Legal Promissory Note Document for the State of Pennsylvania

When it comes to borrowing money or lending it, a Pennsylvania Promissory Note serves as a crucial document that outlines the terms of the loan. This legally binding agreement not only specifies the amount borrowed but also details the interest rate, repayment schedule, and any potential penalties for late payments. Both lenders and borrowers benefit from having a clear understanding of their obligations, which helps to prevent misunderstandings down the line. The form typically includes essential information such as the names and addresses of both parties, the date of the agreement, and any collateral involved in the transaction. Additionally, it may address what happens in the event of default, ensuring that all parties are aware of their rights and responsibilities. By using a Promissory Note, individuals can establish a formal record of the transaction, providing peace of mind and legal protection for both sides.

Consider Other Common Promissory Note Templates for Specific States

Personal Loan Promissory Note - The form can include confidentiality clauses to protect sensitive information about the transaction.

A Florida Power of Attorney form is a legal document that grants someone the authority to act on another person's behalf in a variety of matters, including financial, legal, and health-related decisions. For those looking to create this important document, you can find a blank template at https://floridaforms.net/blank-power-of-attorney-form. This form plays a crucial role in ensuring that one's affairs are managed according to their wishes should they become unable to do so themselves.

Texas Promissory Note Requirements - They can be used for various loans, including personal loans, student loans, and business loans.

Free Promissory Note Template Ohio - The document typically states the purpose of the loan, offering clarity for both parties.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Promissory Note is a written promise to pay a specified amount of money to a designated person at a defined time. |

| Governing Law | This form is governed by the Uniform Commercial Code (UCC) as adopted in Pennsylvania. |

| Requirements | It must include the amount, interest rate (if applicable), payment schedule, and signatures of the parties involved. |

| Enforceability | For the note to be enforceable, it must be in writing and signed by the borrower. |

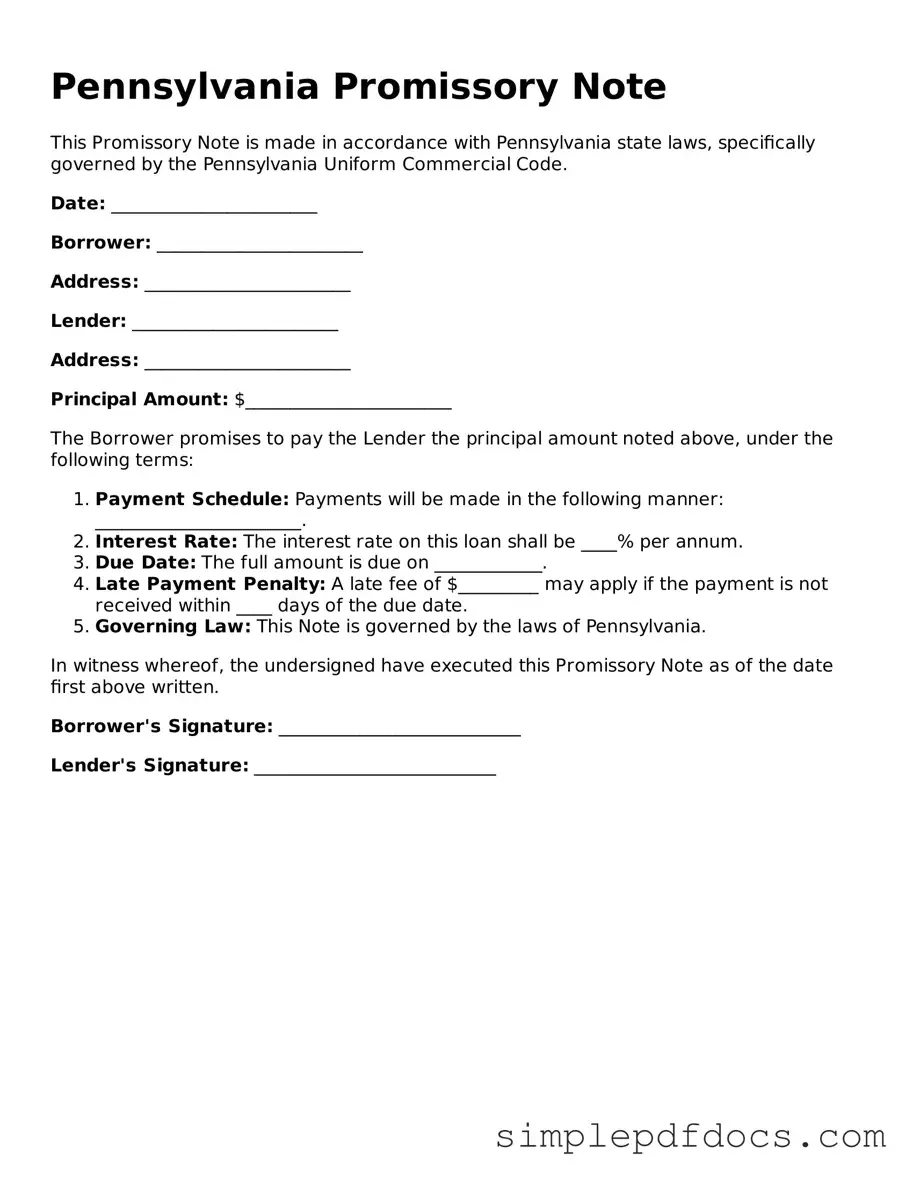

How to Write Pennsylvania Promissory Note

Once you have the Pennsylvania Promissory Note form in hand, it’s time to fill it out carefully. This document will require specific information from both the borrower and the lender. Make sure to have all necessary details ready before you start.

- Begin by entering the date at the top of the form. This is the date when the note is created.

- Next, fill in the name and address of the borrower. This is the individual or entity who is borrowing the money.

- Then, provide the name and address of the lender. This is the individual or entity providing the loan.

- Specify the principal amount. This is the total amount of money being borrowed.

- Indicate the interest rate, if applicable. This is the percentage of the principal that will be charged as interest.

- Detail the repayment terms. Include information on when payments are due and how they should be made.

- If there are any late fees or penalties for missed payments, list those terms clearly.

- Sign the document where indicated. The borrower must sign to acknowledge the terms of the note.

- Finally, have the lender sign the document as well. Both signatures are necessary for the note to be valid.

After completing the form, make sure to keep a copy for your records. It’s also wise to provide a copy to the other party involved. This ensures that both the borrower and lender have the same understanding of the agreement.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it is crucial to approach the task with care. A promissory note is a legal document that outlines a promise to pay a specified amount of money under defined terms. Here are some important dos and don'ts to consider:

- Do ensure that all parties involved are clearly identified, including full names and addresses.

- Do specify the amount being borrowed, including both the principal and any applicable interest rates.

- Do include a clear repayment schedule, detailing when payments are due and how they should be made.

- Do consider having the document notarized to add an extra layer of authenticity.

- Do keep a copy of the signed note for your records after it has been completed.

- Don't leave any sections of the form blank; incomplete forms can lead to misunderstandings.

- Don't use vague language; clarity is key to avoiding disputes in the future.

- Don't forget to date the document; the date is essential for establishing the timeline of the agreement.

- Don't overlook the importance of signatures; all parties must sign the note for it to be valid.

Documents used along the form

In Pennsylvania, a Promissory Note serves as a written promise to repay a specified sum of money under agreed-upon terms. When engaging in financial transactions, several other forms and documents may accompany the Promissory Note to ensure clarity and legal compliance. Below is a list of commonly used documents.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a more detailed contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document describes the collateral and the rights of the lender in the event of default. It provides legal protection for the lender.

- Power of Attorney: This legal form allows one party to act on behalf of another regarding specific financial transactions, which can be advantageous in certain lending scenarios. For more information, visit texasformspdf.com/.

- Personal Guarantee: This document involves a third party agreeing to repay the loan if the primary borrower defaults. It adds an additional layer of security for the lender.

- Disclosure Statement: This statement provides important information about the terms of the loan, including fees, interest rates, and other charges. It ensures that the borrower understands their obligations.

- Payment Schedule: This document outlines the specific dates and amounts of each payment due under the Promissory Note. It helps both parties keep track of payment obligations.

- Default Notice: If the borrower fails to make payments as agreed, this document serves as a formal notification of default. It outlines the consequences and potential actions the lender may take.

- Amendment Agreement: If any terms of the Promissory Note need to be changed after it has been executed, this document formally modifies the original agreement. It ensures that all parties are in agreement regarding the new terms.

These documents work together with the Promissory Note to create a comprehensive framework for the loan transaction. Each serves a specific purpose and helps to protect the interests of both the lender and the borrower.