Fill Your Profit And Loss Form

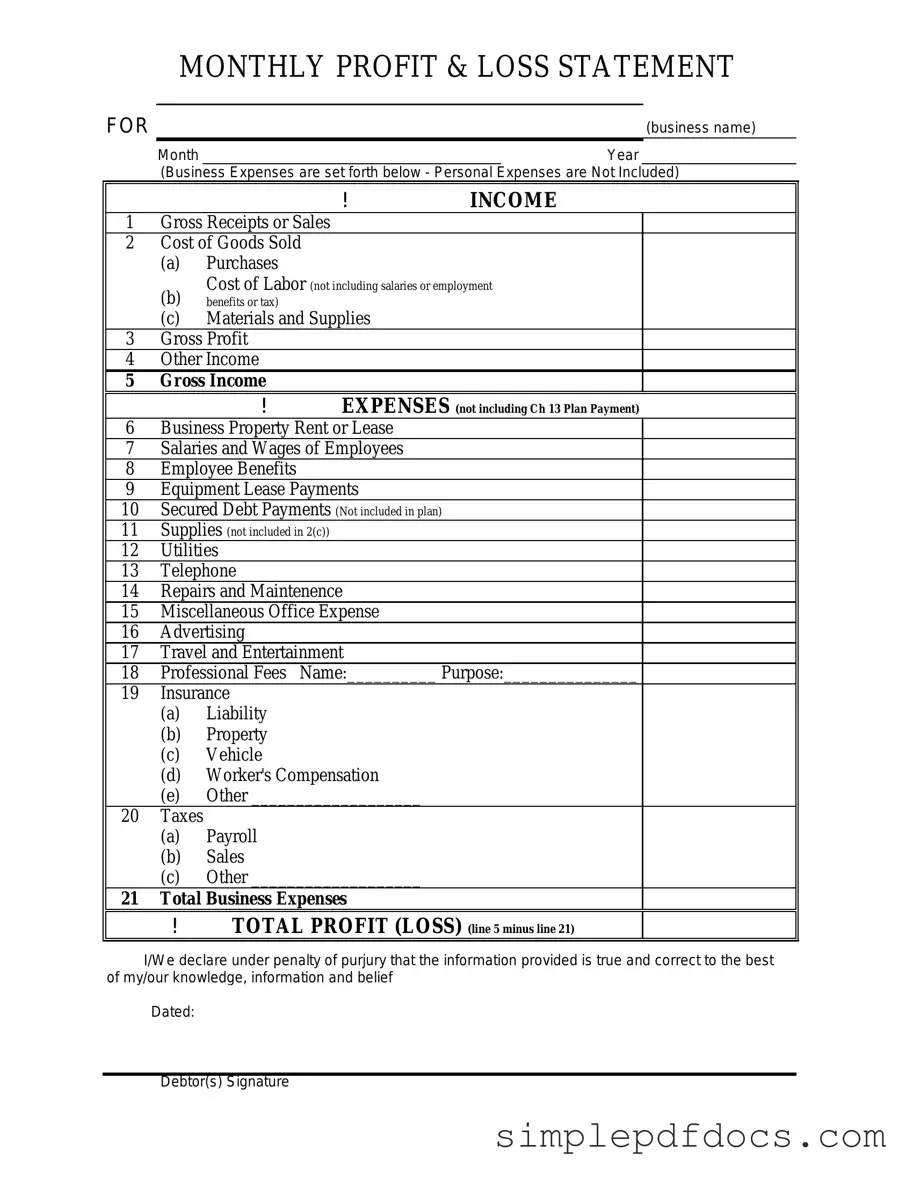

The Profit and Loss form is a crucial financial document that provides a clear snapshot of a business's financial performance over a specific period. It highlights revenues, costs, and expenses, ultimately leading to the calculation of net profit or loss. This form typically includes sections for gross income, operating expenses, and non-operating income or expenses. By breaking down these components, it allows business owners and stakeholders to assess the company's profitability, identify trends, and make informed decisions. Understanding the Profit and Loss form is essential for anyone involved in managing finances, as it serves as a key tool for budgeting, forecasting, and evaluating overall business health. Regularly reviewing this form can help pinpoint areas for improvement and ensure that financial goals are met.

More PDF Templates

Free Doctors Note - It ensures that necessary health information is recorded succinctly for future reference.

For those looking to understand the relevant documentation, the form for the ATV Bill of Sale is crucial for ensuring compliance with state laws. You can learn more about this important transaction by visiting the comprehensive guide on the ATV Bill of Sale form.

Florida Immunization Records - Before submitting, ensure all sections are thoroughly filled to avoid any delays in school enrollment.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form is used to summarize a company's revenues and expenses over a specific period, helping to assess financial performance. |

| Components | This form typically includes sections for total revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Frequency | Businesses often prepare this form monthly, quarterly, or annually, depending on their reporting requirements and business needs. |

| Governing Laws | In the United States, the preparation of Profit and Loss statements is governed by Generally Accepted Accounting Principles (GAAP) and may vary by state regulations. |

How to Write Profit And Loss

Filling out the Profit and Loss form is an important task for anyone looking to track their financial performance. By accurately completing this form, you can gain insights into your income and expenses, helping you make informed decisions for your business or personal finances.

- Start with your business name and contact information at the top of the form.

- Enter the reporting period for which you are completing the form. This could be monthly, quarterly, or annually.

- List all sources of income. Include sales revenue, service income, and any other earnings.

- Calculate the total income by adding all sources of income together.

- Next, move on to expenses. List all expenses incurred during the reporting period. This may include rent, utilities, salaries, and other operational costs.

- Calculate the total expenses by adding all listed expenses together.

- Subtract the total expenses from the total income to determine your net profit or loss.

- Finally, review all entries for accuracy before submitting the form.

Dos and Don'ts

When filling out the Profit and Loss form, it is important to follow certain guidelines to ensure accuracy and clarity. Here is a list of things you should and shouldn't do:

- Do: Double-check all figures before submission.

- Do: Use consistent formatting for dates and numbers.

- Do: Clearly categorize income and expenses.

- Do: Include all relevant sources of income.

- Do: Keep documentation for all entries in case of audits.

- Don't: Leave any sections blank; provide explanations if necessary.

- Don't: Use vague descriptions for income or expenses.

- Don't: Forget to update your records regularly.

- Don't: Mix personal and business expenses.

- Don't: Rely solely on memory; use records to ensure accuracy.

Documents used along the form

The Profit and Loss form is a vital document for assessing a business's financial performance over a specific period. However, it is often used in conjunction with several other forms and documents that provide a more comprehensive view of a company's financial health. Below is a list of these documents, each serving a unique purpose in financial reporting and analysis.

- Balance Sheet: This document summarizes a company's assets, liabilities, and equity at a specific point in time. It provides insight into what the company owns and owes, helping stakeholders assess its financial stability.

- Cash Flow Statement: This statement tracks the inflow and outflow of cash within a business over a given period. It highlights how well the company generates cash to meet its obligations and fund its operations.

- Statement of Changes in Equity: This document outlines the changes in a company's equity accounts over a reporting period. It includes details about new investments, dividends paid, and retained earnings.

- Budget Report: A budget report compares projected financial performance against actual results. This document helps businesses understand variances and adjust their financial strategies accordingly.

- Tax Returns: These forms are filed with the government to report income, expenses, and other tax-related information. They are crucial for compliance and can influence financial planning and decision-making.

- Accounts Receivable Aging Report: This report categorizes a company's accounts receivable based on the length of time an invoice has been outstanding. It helps in assessing the effectiveness of the company's credit policies and collection efforts.

- Inventory Report: This document provides a detailed account of the company's inventory levels, including quantities and values. It is essential for managing stock and understanding cost of goods sold.

- Horse Bill of Sale: This crucial document ensures proof of the transfer of ownership for a horse and is vital for both buyers and sellers, detailing essential information about the horse and the sale terms; for more information, visit Florida Forms.

- Sales Report: A sales report summarizes sales activity over a specific period. It can provide insights into trends, customer preferences, and overall business performance.

Each of these documents plays a critical role in providing a complete picture of a business's financial standing. Together with the Profit and Loss form, they enable stakeholders to make informed decisions based on accurate and comprehensive financial data.