Attorney-Approved Release of Promissory Note Form

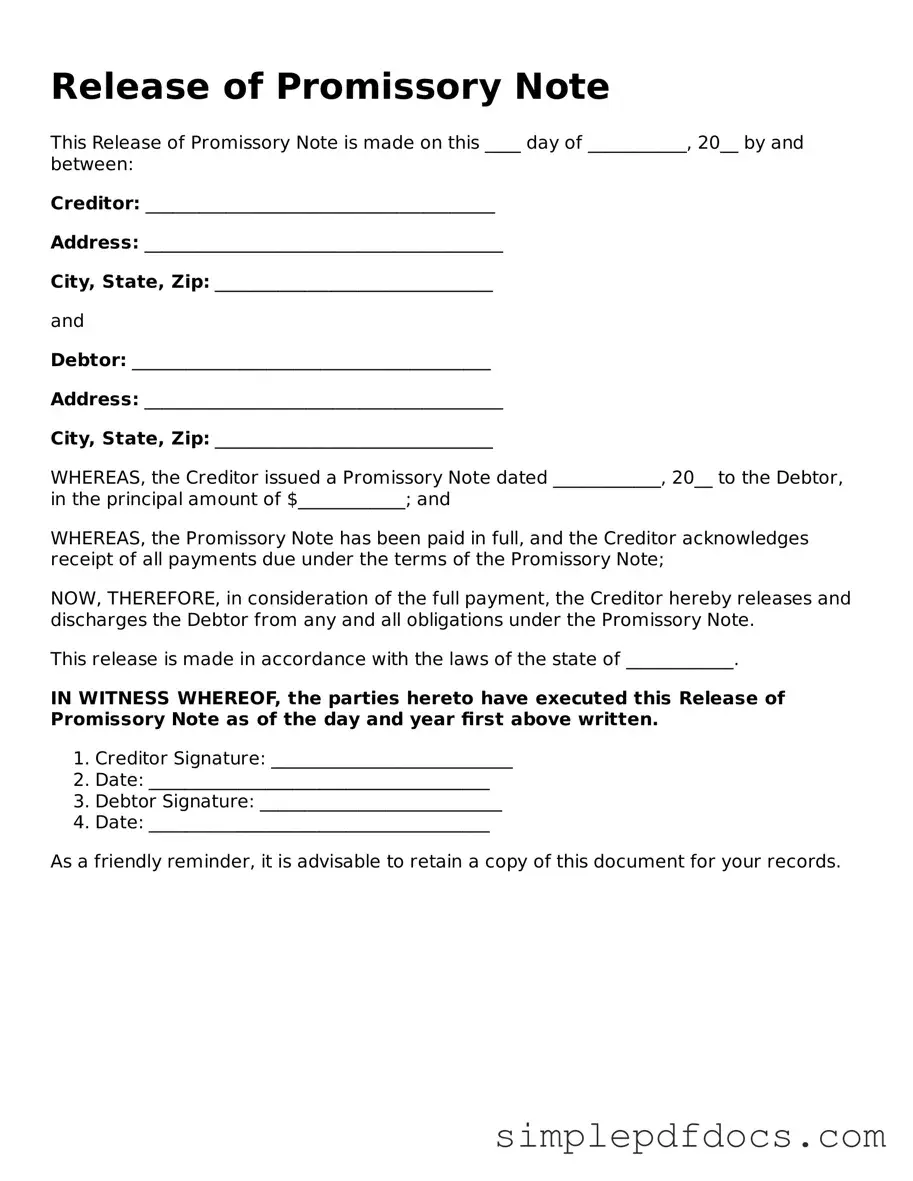

The Release of Promissory Note form plays a crucial role in the world of financial agreements and personal loans. When a borrower pays off a loan, this form serves as a formal acknowledgment that the debt has been settled. It provides peace of mind to both parties by documenting the release of the borrower's obligation. This form typically includes essential details such as the names of the borrower and lender, the original loan amount, and the date of payment. It also may outline any conditions or stipulations related to the release. By completing this form, both parties can ensure clarity and avoid potential disputes in the future. Understanding the importance of this document is vital for anyone involved in lending or borrowing, as it protects the rights of both the lender and the borrower. Without it, misunderstandings can arise, leading to unnecessary complications. Thus, utilizing the Release of Promissory Note form is a key step in concluding a loan agreement effectively.

More Release of Promissory Note Types:

Loan Note Template - By signing the note, both parties demonstrate their commitment to the loan agreement.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. Understanding its structure and requirements can help individuals navigate their financial obligations effectively. For those seeking a ready-to-use format, the NY Templates offers a helpful resource.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Release of Promissory Note form is used to formally acknowledge the satisfaction of a debt, indicating that the borrower has repaid the loan in full. |

| Parties Involved | This form typically involves two parties: the lender, who is releasing the note, and the borrower, who has fulfilled their repayment obligations. |

| State-Specific Requirements | Different states may have specific laws governing the release of promissory notes. For example, in California, the relevant law is found in the California Civil Code. |

| Filing and Record Keeping | After the form is completed and signed, it is advisable to keep a copy for personal records. In some cases, it may also be filed with a local government office to provide public notice of the debt release. |

How to Write Release of Promissory Note

After completing the Release of Promissory Note form, it's important to ensure that all necessary information is accurate and that the document is properly signed. This form serves as a formal acknowledgment that the promissory note has been satisfied or is no longer in effect. Once filled out, the form should be kept in a safe place and shared with relevant parties as needed.

- Begin by entering the date at the top of the form. This should be the date on which you are filling out the form.

- Next, provide the name of the borrower. This is the individual or entity that originally took out the loan.

- In the following section, write the name of the lender. This is the individual or entity that provided the loan.

- Then, include the amount of the loan that was originally documented in the promissory note. Be sure to write the amount clearly.

- After that, specify the date on which the promissory note was executed. This is the date when the borrower and lender signed the original note.

- Next, indicate the date on which the loan was fully paid off. This is crucial for the release of the note.

- Proceed to sign the form. The lender should sign to confirm the release of the promissory note.

- Finally, print the name of the lender below the signature to provide clarity on who has signed the document.

Dos and Don'ts

When filling out the Release of Promissory Note form, it's important to be mindful of certain practices to ensure accuracy and compliance. Here’s a straightforward guide to help you navigate the process.

- Do read the entire form carefully before starting. Understanding each section will help prevent mistakes.

- Do provide accurate and complete information. Double-check names, dates, and amounts to ensure they are correct.

- Do sign and date the form in the appropriate sections. An unsigned form may not be valid.

- Do keep a copy of the completed form for your records. This can be helpful for future reference.

- Do consult with a professional if you have questions or uncertainties. It’s better to ask than to risk errors.

- Don't rush through the form. Taking your time can help you avoid errors.

- Don't leave any sections blank unless instructed. Incomplete forms may be rejected.

- Don't use white-out or correction fluid. If you make a mistake, it’s best to cross it out and initial the change.

- Don't forget to check for any additional requirements or documents that need to accompany the form.

- Don't assume that verbal agreements are sufficient. Written documentation is crucial for legal purposes.

Documents used along the form

When dealing with a Release of Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Each of these documents serves a specific purpose in the transaction process. Below is a list of commonly associated forms.

- Promissory Note: This is the original document where the borrower agrees to repay a specified amount to the lender, detailing the terms of repayment and interest rates.

- Loan Agreement: This contract outlines the terms and conditions of the loan, including repayment schedules, collateral, and any covenants that both parties must adhere to.

- Blank Promissory Note: A template form that provides a structured way to outline the terms and conditions of a loan agreement, available at promissoryform.com/blank-arkansas-promissory-note.

- Security Agreement: If the loan is secured, this document describes the collateral pledged by the borrower to the lender in case of default.

- Payment Schedule: This document provides a detailed timeline of payment due dates, amounts, and any applicable interest, ensuring both parties understand their obligations.

- Release of Liability: This form releases the lender from any further claims or liabilities related to the promissory note once it has been satisfied.

- Affidavit of Payment: A sworn statement confirming that the borrower has fulfilled their payment obligations under the promissory note.

- Notice of Default: Should the borrower fail to meet payment terms, this document formally notifies them of their default status, outlining potential consequences.

- Amendment Agreement: If any terms of the original promissory note or loan agreement need to be changed, this document formally amends those terms with mutual consent.

- Subordination Agreement: This document is used when a new lender requires that their claim on the collateral be prioritized over the existing loan, altering the order of repayment in case of default.

Understanding these documents can help both borrowers and lenders navigate the complexities of financial agreements. Ensuring that all necessary paperwork is in order protects the interests of both parties and fosters a transparent relationship.