunction with the Single-Member Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Employer Identification Number (EIN): An EIN is a unique number assigned by the IRS for tax purposes. It is required for opening a business bank account and filing taxes.

- Initial Resolution: This document records the initial decisions made by the single member, such as the appointment of officers or the approval of the operating agreement.

- Membership Certificate: This certificate serves as proof of ownership in the LLC. It details the member's ownership percentage and rights within the company.

- Bylaws: While not always required, bylaws outline the internal rules for the LLC's operations. They can cover topics like meetings and voting procedures.

- Operating Agreement Form: To establish clear management guidelines for your LLC, utilize the comprehensive Operating Agreement form requirements for effective setup and operation.

- Bank Resolution: This document authorizes the opening of a bank account in the name of the LLC and designates who can sign on behalf of the company.

- Annual Report: Many states require LLCs to file an annual report to maintain good standing. This report often includes updated information about the business and its members.

- Tax Documents: Depending on the LLC's structure, various tax forms may need to be filed with federal and state authorities, including income tax returns and sales tax permits.

These documents work together to establish a solid foundation for a single-member LLC. Ensuring that each form is completed accurately and filed on time is crucial for maintaining compliance and protecting the member's interests.