Legal Quitclaim Deed Document for the State of Pennsylvania

The Pennsylvania Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in real estate without the complexities often associated with traditional property transfers. This straightforward document allows one party, known as the grantor, to convey their rights to a property to another party, referred to as the grantee. Unlike warranty deeds, quitclaim deeds do not guarantee the quality of the title being transferred, which means the grantee receives whatever interest the grantor has—if any—without any promises or warranties. This form is particularly useful in situations such as transferring property between family members, settling estates, or clearing up title issues. The quitclaim deed must be properly executed and notarized to ensure its validity, and it should be filed with the county recorder of deeds to provide public notice of the transfer. Understanding the implications of using a quitclaim deed is crucial, as it can affect ownership rights and future claims on the property.

Consider Other Common Quitclaim Deed Templates for Specific States

Where Do I Get a Quitclaim Deed Form - It’s a common choice for small transactions, such as transferring ownership of a modest family home.

A Florida Quitclaim Deed form is a legal document used to transfer interest in real estate with no guarantees about the title. It's commonly employed between family members or close acquaintances when the property is not being sold for its full market value. To learn more about this document and access a template, you can visit https://floridaforms.net/blank-quitclaim-deed-form. This form simplifies the process, making it faster and more straightforward to shift ownership.

Quitclaim Deed North Carolina - No actual monetary exchange is required when using a Quitclaim Deed.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property in Pennsylvania without any warranties regarding the title. |

| Governing Law | The Pennsylvania Uniform Conveyancing Act governs the use and execution of quitclaim deeds in the state. |

| Purpose | This type of deed is often used to transfer property between family members or to clear up title issues. |

| Consideration | While consideration (payment) is not required, it is common to include a nominal amount, such as $1, to validate the transaction. |

| Signature Requirements | The grantor must sign the quitclaim deed in the presence of a notary public for it to be valid. |

| Recording | To protect the interests of the grantee, it is advisable to record the quitclaim deed with the county recorder of deeds where the property is located. |

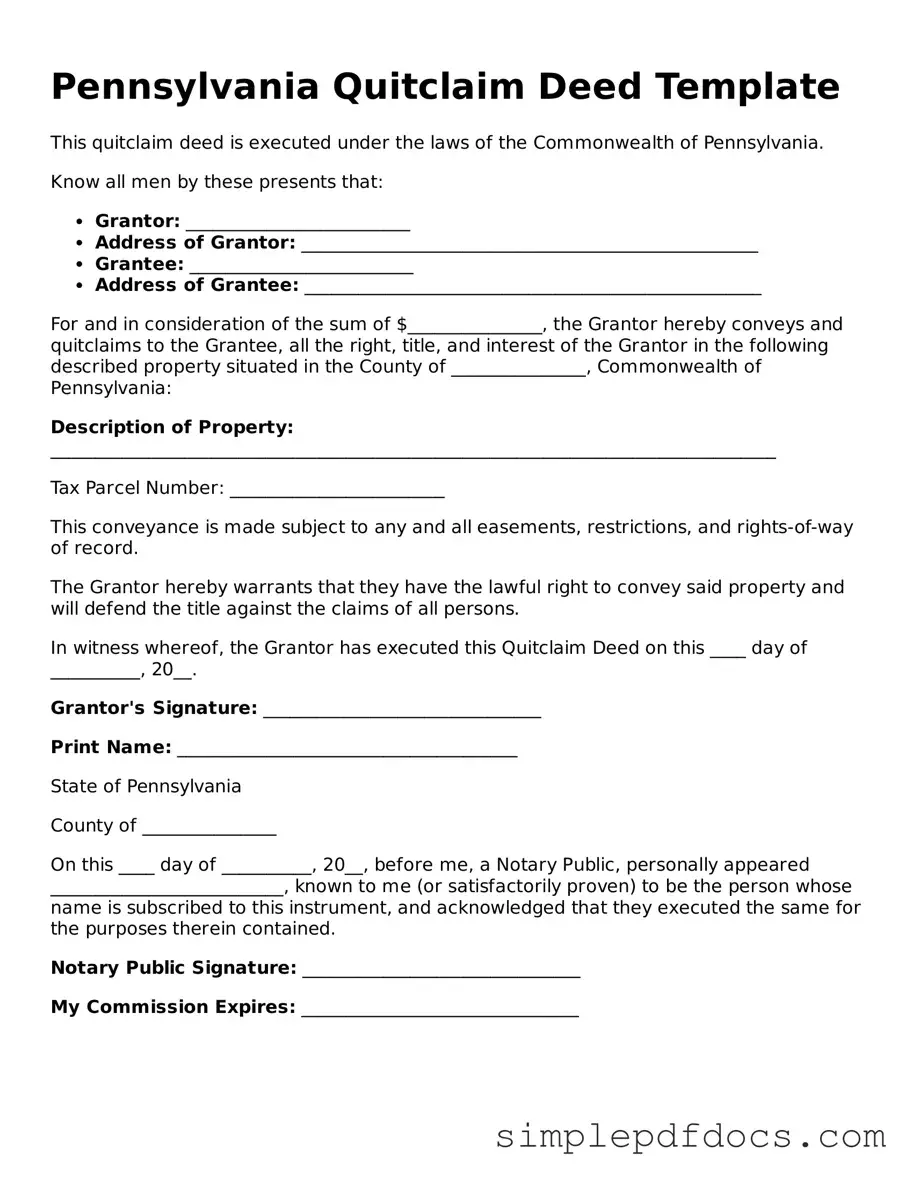

How to Write Pennsylvania Quitclaim Deed

Once you have the Pennsylvania Quitclaim Deed form, you’ll need to fill it out carefully. After completing the form, you will need to sign it and have it notarized before filing it with the appropriate county office.

- Begin by entering the date at the top of the form.

- In the first section, provide the names of the current owner(s) (grantor) of the property. Include their full legal names.

- Next, enter the names of the new owner(s) (grantee) who will receive the property. Again, use full legal names.

- Provide the property address, including the street address, city, and zip code.

- Include a legal description of the property. This can often be found on the current deed or through your county’s property records.

- State the consideration amount. This is the price or value exchanged for the property, even if it is a nominal amount.

- Leave space for the signatures of the grantor(s). Ensure that all grantors sign the form.

- Have the form notarized. A notary public will verify the identities of the signers and witness the signing.

- Once notarized, make copies for your records before filing.

- Finally, file the completed Quitclaim Deed with the county recorder’s office where the property is located.

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, it is essential to approach the task carefully. Here are some dos and don’ts to keep in mind:

- Do ensure that all parties involved are correctly identified, including their full legal names.

- Do provide a clear and accurate description of the property being transferred.

- Do sign the document in the presence of a notary public to validate the deed.

- Do check for any local requirements or additional forms that may be necessary for your specific county.

- Don't leave any blank spaces on the form, as this can lead to confusion or legal issues.

- Don't use abbreviations or shorthand when describing the property.

- Don't forget to include the date of the transfer, as this is a crucial element of the deed.

- Don't submit the form without first reviewing it for accuracy and completeness.

Documents used along the form

When dealing with property transfers in Pennsylvania, the Quitclaim Deed is just one piece of the puzzle. Several other documents often accompany it to ensure a smooth transaction. Here are four important forms you may encounter:

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It must be submitted to the county when recording the deed.

- Florida Sales Tax Form: When operating business in Florida, it is crucial to complete the Florida Forms to properly report sales tax obligations and ensure compliance with state tax regulations.

- Affidavit of Residence: This document verifies the residency status of the grantor. It helps establish tax obligations and can be crucial for determining whether certain exemptions apply.

- Title Search Documentation: A title search is conducted to confirm the property’s ownership history. This documentation ensures there are no liens or claims against the property that could affect the transfer.

- Settlement Statement: Also known as a HUD-1, this statement outlines the financial details of the transaction. It includes costs, fees, and credits associated with the sale, providing transparency for both parties.

Understanding these documents can help streamline the property transfer process and protect your interests. Always consider consulting a professional if you have questions about any specific forms or requirements.