Legal Operating Agreement Document for the State of Pennsylvania

The Pennsylvania Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal workings of the LLC, detailing the rights, responsibilities, and obligations of its members. By establishing clear guidelines, the agreement helps to prevent misunderstandings and conflicts among members. It typically includes provisions related to management structure, profit distribution, and decision-making processes. Additionally, the form addresses how new members can be added and how existing members can exit the company. Having a well-crafted Operating Agreement is not just a legal formality; it is an essential tool that fosters transparency and accountability within the organization. Without this document, members may find themselves navigating disputes without a clear framework, potentially jeopardizing the stability of the business. Therefore, understanding the key components of the Pennsylvania Operating Agreement is vital for any LLC looking to operate smoothly and effectively in the state.

Consider Other Common Operating Agreement Templates for Specific States

Llc Template - It serves as an internal rulebook for the members regarding daily operations.

The Texas Operating Agreement form is essential for members of a Limited Liability Company (LLC) to establish clear operational procedures and ownership structures. By utilizing this important legal document, members can protect their interests and maintain clarity in their business dealings. To formalize the structure of your business and safeguard member agreements, fill out the Texas Operating Agreement form by clicking the button below or visit texasformspdf.com for more information.

Creating an Operating Agreement - Use the Operating Agreement to specify member contributions and expectations.

How to Register an Llc - The Operating Agreement serves as a reference point for members during disputes.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | The Pennsylvania Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Pennsylvania. |

| Governing Law | This agreement is governed by the Pennsylvania Limited Liability Company Law, specifically Title 15, Chapter 89 of the Pennsylvania Consolidated Statutes. |

| Purpose | It serves to define the rights and responsibilities of members and managers, ensuring clarity and reducing potential disputes. |

| Customization | Members can tailor the agreement to fit their specific needs, addressing issues like profit distribution, decision-making processes, and member responsibilities. |

| Not Mandatory | While it is not required by law to have an Operating Agreement in Pennsylvania, having one is highly recommended to protect the interests of all members. |

| Amendments | The agreement can be amended as needed, provided that all members agree to the changes, ensuring flexibility as the business evolves. |

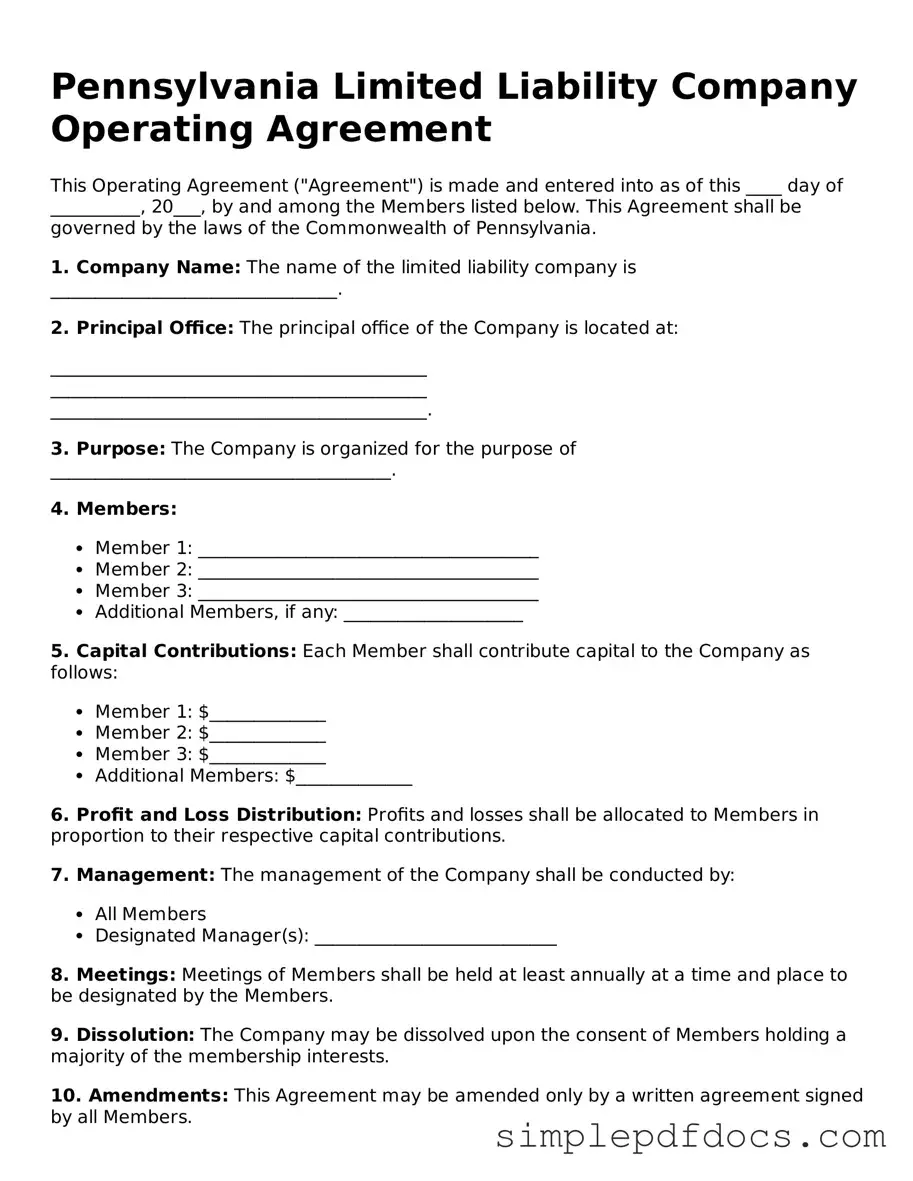

How to Write Pennsylvania Operating Agreement

After gathering the necessary information, you will be ready to fill out the Pennsylvania Operating Agreement form. This document is essential for outlining the management and operational procedures of your business. Follow these steps to ensure you complete the form accurately.

- Begin by providing the name of your business. Ensure it matches the name registered with the state.

- Next, enter the principal address of your business. This should be the location where your business operates.

- Identify the members of the business. List the names and addresses of all individuals or entities involved.

- Specify the purpose of your business. Clearly state what your business will be doing.

- Outline the management structure. Indicate whether the business will be member-managed or manager-managed.

- Detail the voting rights of each member. This includes how decisions will be made and what percentage of votes each member holds.

- Include provisions for profit and loss distribution. Clearly state how profits and losses will be shared among members.

- Address the process for adding or removing members. Outline the steps that will be taken if changes in membership occur.

- Provide information on how disputes will be resolved. This might include mediation or arbitration procedures.

- Finally, ensure all members sign and date the document. This signifies their agreement to the terms outlined in the Operating Agreement.

Once the form is completed and signed, you may want to keep copies for your records and submit it as required by Pennsylvania state law. This document will serve as a foundational element for your business operations.

Dos and Don'ts

When filling out the Pennsylvania Operating Agreement form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are six things to consider:

- Do: Review the form thoroughly before starting to fill it out.

- Do: Provide accurate and complete information about all members.

- Do: Sign and date the form in the appropriate sections.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that could cause confusion.

Documents used along the form

When forming a business in Pennsylvania, particularly a limited liability company (LLC), the Operating Agreement is a crucial document. However, it is often accompanied by several other forms and documents that help establish the business's structure and ensure compliance with state laws. Below is a list of common documents used alongside the Pennsylvania Operating Agreement.

- Articles of Organization: This is the foundational document that officially creates your LLC in Pennsylvania. It includes basic information about your business, such as its name, address, and the names of its members.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes. This unique number identifies your business for federal tax filings and can also be necessary for opening a business bank account.

- Bylaws: Although not mandatory for LLCs, bylaws can outline the internal rules and procedures for managing the business. They serve as a guide for decision-making and member responsibilities.

- Real Estate Purchase Agreement: This document is essential for those engaging in property transactions in Texas, outlining terms and ensuring clarity between parties involved. For more details, refer to the for the document.

- Member Consent Forms: These forms document the agreement among members regarding specific decisions or actions taken by the LLC. They can be useful for maintaining transparency and a record of member approvals.

- Operating Procedures: While the Operating Agreement covers the overall structure, detailed operating procedures can provide clarity on day-to-day operations, roles, and responsibilities within the LLC.

- Meeting Minutes: Keeping records of meetings is important for compliance and governance. Meeting minutes document discussions, decisions made, and actions taken during meetings, ensuring all members are informed.

- Membership Certificates: These certificates can be issued to members to signify their ownership interest in the LLC. They serve as a formal acknowledgment of membership and can help in resolving disputes about ownership.

- State Filings: Depending on your business activities, you may need to file additional documents with the state, such as business licenses or permits, to comply with local regulations.

Understanding these documents and their roles can significantly ease the process of establishing and operating your LLC in Pennsylvania. Each document contributes to a well-structured business framework, ensuring clarity and legal compliance as your company grows.