Attorney-Approved Prenuptial Agreement Form

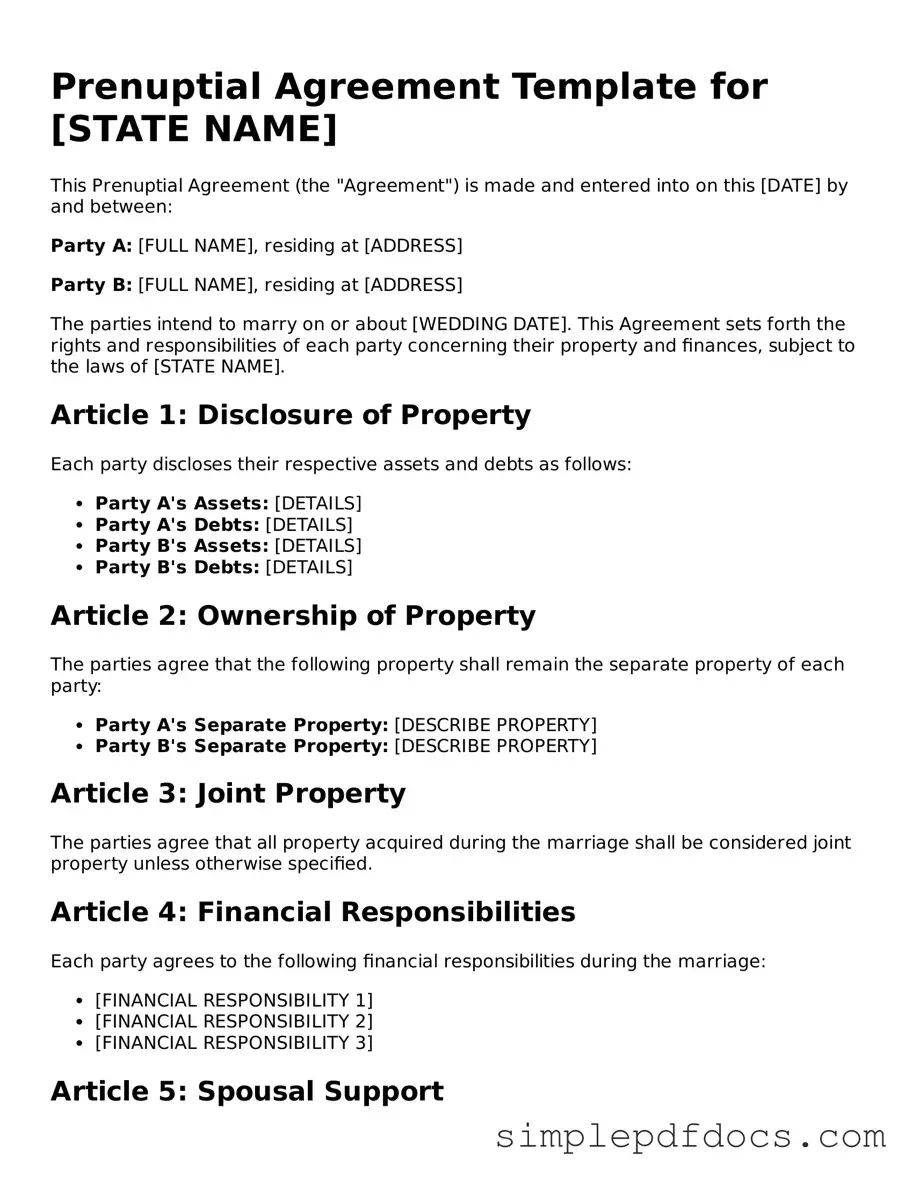

When couples decide to marry, they often overlook the importance of discussing financial matters and asset protection. A prenuptial agreement, commonly known as a prenup, serves as a proactive step in addressing these concerns before tying the knot. This legal document outlines how assets and debts will be managed during the marriage and what will happen in the event of a divorce. Key elements typically included in a prenup are the identification of separate and marital property, provisions for spousal support, and the handling of debts. Couples can also specify how future earnings and assets will be treated, ensuring clarity and reducing potential conflicts down the road. While discussing a prenup may feel uncomfortable, it can foster open communication about finances, ultimately strengthening the relationship. By taking the time to create a comprehensive prenuptial agreement, couples can lay a solid foundation for their marriage, protecting both parties and promoting a sense of security as they embark on their life together.

State-specific Prenuptial Agreement Forms

Check out Other Documents

What Is Letter of Intent for Job - The letter may reiterate the company’s commitment to diversity, equity, and inclusion in the workplace.

For those interested in pursuing a career in nursing, it is important to complete the necessary paperwork, such as the Florida Board Nursing Application form, which can be accessed through Florida Forms. This application is fundamental in ensuring that all candidates are evaluated based on their qualifications, ultimately supporting a seamless transition into the nursing field.

Florida Immunization Records - The 680 form helps parents establish a clear record for future educational requirements.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract entered into by a couple before marriage, outlining the division of assets and financial responsibilities in the event of divorce or separation. |

| Legal Requirement | Most states require that both parties fully disclose their financial situations for the agreement to be enforceable. |

| Governing Law | The laws governing prenuptial agreements vary by state. For example, California Family Code Section 1610 governs these agreements in California. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing and signed by both parties. |

| Modification | Couples can modify a prenuptial agreement after marriage, but any changes must also be in writing and signed by both parties. |

| Common Misconceptions | Many people believe prenuptial agreements are only for the wealthy; however, they can benefit couples of all financial backgrounds by providing clarity and protection. |

How to Write Prenuptial Agreement

Completing a Prenuptial Agreement form is an important step for couples who wish to clarify their financial arrangements before marriage. This process involves several key sections that need to be filled out accurately to ensure the agreement is valid and enforceable. Follow the steps below to fill out the form correctly.

- Gather Necessary Information: Collect all relevant financial information, including assets, debts, and income for both parties.

- Begin with Personal Details: Fill in the full names, addresses, and contact information for both individuals involved in the agreement.

- List Assets: Clearly outline each person’s assets. Include properties, bank accounts, investments, and any other significant possessions.

- Detail Debts: Provide a comprehensive list of debts for both parties. This includes loans, credit card debts, and any other financial obligations.

- Specify Income: Document the income sources for both parties, including salaries, bonuses, and any other earnings.

- Outline Property Rights: Indicate how property will be divided in the event of a divorce or separation. Be specific about what is considered separate and marital property.

- Include Spousal Support Terms: If applicable, state any agreements regarding spousal support or alimony, including amounts and duration.

- Review the Terms: Carefully read through the entire document to ensure all information is accurate and complete.

- Sign and Date: Both parties must sign and date the agreement in the presence of a notary public to ensure its legality.

Dos and Don'ts

When filling out a Prenuptial Agreement form, it is essential to approach the process thoughtfully. Here are some important guidelines to follow and avoid.

- Do be honest about your financial situation. Transparency is crucial.

- Do discuss your intentions with your partner. Open communication fosters trust.

- Do consult with a qualified attorney. Professional guidance can help you navigate complexities.

- Do ensure both parties have independent legal representation. This protects everyone's interests.

- Don't rush the process. Take your time to consider all aspects carefully.

- Don't include unfair or unreasonable terms. Agreements should be equitable and just.

By adhering to these guidelines, individuals can create a more effective and fair Prenuptial Agreement.

Documents used along the form

A Prenuptial Agreement is a legal document that outlines the financial and personal arrangements between two individuals before they enter into marriage. Various other forms and documents may accompany this agreement to ensure a comprehensive understanding of the parties' rights and obligations. Below is a list of related documents that are often utilized in conjunction with a Prenuptial Agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is executed after marriage and addresses the same issues regarding the distribution of assets and responsibilities in the event of divorce or separation.

- Financial Disclosure Statement: This form requires both parties to provide a detailed account of their financial situation, including assets, debts, income, and expenses, ensuring transparency before marriage.

- Marital Property Agreement: This document specifies which assets will be considered marital property and how they will be divided in case of divorce, providing clarity on ownership and rights.

- Separation Agreement: In the event of a separation, this document outlines the terms of the separation, including asset division, child custody, and support obligations.

- Living Will: Although not directly related to prenuptial agreements, a living will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes.

- Durable Power of Attorney: This form allows one person to designate another to make financial or medical decisions on their behalf, which can be important in a marital context.

- Power of Attorney: To ensure effective management of legal and financial affairs, refer to our important Power of Attorney documentation for accurate guidance.

- Child Custody Agreement: If children are involved, this document details the arrangements for custody and visitation rights, ensuring that both parties agree on parenting responsibilities.

- Debt Agreement: This document outlines how debts incurred during the marriage will be handled, clarifying the responsibility of each party for existing and future debts.

- Estate Planning Documents: These include wills and trusts that outline how an individual's assets will be distributed upon death, which may be influenced by the terms of a prenuptial agreement.

Each of these documents plays a crucial role in defining the legal and financial landscape of a marriage. They contribute to a clearer understanding of rights and responsibilities, thereby helping to prevent disputes in the future.