Legal Transfer-on-Death Deed Document for the State of Pennsylvania

In Pennsylvania, planning for the future often involves ensuring that your assets are passed on to your loved ones without unnecessary complications. One effective tool for this purpose is the Transfer-on-Death Deed (TODD) form. This legal document allows property owners to designate beneficiaries who will automatically receive the property upon the owner’s death. The process is straightforward and avoids the lengthy probate process, which can burden families during an already difficult time. Importantly, the property remains under the owner's control during their lifetime, meaning they can sell or modify it as they see fit. Additionally, the TODD form can be revoked or altered at any time before the owner’s death, providing flexibility in estate planning. Understanding how to properly execute this deed is crucial for ensuring that your wishes are honored and that your beneficiaries are protected. By utilizing the TODD form, Pennsylvania residents can streamline the transfer of real estate, making the transition smoother for their heirs.

Consider Other Common Transfer-on-Death Deed Templates for Specific States

Transfer Deed Upon Death - This deed is a powerful tool to enable you to make specific provisions for your beloved property.

Ohio Transfer on Death Form - This deed is often more cost-effective than preparing a full estate plan involving a trust.

For those navigating rental agreements, understanding the Georgia Notice to Quit form is essential for proper lease termination and tenant communication. Learn more about this vital document to facilitate a smooth transition.

Problems With Transfer on Death Deeds in Virginia - With this deed, you can change beneficiaries at any time during your lifetime.

Where Can I Get a Tod Form - The use of this deed empowers property owners to have a direct say in their estate without unnecessary legal hassles.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by the Pennsylvania Consolidated Statutes, Title 20, Chapter 77. |

| Eligibility | Any individual who owns real estate in Pennsylvania can create a Transfer-on-Death Deed. |

| Revocability | The deed can be revoked at any time by the property owner during their lifetime. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Beneficiary Designation | Property owners can name one or more beneficiaries in the deed. |

| Effect on Creditors | The property transferred via this deed may still be subject to the claims of the owner's creditors. |

| Tax Implications | There are no immediate tax consequences upon executing the deed; taxes are assessed upon the owner's death. |

| Filing Requirements | The Transfer-on-Death Deed must be recorded in the county where the property is located to be effective. |

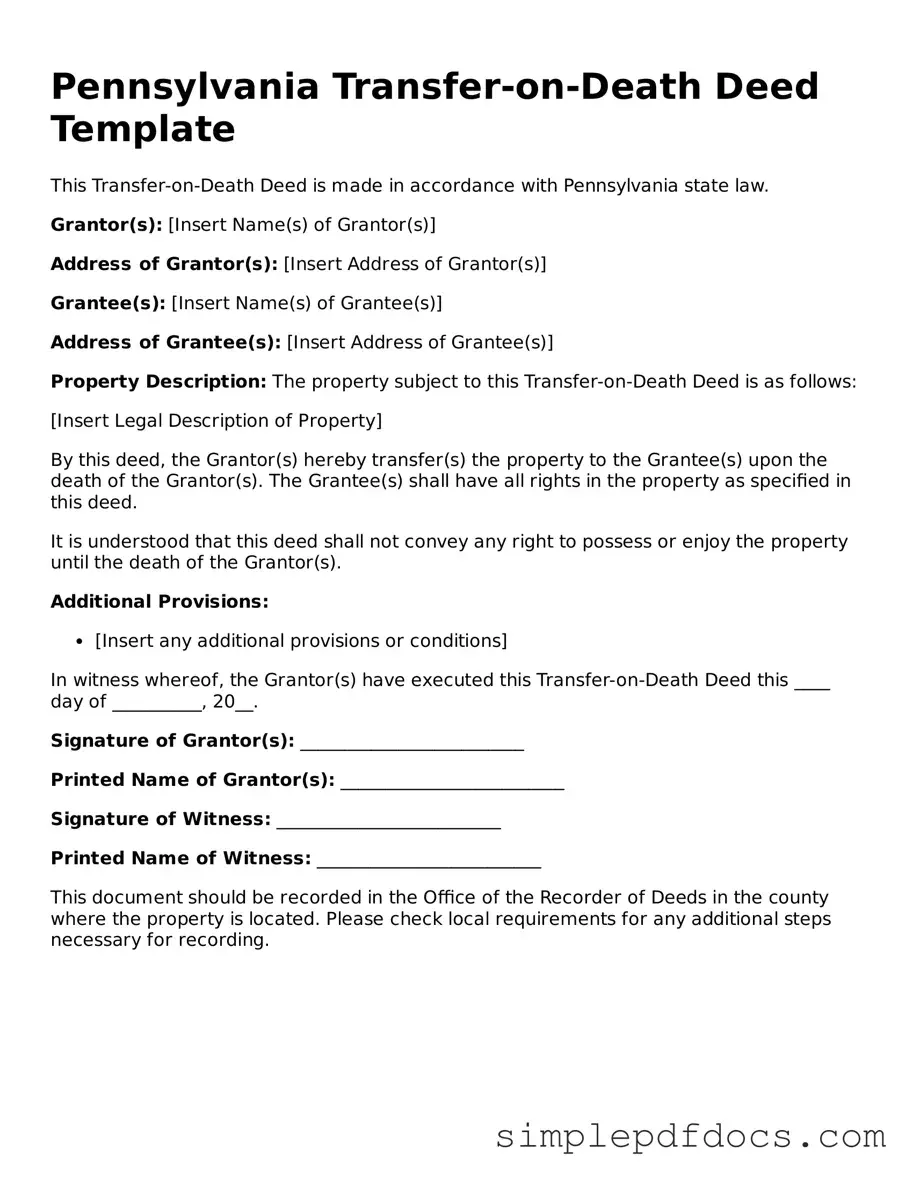

How to Write Pennsylvania Transfer-on-Death Deed

Once you have the Pennsylvania Transfer-on-Death Deed form in hand, you will need to carefully fill it out to ensure that your intentions are clearly documented. After completing the form, it will need to be signed and recorded with the appropriate county office to be effective.

- Begin by writing your name as the owner of the property in the designated space.

- Provide your current address, ensuring it is accurate and complete.

- Next, identify the property you wish to transfer. Include the full legal description, which can typically be found on your property deed.

- List the name of the beneficiary who will receive the property upon your passing. Be sure to include their address as well.

- If there are multiple beneficiaries, list each one separately, along with their addresses.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- After notarization, make copies of the signed form for your records.

- Finally, take the completed form to your county's Recorder of Deeds office to officially record it.

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it’s important to follow certain guidelines. Here’s a list of things you should and shouldn’t do:

- Do ensure that you have the correct legal description of the property.

- Do provide accurate information about the beneficiaries.

- Do sign the deed in front of a notary public.

- Do file the completed deed with the county recorder of deeds.

- Don’t leave any fields blank; complete all required sections.

- Don’t forget to check for any local laws that may affect the deed.

Documents used along the form

When creating a Pennsylvania Transfer-on-Death Deed, there are several other forms and documents that may be necessary to ensure a smooth transfer of property. These documents help clarify intentions, establish legal authority, and provide essential information about the property and its ownership. Below is a list of commonly used documents alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed after their death. It can complement a Transfer-on-Death Deed by addressing any assets not covered by the deed.

- Divorce Settlement Agreement: A crucial legal document that outlines the agreement between parties during a divorce, addressing asset division and support obligations. For a detailed understanding, consider reviewing the Florida Forms.

- Power of Attorney: This legal document allows an individual to designate someone else to make decisions on their behalf. It can be useful in managing property affairs before the transfer occurs.

- Property Deed: The existing deed to the property being transferred provides proof of ownership. It may be necessary to reference this document to confirm the details of the property.

- Affidavit of Heirship: This document establishes the heirs of a deceased person. It can be important for clarifying who is entitled to inherit property if the original owner passes away without a will.

- Tax Clearance Certificate: Obtained from the Pennsylvania Department of Revenue, this certificate verifies that all taxes related to the property have been paid. It is often required before the transfer can be finalized.

Understanding these documents can greatly assist in the process of transferring property through a Transfer-on-Death Deed in Pennsylvania. Each plays a unique role in ensuring that the transfer is executed properly and that the intentions of the property owner are honored.