Attorney-Approved Purchase Letter of Intent Form

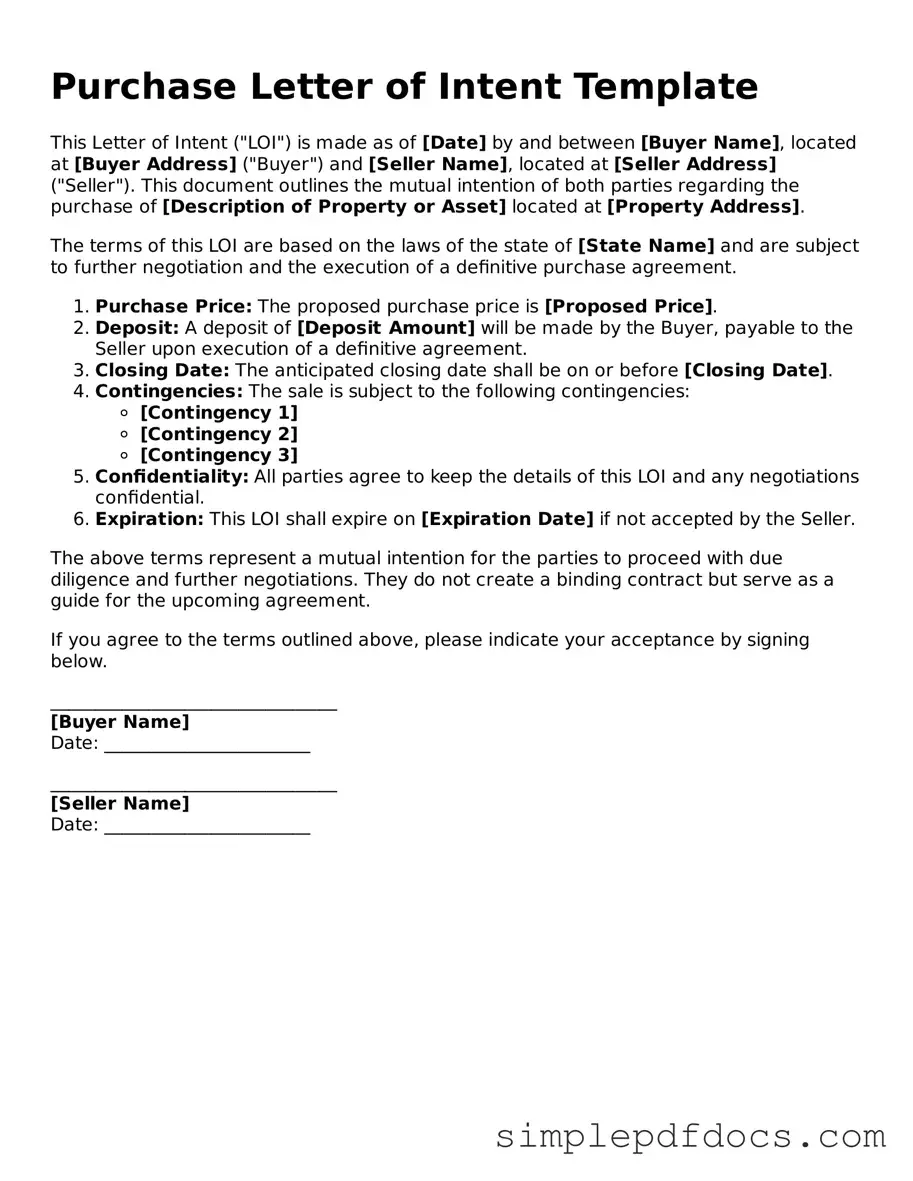

The Purchase Letter of Intent (LOI) serves as a crucial preliminary document in the realm of real estate and business transactions. This form outlines the basic terms and conditions that the buyer and seller agree upon before entering into a formal purchase agreement. It typically includes essential elements such as the purchase price, the timeline for closing, and any contingencies that may affect the transaction. Additionally, the LOI often addresses confidentiality, exclusivity, and the intention to negotiate in good faith. By providing a framework for the negotiation process, the Purchase Letter of Intent helps both parties clarify their intentions and expectations, thereby reducing the likelihood of misunderstandings later on. This document is not legally binding in most cases but serves as a stepping stone toward a more detailed and binding agreement. Understanding the nuances of the Purchase Letter of Intent is vital for anyone involved in a transaction, as it lays the groundwork for a successful negotiation and eventual sale.

More Purchase Letter of Intent Types:

What Is Letter of Intent for Job - Including a scholarship or training opportunity in the letter can make the offer more attractive.

In the realm of investment agreements, the Investment Letter of Intent plays a pivotal role, serving as a formalized prelude that sets the stage for a potential partnership. This document not only clarifies the essential terms of the investment but also provides a clear structure for negotiations. For those looking to understand more about this key document, additional insights can be found at https://topformsonline.com/investment-letter-of-intent, where you can explore its significance and applications in greater detail.

Intention to Marry Within 90 Days of Entry - This Letter can provide clarity to both parties about their marriage plans.

How to Create a Letter of Intent - A focus on measurable outcomes can make your project appealing.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Purchase Letter of Intent (LOI) is a document that outlines the preliminary terms of a potential purchase agreement between a buyer and a seller. |

| Purpose | The LOI serves to clarify the intentions of both parties before entering into a formal contract. |

| Non-Binding Nature | Typically, a Purchase LOI is non-binding, meaning it does not create a legal obligation to complete the transaction. |

| Key Components | Common elements include the purchase price, payment terms, and timelines for due diligence. |

| State Variations | Some states may have specific requirements or forms for Purchase LOIs, so it's important to check local laws. |

| Governing Law | In California, for example, the LOI is governed by the California Civil Code. |

| Negotiation Tool | The LOI can act as a negotiation tool, helping both parties agree on essential terms before drafting a full contract. |

How to Write Purchase Letter of Intent

Completing the Purchase Letter of Intent form is a crucial step in initiating a transaction. After filling out the form, you will typically submit it to the seller, who will review your intentions and respond accordingly. This process is essential for establishing mutual interest and setting the stage for further negotiations.

- Begin by entering your name and contact information at the top of the form.

- Provide the date on which you are completing the form.

- Clearly state the name of the seller or the entity you are addressing.

- Describe the property or item you intend to purchase, including any relevant details such as location or specifications.

- Specify the proposed purchase price. Make sure this figure reflects your intentions accurately.

- Outline any conditions that must be met before the purchase can proceed, such as financing or inspections.

- Indicate your desired timeline for completing the transaction.

- Sign and date the form to validate your intent.

- Review the completed form for accuracy and completeness before submission.

Dos and Don'ts

When filling out a Purchase Letter of Intent (LOI), it’s essential to approach the process with care and attention to detail. Here are some important do's and don'ts to keep in mind:

- Do ensure all information is accurate and up-to-date.

- Do clearly outline the terms and conditions you expect from the transaction.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to review the document for any errors before submission.

Documents used along the form

A Purchase Letter of Intent (LOI) is often the first step in a real estate or business transaction. Along with the LOI, several other documents can help clarify the terms and intentions of the parties involved. Here are some commonly used forms and documents that accompany a Purchase Letter of Intent:

- Purchase Agreement: This is a formal contract that outlines the specific terms and conditions of the sale, including price, payment terms, and contingencies.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document ensures that sensitive information shared during negotiations remains confidential.

- Due Diligence Checklist: This is a list of items that the buyer needs to investigate before finalizing the purchase, such as financial records, property inspections, and legal compliance.

- Financing Commitment Letter: A document from a lender that outlines the terms of financing for the purchase, confirming that the buyer has the necessary funds to proceed.

- Escrow Agreement: This agreement establishes a neutral third party to hold funds and documents until all conditions of the sale are met.

- Title Report: A document that provides information about the property’s ownership history, liens, and any legal issues that may affect the sale.

- Inspection Reports: These documents provide findings from property inspections, detailing any issues that may need to be addressed before the sale can close.

- Homeschool Letter of Intent: This formal document is essential for parents wishing to homeschool their children in Alabama, notifying the local school system of their intent. For detailed information, refer to the Homeschool Letter of Intent.

- Closing Statement: A summary of the financial transactions involved in the sale, including the purchase price, closing costs, and any adjustments.

Each of these documents plays a crucial role in ensuring a smooth transaction. Understanding their purposes can help both buyers and sellers navigate the process more effectively.