Attorney-Approved Promissory Note for a Car Form

When purchasing a car, understanding the financial commitments involved is crucial, and a Promissory Note for a Car serves as an essential document in this process. This form outlines the borrower's promise to repay a specified amount over a defined period, ensuring both parties are clear on the terms of the loan. Key elements include the principal amount, interest rate, payment schedule, and any penalties for late payments. Additionally, it may address the consequences of default, providing a safety net for lenders. By detailing these aspects, the Promissory Note not only protects the lender's investment but also offers the borrower a clear roadmap for repayment. Whether you’re buying from a dealership or a private seller, having this document in place can prevent misunderstandings and foster a smoother transaction.

More Promissory Note for a Car Types:

Satisfaction of Promissory Note - Create a clear record of releasing a promissory note.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. Understanding its structure and requirements can help individuals navigate their financial obligations effectively, and resources such as NY Templates can assist in creating the appropriate documentation.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money to the seller or lender, typically used in vehicle financing transactions. |

| Parties Involved | The document involves two primary parties: the borrower (who promises to pay) and the lender (who provides the funds for the car purchase). |

| Interest Rate | Most promissory notes will include an interest rate, which can be fixed or variable, impacting the total amount paid over time. |

| Governing Law | The laws governing promissory notes vary by state. For instance, in California, the relevant laws are found in the California Commercial Code. |

| Default Consequences | If the borrower fails to make payments, the lender may have the right to repossess the vehicle, depending on the terms outlined in the note. |

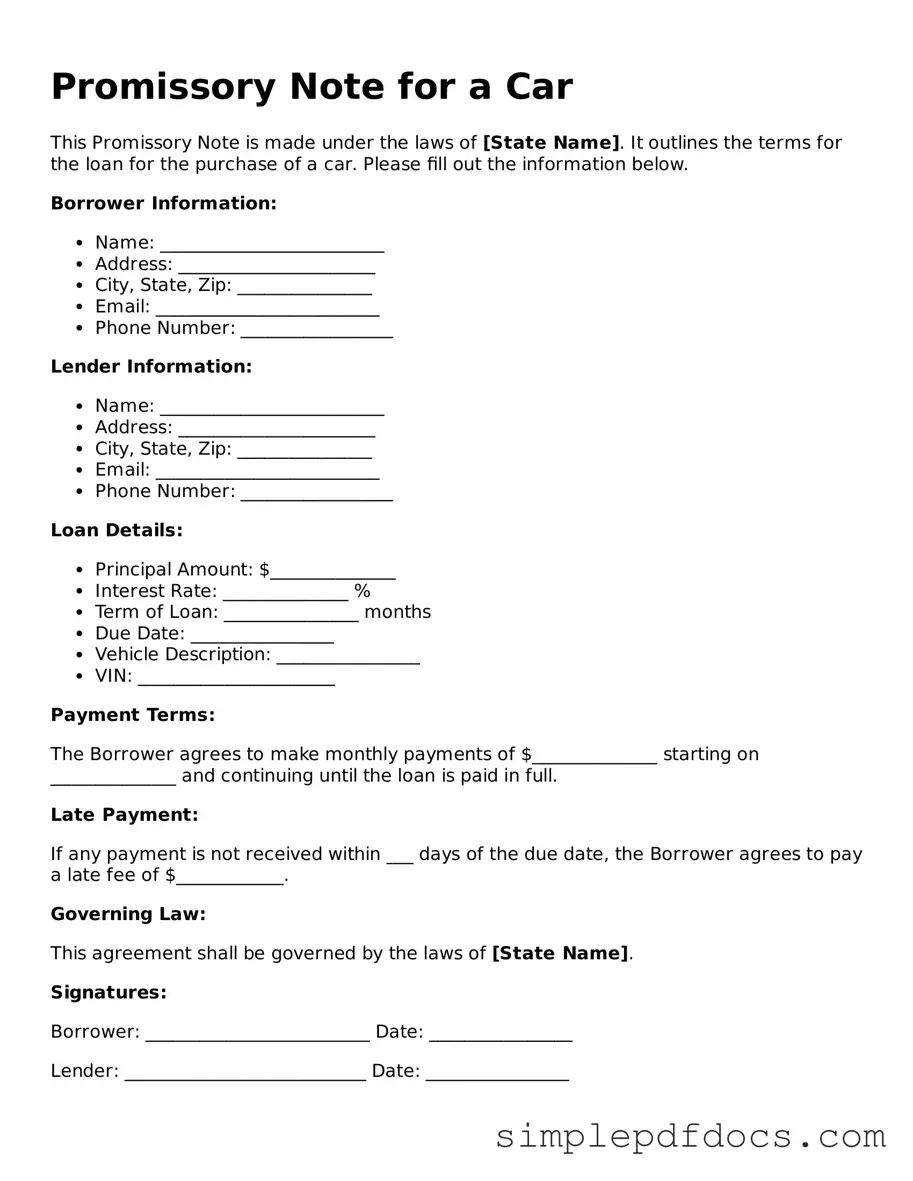

How to Write Promissory Note for a Car

After obtaining the Promissory Note for a Car form, it's essential to fill it out accurately to ensure a clear understanding between the buyer and the seller regarding the loan terms. This document will outline the repayment plan and the obligations of both parties.

- Start with the date: Write the date when you are filling out the form at the top of the document.

- Identify the parties: Fill in the names and addresses of both the borrower (the person buying the car) and the lender (the person or institution providing the loan).

- Detail the loan amount: Clearly state the total amount of money being borrowed to purchase the car.

- Specify the interest rate: Indicate the interest rate that will be applied to the loan. If there is no interest, make that clear.

- Outline the repayment terms: Describe how and when payments will be made. Include details about the payment schedule, such as monthly or bi-weekly payments.

- State the loan term: Write down the total duration of the loan, indicating when the final payment is due.

- Include any late fees: If applicable, specify any fees that will be charged if a payment is missed.

- Sign the document: Both the borrower and the lender should sign the form to indicate their agreement to the terms outlined.

- Make copies: After signing, make copies of the completed form for both parties to keep for their records.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it's important to be careful and thorough. Here are some key things to keep in mind:

- Do: Read the entire form carefully before you start filling it out.

- Do: Provide accurate information about the car, including the make, model, and VIN.

- Do: Clearly state the loan amount and interest rate.

- Do: Include the repayment schedule, specifying when payments are due.

- Do: Sign and date the document once you have completed it.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Use incorrect or misleading information, as this can lead to legal issues.

By following these guidelines, you can help ensure that your Promissory Note is filled out correctly and is legally binding.

Documents used along the form

When entering into a financing agreement for a vehicle, several key documents complement the Promissory Note for a Car. Each of these documents serves a specific purpose, ensuring clarity and protection for both the borrower and lender.

- Vehicle Purchase Agreement: This document outlines the terms of the sale between the buyer and seller. It includes details such as the purchase price, vehicle identification number (VIN), and any warranties or guarantees associated with the vehicle.

- Title Transfer Document: This form is essential for transferring ownership of the vehicle from the seller to the buyer. It includes information about the vehicle and must be signed by both parties to ensure a legal transfer.

- Promissory Note: A crucial document in the financing process, it represents a written promise to pay back the loan amount, and can be generated using this promissoryform.com/blank-arkansas-promissory-note/.

- Bill of Sale: A bill of sale serves as a receipt for the transaction. It details the sale price, date of sale, and the parties involved. This document can be crucial for future reference or disputes.

- Loan Agreement: If financing is involved, a loan agreement may be required. This document outlines the terms of the loan, including interest rates, repayment schedule, and any fees associated with the loan.

- Insurance Policy Document: Proof of insurance is often necessary when purchasing a vehicle. This document verifies that the buyer has obtained the required insurance coverage, protecting both the lender and the borrower in case of accidents or damage.

These documents work together to provide a comprehensive framework for the vehicle financing process. Having them in order helps ensure a smooth transaction and protects the interests of all parties involved.