Attorney-Approved Promissory Note Form

When individuals or businesses engage in a loan agreement, a Promissory Note serves as a crucial document that outlines the terms of the loan. This form is more than just a piece of paper; it is a binding commitment between the borrower and the lender. It typically includes important details such as the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, the Promissory Note may specify any collateral involved, which provides security for the lender in case the borrower defaults. Clear terms regarding late fees, prepayment options, and the consequences of non-payment are also commonly included to ensure both parties understand their rights and obligations. By providing a written record of the loan agreement, the Promissory Note helps to prevent misunderstandings and disputes in the future. It is essential for anyone considering a loan to familiarize themselves with this important document, as it lays the foundation for a responsible borrowing experience.

State-specific Promissory Note Forms

Promissory Note Document Categories

Check out Other Documents

Fake Restraining Order - Legal compliance is monitored through the California Restraining and Protective Order System.

Understanding the requirements for filing your taxes is crucial, and the Florida Sales Tax form is a key component of this process. For detailed instructions and to access the form, you can visit Florida Forms, which provides a comprehensive guide to help ensure you meet all necessary compliance regulations when submitting the Sales and Use Tax Return (DR-15CS) to the Florida Department of Revenue.

Printable Return to Work Doctors Note - The Work Release form establishes guidelines for both individuals and employers involved.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time or on demand. |

| Parties Involved | Typically, there are two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Governing Law | In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3. |

| Interest Rates | Promissory notes can include interest rates, which must be clearly stated in the document to avoid confusion. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and contain all essential terms, including the amount and payment schedule. |

| State-Specific Forms | Some states have specific requirements for promissory notes, so it is important to consult state laws for compliance. |

How to Write Promissory Note

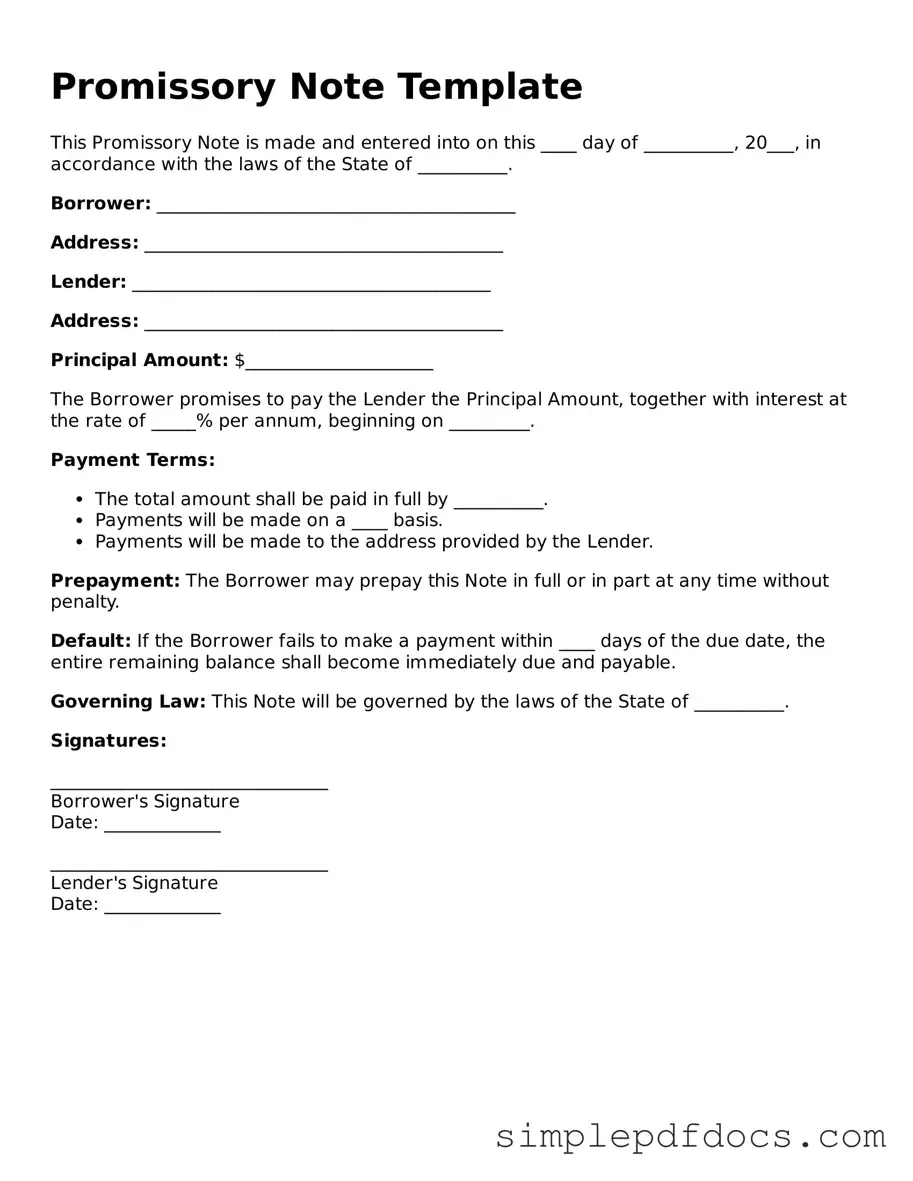

After you have gathered the necessary information and documents, you are ready to fill out the Promissory Note form. This form is essential for establishing the terms of a loan agreement between the lender and the borrower. Once completed, it will serve as a formal record of the agreement.

- Start with the Date: Write the date on which the note is being executed at the top of the form.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. Make sure this information is accurate.

- Loan Amount: Specify the total amount of money being borrowed. This should be written in both numbers and words for clarity.

- Interest Rate: Indicate the interest rate that will apply to the loan. Include whether it is fixed or variable.

- Payment Terms: Outline the repayment schedule. This includes the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Maturity Date: Specify the date when the loan must be fully repaid.

- Signatures: Both the borrower and the lender must sign and date the form to make it legally binding.

- Witness or Notary: If required, have a witness or notary public sign the document to validate it.

Once the form is completed and signed, keep a copy for your records. The lender should also retain a copy. This ensures that both parties have access to the terms agreed upon and can refer back to them if necessary.

Dos and Don'ts

When filling out a Promissory Note form, it's important to follow certain guidelines to ensure clarity and legality. Here are some do's and don'ts to consider:

- Do: Clearly state the loan amount.

- Do: Include the names and addresses of all parties involved.

- Do: Specify the repayment terms, including interest rates and due dates.

- Do: Sign and date the document to make it valid.

- Don't: Leave any sections blank; this can lead to misunderstandings.

- Don't: Use vague language; be specific about the terms.

- Don't: Forget to keep a copy for your records.

- Don't: Ignore state laws that may affect the note.

Documents used along the form

A Promissory Note is a key document in lending transactions, but it often works alongside other important forms. Each of these documents serves a specific purpose and helps to clarify the terms of the agreement between the parties involved. Below is a list of common forms and documents that are frequently used in conjunction with a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any conditions that must be met by the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details what assets are being pledged as security for the loan.

- Personal Guarantee: This document is signed by a third party who agrees to take responsibility for the loan if the borrower defaults.

- Disclosure Statement: This statement provides borrowers with important information about the loan, including fees, interest rates, and other financial terms.

- Amortization Schedule: This table shows the breakdown of each payment over time, detailing how much goes toward interest and how much goes toward the principal balance.

- Loan Application: This form collects information about the borrower’s financial situation and creditworthiness, helping the lender make informed decisions.

- Payment Receipt: A document confirming that a payment has been made on the loan, which is important for record-keeping.

- Default Notice: This notice is sent to the borrower if they fail to make payments as agreed, outlining the consequences of default.

- Power of Attorney: A Florida Power of Attorney form allows one person to delegate authority to another for making decisions, especially important in financial and legal matters. For more information, visit https://floridaforms.net/blank-power-of-attorney-form/.

- Modification Agreement: If the terms of the loan need to be changed, this document outlines the new terms and conditions agreed upon by both parties.

- Release of Liability: This document releases the borrower from further obligations under the loan once it has been paid off or settled.

Understanding these documents can help both lenders and borrowers navigate the complexities of loan agreements. Each plays a vital role in ensuring that the terms are clear and that all parties are protected throughout the lending process.