Fill Your Sample Tax Return Transcript Form

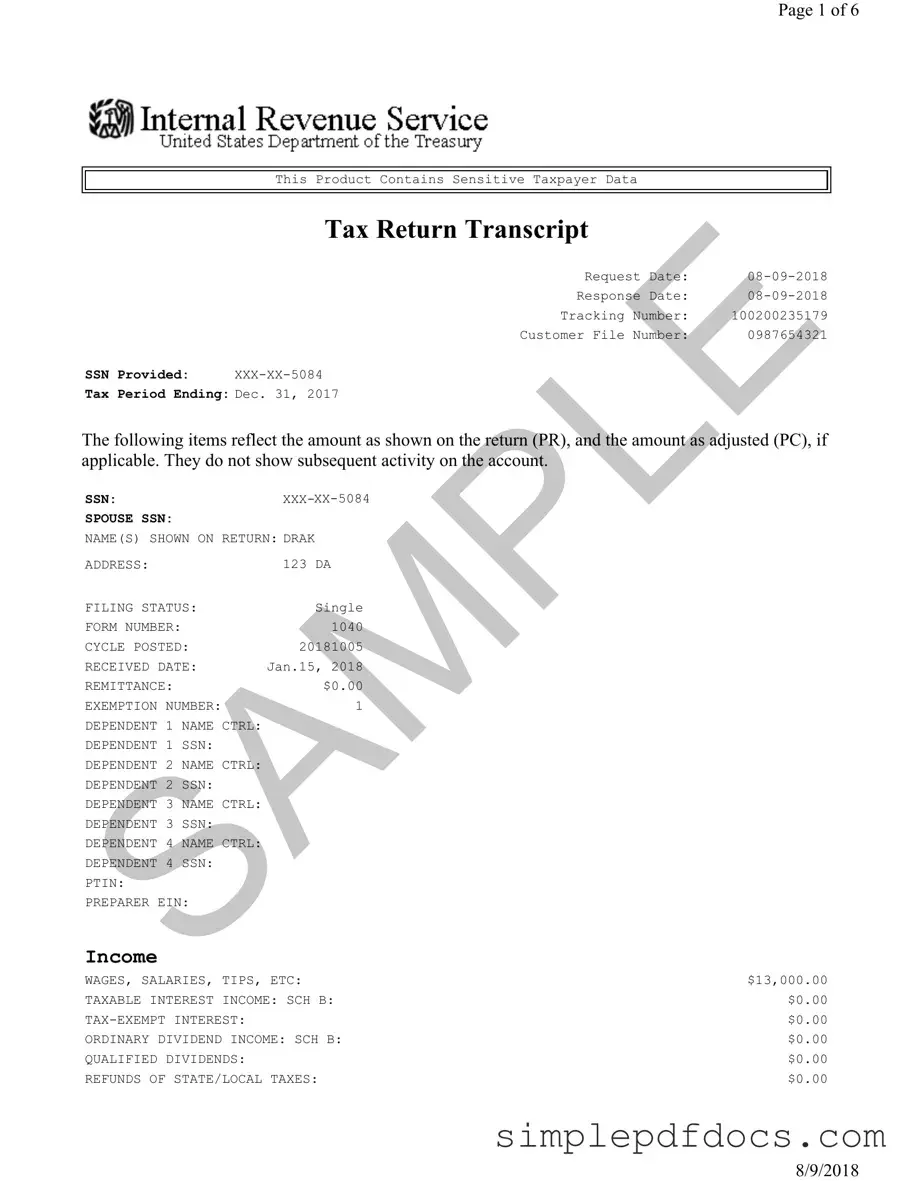

The Sample Tax Return Transcript form serves as a crucial document for individuals seeking to understand their tax situation. It provides a detailed summary of the information reported on a taxpayer's federal income tax return, including essential data such as income, deductions, and credits. This form is particularly valuable for those applying for loans, financial aid, or other situations where proof of income is necessary. Key components include the taxpayer's Social Security Number (SSN), filing status, and total income, along with adjustments that may affect the taxable amount. Additionally, it outlines various income sources, such as wages, business income, and potential credits that can reduce tax liability. The transcript does not reflect any subsequent account activity, making it a snapshot of the tax return for a specific year. By understanding the details within this form, taxpayers can gain clarity on their financial standing and ensure they are well-prepared for any financial obligations or opportunities that may arise.

More PDF Templates

Affidavit of Successor Trustee California - The affidavit must be signed under penalty of perjury, affirming the truthfulness of its contents.

Form 10-2850c - Healthcare professionals are encouraged to maintain their licenses in good standing before applying with the VA using this form.

For those looking to sell or purchase a boat, it’s important to have the necessary documentation in order. The California Boat Bill of Sale form can be easily accessed through PDF Documents Hub, ensuring that you have everything you need to make the transaction official and smooth.

Dd 214 - The DD 214 records military education, reinforcing the member's qualifications and training achievements.

Document Specifics

| Fact Name | Details |

|---|---|

| Request Date | 08-09-2018 |

| Tax Period Ending | December 31, 2017 |

| Filing Status | Single |

| Total Income | $15,500.00 |

| Adjusted Gross Income | $15,323.00 |

| Total Payments | $1,000.00 |

How to Write Sample Tax Return Transcript

Filling out the Sample Tax Return Transcript form can seem daunting, but with a little guidance, you can navigate it with ease. This form contains important information regarding your tax return, including your income, deductions, and credits. Here's how to fill it out step by step.

- Start by entering the Request Date at the top of the form. This is the date you are completing the form.

- Next, fill in the Response Date. This is typically the same date as the request date.

- Write down the Tracking Number provided on your form. This helps in tracking your request.

- Input your Customer File Number. This number is unique to your account.

- Enter your Social Security Number (SSN). Make sure to include the full number, replacing the last four digits with 'XXX-XX-XXXX' for privacy.

- Indicate the Tax Period Ending date. This is usually December 31 of the tax year you are reporting.

- Fill in your Name(s) Shown on Return. This should match your tax return.

- Provide your Address as it appears on your tax return.

- Indicate your Filing Status. In this case, it is "Single".

- Enter the Form Number you are using, which is typically 1040 for individual tax returns.

- Fill in the Cycle Posted date. This is when your tax return was processed.

- Record the Received Date of your tax return.

- Note the Remittance amount, which indicates any payments made.

- Input the Exemption Number based on your tax return.

- For any dependents, list their names and SSNs in the designated areas.

- Fill in the PTIN if you are a paid preparer, along with your Preparer EIN.

- Next, enter your income details. This includes wages, salaries, tips, and any other income sources.

- Complete the section on Adjustments to Income, including any deductions you qualify for.

- Fill in the Tax and Credits section, noting any credits you are eligible to claim.

- Lastly, review the Payments and Refund or Amount Owed sections to ensure accuracy.

Once you have completed the form, double-check all entries for accuracy. Make sure your numbers add up and that you have included all necessary information. This will help ensure a smooth processing of your request. If you have any questions or need assistance, don't hesitate to reach out to a tax professional.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do double-check your Social Security Number (SSN) for accuracy.

- Do ensure that all income sources are reported correctly.

- Do review the form for any missing information before submission.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank unless instructed to do so.

- Don't provide false information or estimates.

- Don't forget to sign and date the form before sending it in.

Taking these steps will help you navigate the tax return process with greater confidence. Remember, accuracy is crucial, and attention to detail can prevent future complications.

Documents used along the form

The Sample Tax Return Transcript form provides a summary of a taxpayer's income, deductions, and tax credits for a specific tax year. Several other documents often accompany this form to provide additional context or details about the taxpayer's financial situation. Below is a list of these common forms and documents.

- Form 1040: This is the standard individual income tax return form used by taxpayers to report their annual income to the IRS. It includes information about income, deductions, and tax liability.

- W-2 Form: Employers provide this form to employees, summarizing their annual wages and the taxes withheld. It is essential for completing the tax return accurately.

- Bill of Sale Form: For those finalizing asset transfers, the comprehensive Bill of Sale documentation guide is critical to ensure proper legal acknowledgment of ownership changes.

- Schedule C: This form is used by self-employed individuals to report income and expenses from their business. It details profit or loss from business activities.

- Form 1099: Various types of 1099 forms report income received by individuals who are not employees, such as freelancers or independent contractors. They are critical for reporting additional income on tax returns.

These documents collectively help in accurately reporting financial information to the IRS and determining tax obligations. It is important to gather all relevant forms when preparing a tax return to ensure compliance and accuracy.