Legal Prenuptial Agreement Document for the State of Pennsylvania

When couples in Pennsylvania consider tying the knot, discussions about finances and property often arise. A prenuptial agreement, commonly known as a prenup, serves as a proactive approach to managing these important matters before marriage. This legal document outlines how assets will be divided in the event of a divorce, protecting both partners’ interests. It can address a variety of topics, including the distribution of property, spousal support, and even debt responsibilities. Creating a prenup can help clarify expectations and reduce potential conflicts in the future. In Pennsylvania, specific guidelines and requirements must be followed to ensure the agreement is valid and enforceable. Understanding these aspects can empower couples to make informed decisions, fostering a healthier foundation for their marriage.

Consider Other Common Prenuptial Agreement Templates for Specific States

Texas Prenuptial Contract - A prenuptial agreement can also facilitate the protection of retirement accounts.

New York Prenuptial Contract - A prenuptial agreement includes terms that both partners must agree upon.

Ohio Prenuptial Contract - This document is an opportunity to have honest discussions about financial expectations.

The Florida Employment Verification form is a document used by employers to confirm the employment status of an individual. This form serves as a crucial tool for various purposes, including background checks and loan applications. To access the necessary documentation and understand its significance, you can visit Florida Forms, which can help both employers and employees navigate the verification process effectively.

North Carolina Prenuptial Contract - The agreement can protect assets acquired during cohabitation prior to marriage.

PDF Details

| Fact Name | Details |

|---|---|

| Governing Law | Pennsylvania law governs prenuptial agreements under the Pennsylvania Uniform Premarital Agreement Act (23 Pa.C.S. § 3101 et seq.). |

| Purpose | A prenuptial agreement outlines the distribution of assets and financial responsibilities in the event of divorce or death. |

| Requirements | Both parties must voluntarily sign the agreement, and full financial disclosure is recommended to ensure fairness. |

| Enforceability | The agreement may be deemed unenforceable if it is found to be unconscionable or if one party did not enter into it voluntarily. |

| Modification | Changes to the agreement can be made post-marriage, but must be in writing and signed by both parties. |

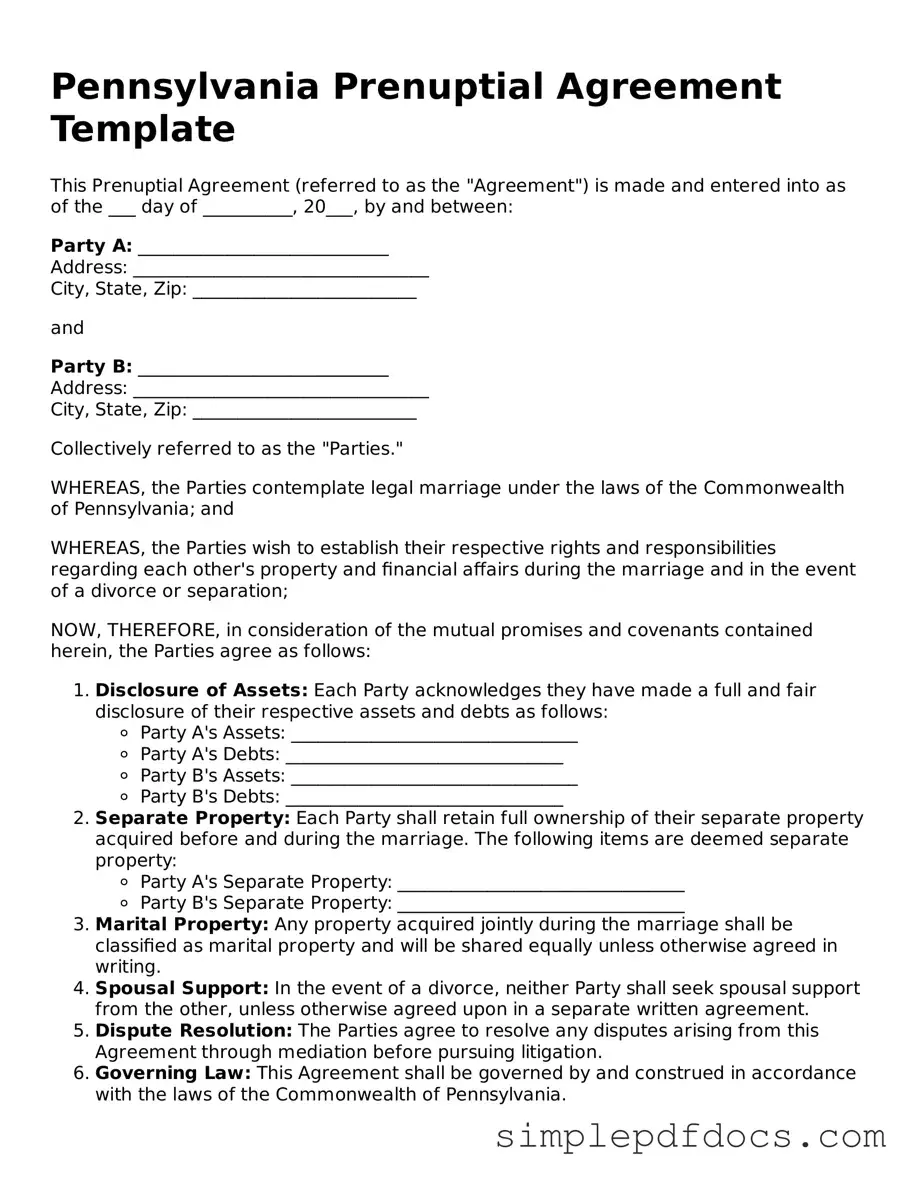

How to Write Pennsylvania Prenuptial Agreement

Filling out the Pennsylvania Prenuptial Agreement form requires careful attention to detail. This process involves gathering personal information, outlining financial assets, and agreeing on terms that will govern your marital relationship. Follow these steps to ensure that the form is completed accurately.

- Begin by downloading the Pennsylvania Prenuptial Agreement form from a reliable source.

- Read through the entire form to understand the sections that need to be filled out.

- Enter your full name and the full name of your partner at the top of the form.

- Provide your current addresses, including city and state, for both parties.

- List all assets owned by each party. Include properties, bank accounts, investments, and any other significant assets.

- Detail any debts or liabilities each party has. Be thorough to avoid future misunderstandings.

- Outline the terms of the agreement. This may include how assets will be divided in the event of divorce or separation.

- Include any provisions regarding spousal support or alimony if applicable.

- Both parties should review the completed form to ensure accuracy and mutual understanding.

- Sign and date the form in the designated areas. It is advisable to have the signatures notarized.

- Make copies of the signed agreement for both parties to retain for their records.

Dos and Don'ts

When considering a Pennsylvania Prenuptial Agreement, it’s essential to approach the process thoughtfully. Here’s a guide to help you navigate the dos and don’ts of filling out this important form.

- Do communicate openly with your partner about your intentions and concerns regarding the prenup.

- Do consult with a qualified attorney who specializes in family law to ensure your agreement complies with state laws.

- Do disclose all assets and debts honestly to avoid any issues later on.

- Do review the agreement together and make sure both parties understand its terms.

- Don't rush the process; take your time to ensure everything is clear and fair.

- Don't use vague language or ambiguous terms that could lead to misunderstandings.

- Don't forget to consider future changes in circumstances, such as children or changes in income.

- Don't overlook the importance of signing the agreement well in advance of the wedding to avoid any claims of coercion.

Documents used along the form

When preparing a prenuptial agreement in Pennsylvania, there are several other forms and documents that may be useful to consider. These documents can help clarify financial arrangements, outline responsibilities, and ensure that both parties are on the same page before entering into marriage. Below is a list of commonly used forms that complement a prenuptial agreement.

- Financial Disclosure Statement: This document requires both parties to provide detailed information about their assets, liabilities, income, and expenses. Transparency is crucial for ensuring that both individuals understand each other's financial situations.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage and can address changes in circumstances or clarify financial arrangements that were not covered in the original prenup.

- Separation Agreement: If a couple decides to separate, this agreement outlines the terms of their separation, including asset division, spousal support, and child custody arrangements, if applicable.

- Marital Settlement Agreement: This document is often used during divorce proceedings to finalize the terms of asset division, debts, and other financial obligations between spouses.

- Will: A will specifies how a person's assets will be distributed upon their death. Having a will can complement a prenuptial agreement by ensuring that both parties' wishes are respected in the event of a tragedy.

- Power of Attorney: This legal document allows one person to make decisions on behalf of another in financial or medical matters. It can be particularly important in situations where one spouse may need to act for the other.

- Power of Attorney for a Child: For parents needing to assign responsibilities temporarily, the essential Power of Attorney for a Child document ensures proper care and decision-making for their child’s well-being.

- Trust Agreement: A trust can be established to manage assets during a person’s lifetime and after death. This document can help ensure that specific assets are protected and distributed according to the parties' wishes.

- Child Custody Agreement: If children are involved, this agreement outlines the custody arrangements and responsibilities of each parent. It is crucial for ensuring the well-being of the children.

- Debt Agreement: This document specifies how debts incurred before or during the marriage will be managed and divided, helping to clarify financial responsibilities.

Each of these documents plays a unique role in the overall financial and legal landscape of a marriage. Having them in place can provide clarity and protection for both parties, ensuring a smoother transition into married life.