Attorney-Approved Personal Guarantee Form

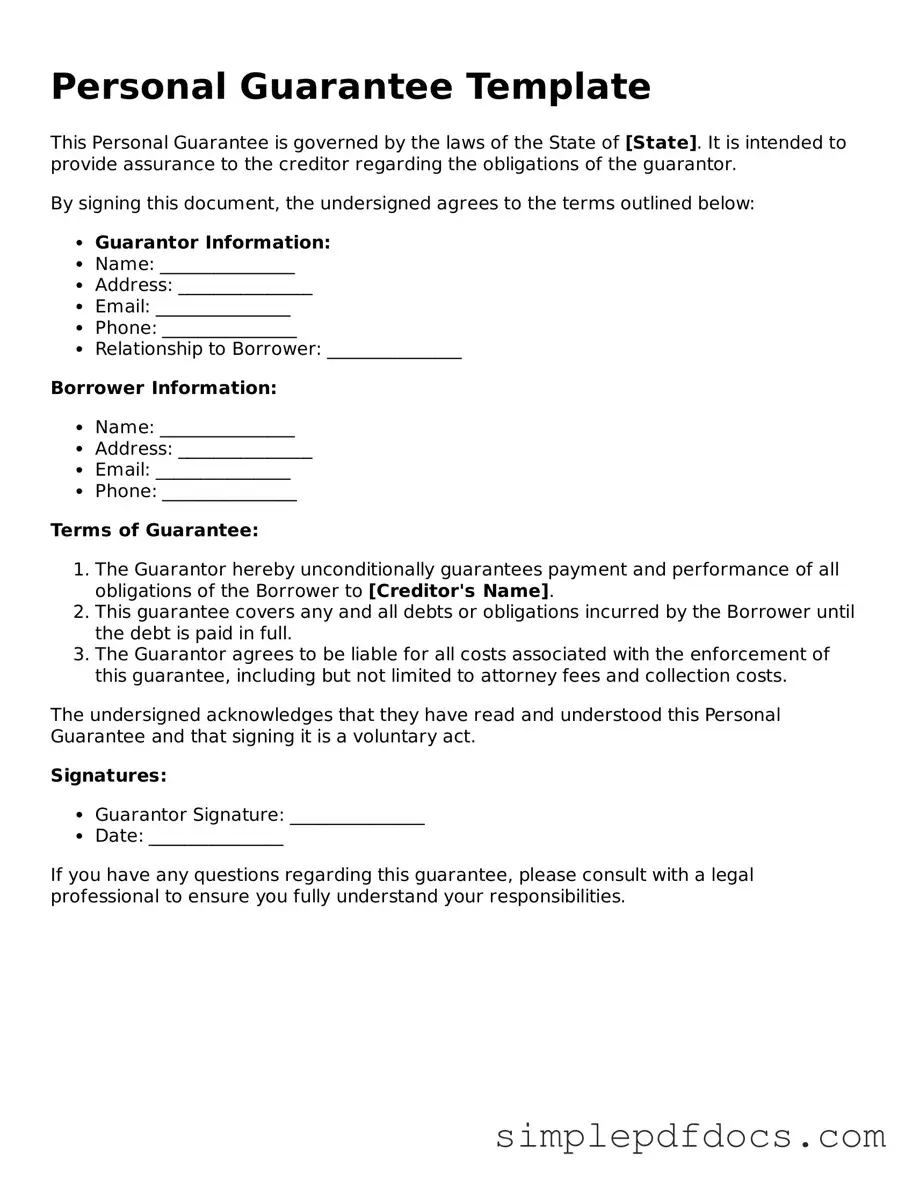

The Personal Guarantee form serves as a critical document in various financial and business transactions, establishing a commitment from an individual to assume responsibility for a debt or obligation incurred by a business or another party. This form typically includes essential details such as the names of the guarantor and the debtor, the nature of the obligation, and the terms under which the guarantee is valid. By signing this form, the guarantor agrees to cover the debt if the primary borrower defaults, which can provide lenders with an additional layer of security. It is important to note that a Personal Guarantee can be either unlimited or limited, depending on the specific terms outlined in the agreement. Furthermore, understanding the implications of signing such a document is crucial, as it can significantly affect the guarantor's financial standing and creditworthiness. Overall, the Personal Guarantee form plays a pivotal role in fostering trust between lenders and borrowers, ensuring that obligations are met and financial relationships are maintained.

More Personal Guarantee Types:

Purchase Agreement Addendum - It helps establish a clear understanding of any new obligations that arise.

To facilitate a smoother transaction, parties involved in real estate dealings should consider utilizing resources such as the Texas Forms Online, which provides access to essential templates and guidance for drafting the Texas Real Estate Purchase Agreement effectively.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Personal Guarantee form is a legal document where an individual agrees to be responsible for another person's debt or obligation. |

| Purpose | This form is often used by lenders to ensure that they can collect debts even if the primary borrower defaults. |

| State-Specific Forms | Some states have specific requirements for Personal Guarantees. For example, in California, the governing law includes the California Civil Code. |

| Enforceability | For a Personal Guarantee to be enforceable, it typically must be in writing and signed by the guarantor. |

| Risks | Signing a Personal Guarantee can expose individuals to significant financial risk, as they may be liable for the full amount of the debt. |

How to Write Personal Guarantee

Once you have the Personal Guarantee form in hand, it's important to complete it accurately to ensure it meets the necessary requirements. Follow these steps carefully to fill out the form correctly.

- Begin by entering your full legal name in the designated field.

- Provide your current residential address, including city, state, and zip code.

- Fill in your contact information, including your phone number and email address.

- Specify the date on which you are completing the form.

- In the section regarding the entity you are guaranteeing, enter the name of the business or organization.

- Clearly state your relationship to the business, such as owner, partner, or officer.

- Review the obligations you are guaranteeing, ensuring that you understand them fully.

- Sign the form in the designated area, ensuring your signature matches your printed name.

- Date your signature to indicate when you completed the form.

After completing the form, double-check all entries for accuracy. This will help avoid any potential issues in the future. Once confirmed, submit the form as instructed, and keep a copy for your records.

Dos and Don'ts

When filling out a Personal Guarantee form, it's important to be thorough and careful. Here’s a list of what to do and what to avoid.

- Do read the entire form carefully before starting.

- Do provide accurate personal information.

- Do review your financial obligations before signing.

- Do consult with a legal advisor if you have questions.

- Do keep a copy of the signed form for your records.

- Don't rush through the form; take your time.

- Don't leave any sections blank unless instructed.

- Don't sign the form without understanding the terms.

- Don't ignore any requests for additional documentation.

Documents used along the form

The Personal Guarantee form serves as a crucial document in various financial and legal transactions. It provides assurance to lenders or creditors that an individual will be responsible for the debt of a business or another individual. Alongside this form, several other documents are commonly utilized to ensure clarity and security in agreements. Below is a list of these documents, each playing a significant role in the process.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved.

- Security Agreement: A security agreement specifies the collateral that secures the loan, detailing what assets can be seized if the borrower defaults.

- Promissory Note: This is a written promise from the borrower to repay a specified amount of money to the lender under agreed-upon terms.

- Business License: A business license demonstrates that a company is legally permitted to operate within a specific jurisdiction, providing credibility to the lender.

- Financial Statements: These documents provide a snapshot of a business's financial health, including balance sheets and income statements, which help lenders assess risk.

- Real Estate Purchase Agreement: When engaging in property transactions, it is essential to utilize the comprehensive Real Estate Purchase Agreement guidelines to formalize the terms of the sale.

- Articles of Incorporation: This document establishes a corporation's existence and outlines its purpose, structure, and governance, which can influence a lender's decision.

- Operating Agreement: For LLCs, this document details the management structure and operating procedures, which can impact financial obligations and guarantees.

- Credit Application: A credit application collects information about the borrower's credit history and financial situation, helping lenders evaluate the risk of lending.

- Personal Financial Statement: This statement provides a detailed overview of an individual's personal assets, liabilities, income, and expenses, aiding lenders in assessing personal risk.

Each of these documents complements the Personal Guarantee form, contributing to a comprehensive understanding of the obligations and risks involved in financial transactions. Together, they create a framework that promotes accountability and transparency, essential elements in any lending relationship.