Fill Your Release Of Lien Texas Form

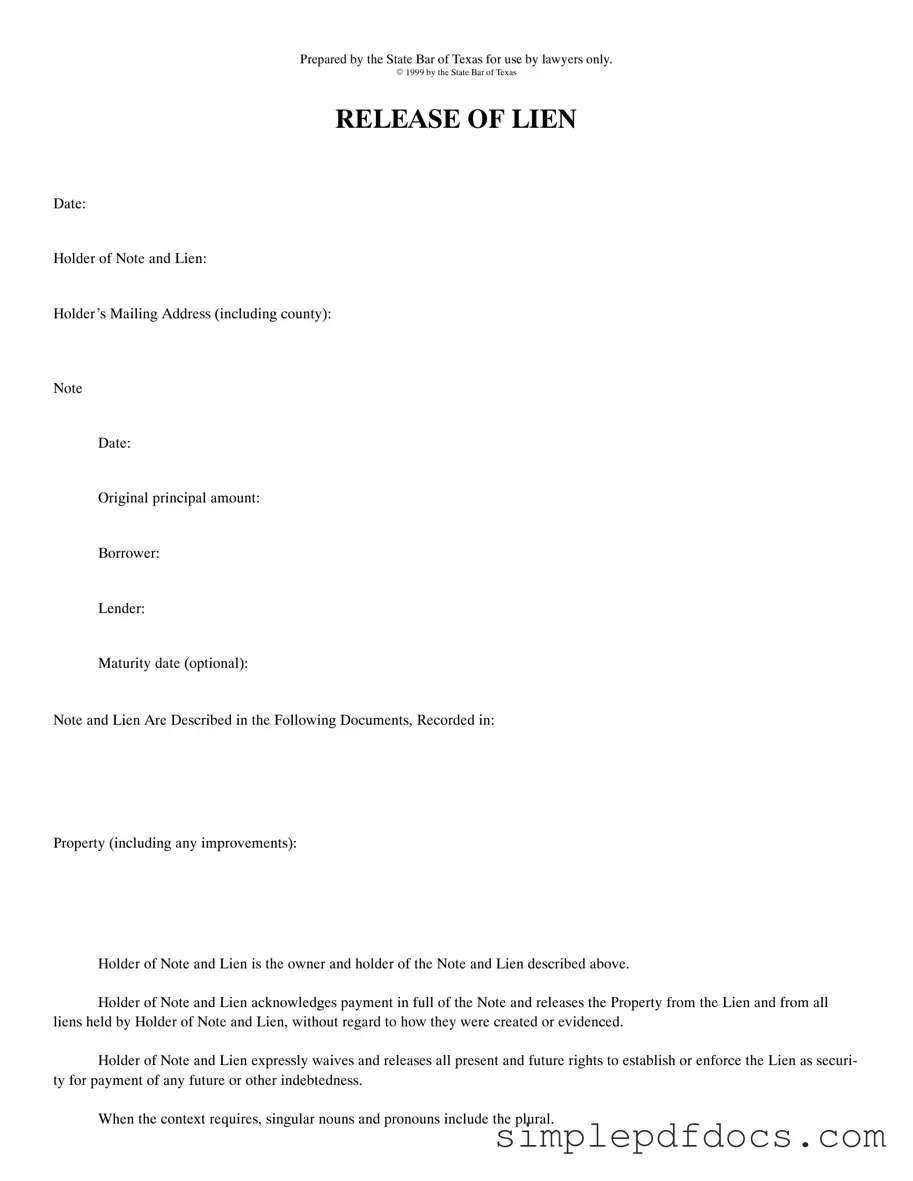

The Release of Lien Texas form serves as a critical document in the realm of property transactions and financing, ensuring that borrowers can clear their titles and lenders can formally acknowledge the satisfaction of their claims. This form is specifically designed for use by legal professionals, highlighting its importance in the legal landscape of Texas. It captures essential details such as the date of the release, the names and addresses of both the holder of the note and lien, as well as the borrower and lender involved in the transaction. The original principal amount and maturity date may also be included, providing clarity and context to the financial obligations that have been fulfilled. By completing this form, the holder of the note and lien affirms that they have received full payment and, consequently, releases the property from any liens they hold. This release is comprehensive, waiving any future rights to enforce the lien for additional debts. The form also includes sections for notarization, ensuring that the release is legally binding and properly recorded. Understanding the nuances of this document is vital for both legal practitioners and property owners, as it directly impacts ownership rights and financial responsibilities.

More PDF Templates

1098 Forms - Transaction activity summarizes your account's payments and charges over a specified period.

Ensuring a smooth transaction, the Texas Motor Vehicle Bill of Sale serves as a crucial document that protects both the buyer and seller by providing a clear record of the vehicle's ownership transfer. It highlights key details such as vehicle specifications, purchase price, and involved parties’ contact information, making it an essential tool for anyone engaging in a vehicle sale in Texas. To easily complete your Motor Vehicle Bill of Sale, you can visit texasformspdf.com/ and follow the steps laid out on their website.

Dmv Reg 256 - Utilize the form for accurate reporting of tax-exempt vehicle gifts between eligible parties.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Release of Lien form is used to formally acknowledge that a lien has been satisfied and to release the property from that lien. |

| Governing Law | This form is governed by Texas Property Code, specifically Chapter 51, which outlines the procedures for lien releases in Texas. |

| Usage | Prepared by the State Bar of Texas, this form is intended for use by lawyers only, ensuring that legal standards are met. |

| Notary Requirement | The form requires acknowledgment by a notary public to validate the release of the lien, ensuring it is legally binding. |

How to Write Release Of Lien Texas

Filling out the Release of Lien form is a straightforward process. Once you complete the form, you'll need to file it with the appropriate county office to officially release the lien. Make sure all information is accurate to avoid any delays.

- Date: Enter the date when you are filling out the form.

- Holder of Note and Lien: Write the name of the person or entity that holds the lien.

- Holder’s Mailing Address: Provide the complete mailing address, including the county.

- Note Date: Fill in the date of the original note.

- Original Principal Amount: Enter the original amount of the loan.

- Borrower: Write the name of the borrower.

- Lender: Fill in the name of the lender.

- Maturity Date (optional): If applicable, include the maturity date of the loan.

- Note and Lien Are Described in the Following Documents, Recorded in: Specify the documents that describe the note and lien.

- Property: Describe the property that the lien is attached to, including any improvements.

- Holder of Note and Lien Acknowledgment: Confirm that the holder acknowledges payment in full and releases the property from the lien.

- Acknowledgment Section: This section must be filled out by a notary public. Include the state and county, the date of acknowledgment, and the name of the person acknowledging the document.

- Notary’s Name (printed): The notary public will print their name here.

- Notary’s Commission Expires: The notary will provide the expiration date of their commission.

- Corporate Acknowledgment (if applicable): If the holder is a corporation, this section must be completed, including the state, county, date, name of the corporation representative, and the notary’s details.

- After Recording Return To: Fill in the name of the law office or individual to whom the document should be returned after recording.

Dos and Don'ts

When filling out the Release Of Lien Texas form, there are important steps to follow. Here are some things you should and shouldn't do:

- Do ensure all information is accurate and complete.

- Do include the correct names and addresses for all parties involved.

- Do have the form notarized to validate the acknowledgment.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless specified.

- Don't forget to check for any required signatures.

- Don't submit the form without confirming it has been properly filled out.

- Don't ignore the need for notarization, as it is crucial for legal validity.

Documents used along the form

The Release of Lien Texas form is an important document in the process of clearing a property from a lien. When using this form, several other documents may also be necessary to ensure proper legal standing and compliance. Below is a list of commonly associated forms and documents.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the loan is repaid. It outlines the terms of the loan and the responsibilities of the borrower and lender.

- Promissory Note: This is a written promise to pay a specified amount of money at a certain time. It details the terms of the loan, including interest rates and repayment schedules.

- Notice of Default: This document informs the borrower that they have failed to meet the terms of the loan agreement. It serves as a formal warning before further action is taken.

- Texas Real Estate Purchase Agreement: This form is a legally binding document used in Texas property transactions, outlining terms, conditions, and important details. For those looking to initiate a real estate deal, you can download and fill out the form to ensure compliance with state regulations.

- Affidavit of Heirship: Used when a property owner passes away without a will, this document establishes the rightful heirs of the property and can aid in transferring ownership.

- Title Insurance Policy: This policy protects the buyer and lender from any issues related to the title of the property, such as liens or ownership disputes that may arise after the purchase.

- Property Survey: A survey outlines the boundaries and features of a property. It can be important in resolving disputes over property lines or easements.

- Quitclaim Deed: This document transfers any interest the grantor has in the property to the grantee without making any guarantees about the title. It is often used in divorce settlements or to clear up title issues.

- Loan Modification Agreement: If the borrower and lender agree to change the terms of the loan, this document outlines the new terms and conditions, which may include adjustments to the interest rate or repayment schedule.

- Release of Mortgage: Similar to the Release of Lien, this document formally states that a mortgage has been paid off and releases the property from the mortgage lien.

Each of these documents plays a vital role in the management and transfer of property ownership. Understanding their purpose can help individuals navigate the complexities of property transactions more effectively.