Attorney-Approved Real Estate Power of Attorney Form

When it comes to navigating the complexities of real estate transactions, having the right tools at your disposal can make all the difference. One such tool is the Real Estate Power of Attorney form, which empowers an individual to act on behalf of another in matters related to property. This form is especially useful when the property owner is unable to be present for important decisions, whether due to travel, health issues, or other commitments. By designating an agent through this document, the property owner can ensure that their interests are represented effectively. The form typically outlines the specific powers granted, which may include buying, selling, leasing, or managing real estate. It's crucial to understand that the authority granted can be broad or limited, depending on the preferences of the principal, the person granting the power. Additionally, the form must meet certain legal requirements to be valid, including proper signatures and, in some cases, notarization. Understanding these aspects can help ensure that the Real Estate Power of Attorney is executed correctly and serves its intended purpose.

More Real Estate Power of Attorney Types:

Revocation of Power of Attorney Form - Using the Revocation of Power of Attorney form can bring peace of mind to the principal.

When considering the establishment of a Power of Attorney, it is essential to understand the implications and responsibilities involved. This legal document enables someone to manage another person's financial, legal, or health-related decisions, making it invaluable for future planning. To assist in this process, resources are available online, including options to fill out necessary forms conveniently. For further assistance, visit https://texasformspdf.com/ to begin taking control of your or a loved one's affairs with ease.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Power of Attorney form allows one person to authorize another to act on their behalf in real estate transactions. |

| Purpose | This form is commonly used when the principal is unable to attend to real estate matters due to absence, illness, or other reasons. |

| Types | There are generally two types: general power of attorney and limited power of attorney. The limited version restricts the agent's authority to specific tasks. |

| State-Specific Forms | Each state may have its own version of the form, which must comply with local laws and regulations. |

| Governing Laws | In the United States, the laws governing powers of attorney vary by state. For example, in California, the relevant law is the California Probate Code. |

| Agent Responsibilities | The agent, or attorney-in-fact, must act in the best interest of the principal and follow any instructions provided in the document. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent to do so. |

| Notarization | Most states require the Real Estate Power of Attorney form to be notarized to ensure its validity and prevent fraud. |

| Duration | The power of attorney can be set for a specific duration or remain in effect until revoked, depending on the principal's wishes. |

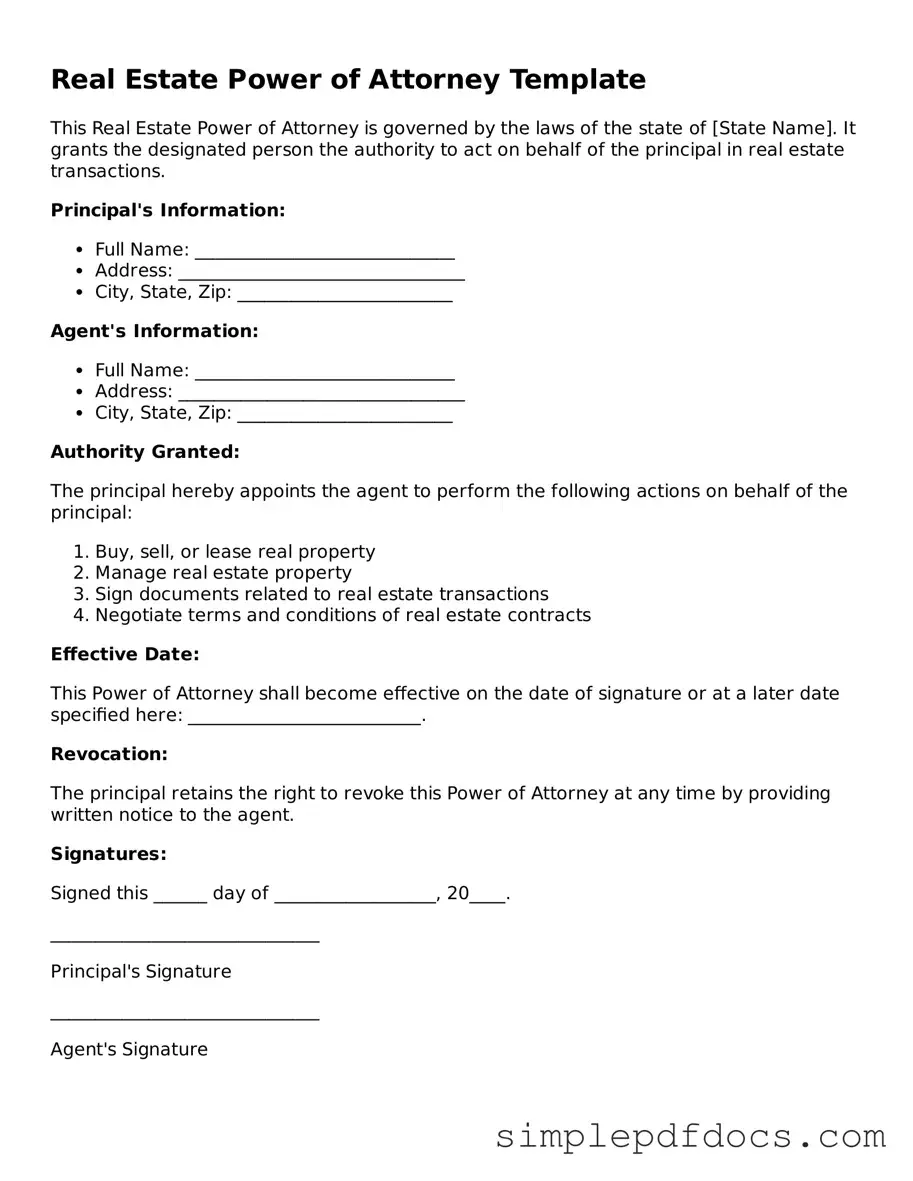

How to Write Real Estate Power of Attorney

Completing the Real Estate Power of Attorney form is an important step for individuals who wish to authorize someone else to handle real estate transactions on their behalf. The following steps will guide you through the process of filling out this form accurately.

- Obtain the Form: Acquire a copy of the Real Estate Power of Attorney form from a reliable source, such as an attorney's office or a legal website.

- Read the Instructions: Carefully review any instructions provided with the form to ensure understanding of the requirements.

- Identify the Principal: Fill in the name and contact information of the individual granting the power, known as the principal.

- Designate the Agent: Enter the name and contact details of the person who will act on behalf of the principal, referred to as the agent.

- Specify Powers Granted: Clearly outline the specific powers being granted to the agent regarding real estate transactions.

- Set the Duration: Indicate whether the power of attorney is durable or if it has a specific expiration date.

- Sign the Form: The principal must sign the form in the presence of a notary public to validate the document.

- Notarization: Ensure that the notary public completes their section, confirming the identity of the principal and the authenticity of the signature.

- Distribute Copies: Provide copies of the completed and notarized form to the agent and any relevant parties involved in real estate transactions.

Dos and Don'ts

When filling out a Real Estate Power of Attorney form, it's essential to approach the task with care and attention. Here’s a list of what you should and shouldn't do to ensure the process goes smoothly.

- Do read the form thoroughly before starting. Understanding each section will help you provide accurate information.

- Do provide clear and complete details about the property involved. This includes the address, legal description, and any other relevant identifiers.

- Do ensure that the person you are granting power to is trustworthy and capable of handling the responsibilities.

- Do sign the form in the presence of a notary public if required. This adds a layer of authenticity and legality to your document.

- Don't rush through the form. Taking your time can prevent mistakes that may cause issues later.

- Don't leave any sections blank unless instructed. Incomplete forms can lead to delays or rejections.

- Don't forget to keep a copy of the completed form for your records. Having a reference can be beneficial in the future.

- Don't assume that all power of attorney forms are the same. Ensure you are using the correct version for real estate transactions.

Documents used along the form

A Real Estate Power of Attorney (POA) is a crucial document that allows one person to act on behalf of another in real estate transactions. However, it often works in conjunction with several other forms and documents to ensure that all legal aspects are covered. Below is a list of commonly used documents that complement the Real Estate Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It is vital for ensuring that decisions can still be made on behalf of the individual who appointed the agent.

- Real Estate Purchase Agreement: This contract outlines the terms and conditions of the sale of a property. It details the purchase price, closing date, and other essential elements of the transaction.

- Title Deed: This legal document establishes ownership of a property. It is essential for transferring ownership from one party to another during a real estate transaction.

- Closing Statement: Also known as a settlement statement, this document summarizes the financial details of the transaction, including costs, fees, and the distribution of funds at closing.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no outstanding liens or claims against it, providing assurance to the buyer.

- Disclosure Statements: These documents inform buyers of any known issues with the property, such as structural problems or environmental hazards. Transparency is key in real estate transactions.

- Power of Attorney for Healthcare: This document allows an agent to make medical decisions on behalf of the principal. For more information, it is recommended to check Florida Forms.

- Inspection Report: A detailed assessment of the property’s condition, typically conducted by a professional inspector. This report helps buyers make informed decisions based on the property’s state.

- Loan Documents: If financing is involved, various loan documents will be necessary. These include the mortgage agreement, promissory note, and any other documents required by the lender.

- Power of Attorney Revocation: This document is used to formally cancel a previously granted power of attorney. It is important for ensuring that the agent no longer has authority to act on behalf of the principal.

Each of these documents plays a vital role in the real estate process, ensuring that all parties are protected and informed. It is advisable to consult with a legal professional to navigate these forms effectively and to ensure compliance with local laws and regulations.