Legal Real Estate Purchase Agreement Document for the State of Pennsylvania

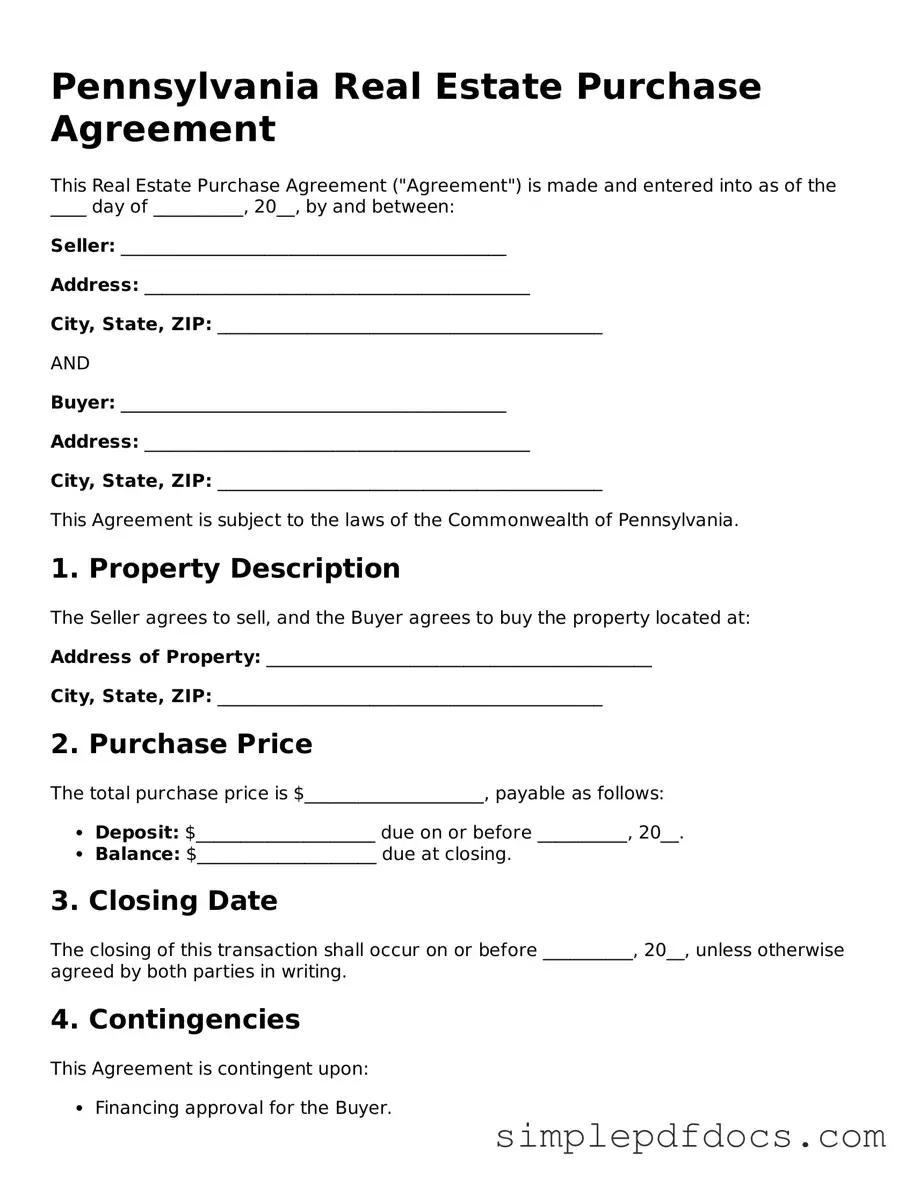

The Pennsylvania Real Estate Purchase Agreement form serves as a crucial document in the home buying process, outlining the terms and conditions under which a property is sold. This form includes essential details such as the purchase price, the closing date, and any contingencies that may apply, such as financing or inspections. Buyers and sellers alike must pay attention to the specific obligations and rights established within the agreement, as these will guide the transaction from start to finish. Additionally, the form addresses important aspects like earnest money deposits, property disclosures, and the responsibilities of both parties during the closing process. By understanding the components of this agreement, individuals can navigate the complexities of real estate transactions with greater confidence and clarity, ensuring that their interests are well protected throughout the journey.

Consider Other Common Real Estate Purchase Agreement Templates for Specific States

Nc Real Estate Sales Contract - Can be modified to address specific needs of the transaction.

When entering into agreements that involve sensitive information, parties often rely on a Florida Non-disclosure Agreement (NDA) form to safeguard their interests. This legally binding document ensures that confidential material shared during business interactions is protected from unauthorized disclosure. By adhering to Florida's specific statutes and regulations, both parties are made aware of their obligations concerning the handling of proprietary information. For those interested in drafting or obtaining such a form, additional resources are available at https://floridaforms.net/blank-non-disclosure-agreement-form, which can assist in creating a robust legal framework for collaboration.

Trec License - Specifies whether the property is sold "as-is" or with warranties.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Real Estate Purchase Agreement is governed by Pennsylvania state law, particularly the Pennsylvania Uniform Commercial Code and relevant real estate statutes. |

| Purpose | This form serves as a legally binding contract between the buyer and seller for the purchase of real estate in Pennsylvania. |

| Essential Elements | Key components include the purchase price, property description, contingencies, and closing date. |

| Contingencies | Common contingencies may include financing, home inspections, and appraisal requirements to protect the buyer's interests. |

| Deposit Requirements | The agreement typically requires an earnest money deposit, which demonstrates the buyer's commitment to the transaction. |

| Disclosure Obligations | Sellers must provide disclosures about the property's condition, including any known defects or issues. |

| Legal Recourse | If either party fails to fulfill their obligations, the other party may seek legal remedies, including specific performance or damages. |

How to Write Pennsylvania Real Estate Purchase Agreement

Once you have the Pennsylvania Real Estate Purchase Agreement form in hand, you’re ready to begin the process of filling it out. This document is essential for outlining the terms of the real estate transaction, so accuracy is key. Take your time and ensure that all information is entered correctly.

- Start by entering the date at the top of the form. This date marks when the agreement is being executed.

- Fill in the names of the buyer(s) and seller(s). Make sure to include full legal names as they appear on identification documents.

- Provide the property address. This should include the street number, street name, city, state, and zip code.

- Indicate the purchase price. Clearly state the total amount the buyer agrees to pay for the property.

- Specify the earnest money deposit. This is the initial deposit the buyer will make to show commitment to the purchase.

- Outline the financing details. Include whether the buyer will be using a mortgage, cash, or other means to finance the purchase.

- Detail any contingencies. This may include inspections, financing approval, or other conditions that must be met for the sale to proceed.

- Provide the closing date. This is the anticipated date when the property will officially change hands.

- Include any additional terms or conditions that are specific to this transaction. This could be anything from repairs to be made before closing to items that will remain with the property.

- Finally, ensure all parties sign and date the agreement. Signatures should be clear and legible, and it’s wise to have a witness if possible.

After completing the form, review it thoroughly for any errors or missing information. Once everything is in order, you can move forward with the next steps in the purchasing process.

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, it's essential to approach the process with care. Here are some important do's and don'ts to keep in mind:

- Do read the entire agreement thoroughly before filling it out. Understanding each section is crucial.

- Do provide accurate information. Ensure that names, addresses, and property details are correct.

- Do consult with a real estate professional if you have questions. They can offer valuable insights.

- Do keep a copy of the completed agreement for your records. This can be helpful for future reference.

- Do be clear about the terms of the sale, including contingencies and timelines.

- Don't rush through the form. Taking your time can prevent mistakes.

- Don't leave any sections blank. If a section does not apply, indicate that clearly.

- Don't make assumptions about legal terms. If you're unsure, seek clarification.

- Don't ignore deadlines. Timely submission is often critical in real estate transactions.

- Don't forget to sign and date the agreement. An unsigned document may not be legally binding.

Documents used along the form

When engaging in a real estate transaction in Pennsylvania, several documents often accompany the Real Estate Purchase Agreement. Each of these forms plays a crucial role in ensuring a smooth process for both buyers and sellers. Below are five important documents commonly used in conjunction with the purchase agreement.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers must provide this information to buyers to ensure transparency.

- Commercial Lease Agreement: Essential for those renting business premises, a comprehensive Florida Forms ensures that both landlords and tenants are clear on the terms of the lease, promoting a healthy rental relationship.

- Title Search Report: A title search reveals the legal ownership of the property and any liens or claims against it. This report is essential for confirming that the seller has the right to sell the property.

- Mortgage Commitment Letter: If the buyer is financing the purchase, this letter from the lender confirms the amount of money they are willing to lend and the terms of the loan. It is a critical step in securing financing.

- Settlement Statement: Also known as a HUD-1, this document details all the financial aspects of the transaction, including closing costs, taxes, and fees. It is provided at the closing of the sale.

- Property Inspection Report: After a home inspection, this report highlights the condition of the property and any necessary repairs. Buyers often use this information to negotiate terms or request repairs before finalizing the sale.

Understanding these documents can help buyers and sellers navigate the complexities of real estate transactions in Pennsylvania. Being well-informed contributes to a more efficient and less stressful experience for everyone involved.