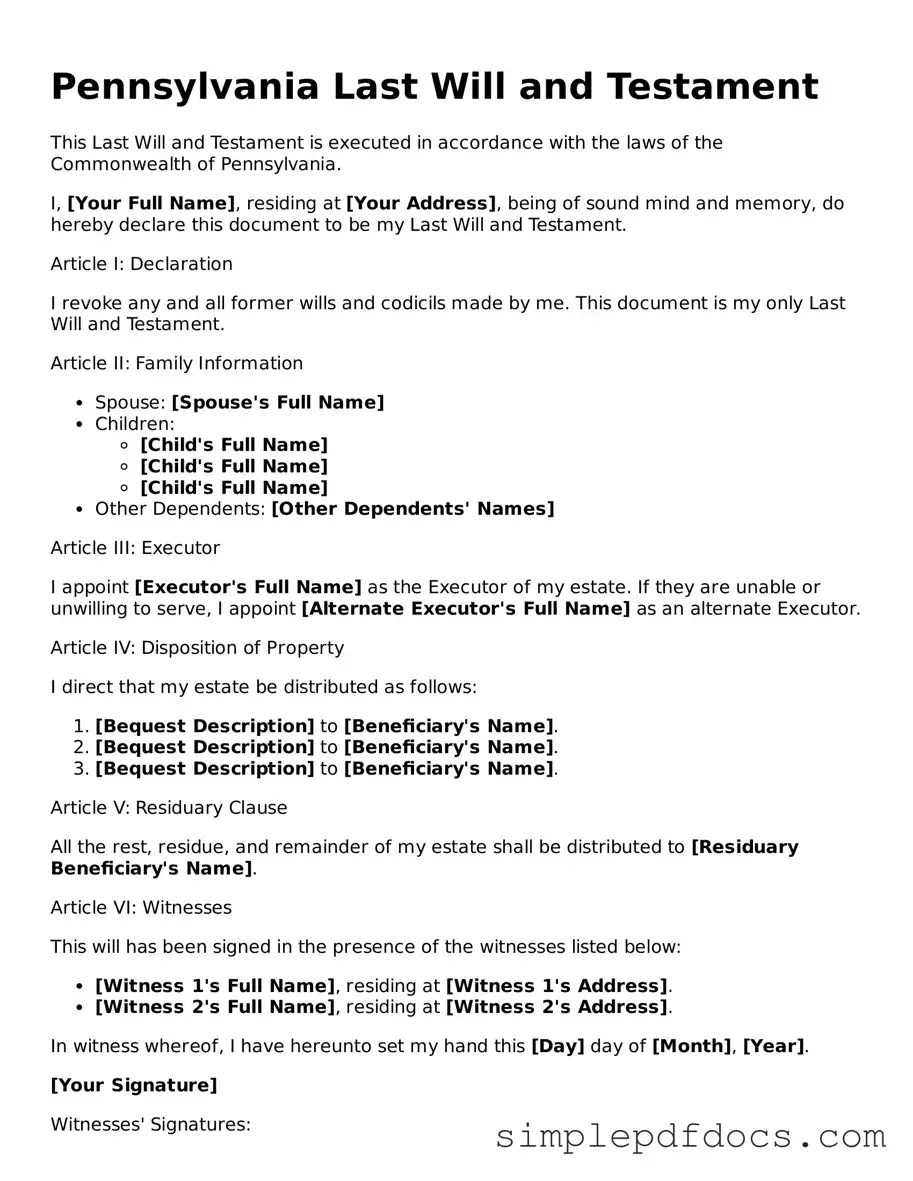

Legal Last Will and Testament Document for the State of Pennsylvania

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Pennsylvania, this legal document serves as a clear expression of your intentions regarding the distribution of your assets, the care of your dependents, and the appointment of an executor to oversee the execution of your estate. The form typically includes essential components such as the identification of beneficiaries, detailed instructions on asset distribution, and the designation of guardians for minor children, if applicable. It is important to ensure that the will is signed and witnessed according to Pennsylvania law to make it valid. By taking the time to complete this form, you provide peace of mind not only for yourself but also for your loved ones, guiding them through a challenging time with clarity and direction. Understanding the intricacies of the Pennsylvania Last Will and Testament form can empower you to make informed decisions that reflect your values and wishes, ultimately safeguarding your legacy.

Consider Other Common Last Will and Testament Templates for Specific States

Simple Last Will and Testament Sample - A tool to communicate your end-of-life wishes clearly and legally.

The Florida Marriage Application form is an essential document for couples looking to marry in Florida, and it is important to familiarize oneself with the process. For more detailed guidance, you can visit the Florida Forms website, which outlines the necessary steps and provides helpful resources to ensure your wedding planning proceeds without a hitch.

Ohio Last Will and Testament Template - Can involve specific directives about investments or business interests.

PDF Details

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Last Will and Testament is governed by the Pennsylvania Probate, Estates and Fiduciaries Code, specifically Title 20 of the Pennsylvania Consolidated Statutes. |

| Age Requirement | To create a valid will in Pennsylvania, the testator must be at least 18 years old. |

| Signature Requirement | The will must be signed by the testator. If the testator is unable to sign, they may direct someone else to sign on their behalf in their presence. |

| Witness Requirement | At least two witnesses must sign the will, and they should be present at the same time as the testator when the will is signed. |

| Revocation | A will can be revoked by the testator at any time, typically by creating a new will or by physically destroying the existing will. |

| Holographic Wills | Pennsylvania recognizes holographic wills, which are handwritten and signed by the testator, but they must still meet certain requirements to be valid. |

| Self-Proving Wills | A self-proving will includes a notarized affidavit from the witnesses, which can simplify the probate process by eliminating the need for witness testimony. |

| Probate Process | After the testator's death, the will must go through probate, a legal process that validates the will and oversees the distribution of assets. |

How to Write Pennsylvania Last Will and Testament

After obtaining the Pennsylvania Last Will and Testament form, you will need to complete it with your personal information and preferences regarding your estate. Ensure that you have all necessary details at hand before starting the process.

- Begin by writing your full name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- State your date of birth.

- Identify your marital status (single, married, divorced, or widowed).

- List your children, if any, including their names and birthdates.

- Designate an executor. This person will be responsible for carrying out your wishes as outlined in the will.

- Detail how you want your assets distributed. Be specific about who receives what.

- Include any special instructions regarding guardianship for minor children, if applicable.

- Sign and date the document in the presence of at least two witnesses.

- Have the witnesses sign the will, noting their names and addresses.

Once you have completed the form, keep it in a safe place and inform your executor of its location. Consider discussing your wishes with your family to ensure clarity and understanding.

Dos and Don'ts

When filling out the Pennsylvania Last Will and Testament form, it's crucial to approach the task with care and attention. Below is a list of ten important dos and don'ts to guide you through the process.

- Do clearly identify yourself at the beginning of the document.

- Don't use vague language that could lead to confusion about your intentions.

- Do list all your assets, including real estate, bank accounts, and personal belongings.

- Don't forget to consider any debts or obligations you may have.

- Do appoint an executor who you trust to carry out your wishes.

- Don't choose someone who may have conflicts of interest or who may not be willing to serve.

- Do sign the will in the presence of two witnesses.

- Don't have your witnesses be beneficiaries of the will, as this could complicate matters.

- Do keep your will in a safe place and inform your executor of its location.

- Don't forget to review and update your will regularly, especially after major life events.

Following these guidelines can help ensure that your Last Will and Testament reflects your true wishes and provides clarity for your loved ones.

Documents used along the form

When preparing a Pennsylvania Last Will and Testament, several other documents can play a crucial role in ensuring your wishes are respected and your estate is managed according to your preferences. Below are four important forms and documents often used alongside a will.

- Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. It ensures that your affairs are handled according to your wishes.

- Quitclaim Deed: For property transfers without title guarantees, consider the comprehensive Quitclaim Deed form guide to ensure proper documentation and understanding of legal implications.

- Healthcare Power of Attorney: Similar to the general power of attorney, this form designates someone to make medical decisions for you if you cannot do so yourself. It is vital for ensuring your healthcare preferences are honored.

- Living Will: A living will outlines your wishes regarding medical treatment and end-of-life care. It provides guidance to your family and healthcare providers about your preferences in situations where you cannot communicate.

- Revocable Trust: A revocable trust allows you to manage your assets during your lifetime and specifies how they will be distributed after your death. It can help avoid probate and provide more privacy for your estate.

These documents complement your Last Will and Testament, helping to create a comprehensive plan for your estate. It’s wise to consider each of these forms carefully to ensure that your wishes are fully expressed and legally protected.