Legal Durable Power of Attorney Document for the State of Pennsylvania

The Pennsylvania Durable Power of Attorney form serves as a crucial legal document that empowers individuals to designate a trusted person to manage their financial and legal affairs in the event they become incapacitated. This form is particularly significant because it remains effective even if the principal, the person granting authority, loses the ability to make decisions due to illness or disability. Key aspects of the form include the ability to specify the scope of authority granted, which can range from handling bank transactions to making healthcare decisions, depending on the preferences of the principal. Additionally, the form requires the signatures of both the principal and the appointed agent, ensuring that the arrangement is consensual and legally binding. It also provides options for the principal to outline any limitations or specific instructions, allowing for personalized control over one’s affairs. Understanding the nuances of this document is essential for anyone considering its use, as it not only facilitates effective management of personal matters but also offers peace of mind for individuals and their families during challenging times.

Consider Other Common Durable Power of Attorney Templates for Specific States

Ohio Power of Attorney Requirements - This form serves as a safeguard for your financial health and legal rights.

How to Get Power of Attorney in Nc - Taking the time to establish this form can safeguard your financial well-being in the future.

When engaging in activities that carry inherent risks, it's essential to be informed about protective measures such as the Hold Harmless Agreement. This legal document not only clarifies liability but also safeguards individuals from unforeseen damages related to these activities. To acquire the necessary paperwork for these agreements, interested parties can refer to resources like Florida Forms, ensuring that everyone involved understands their rights and responsibilities fully.

Power of Attorney Form Texas Pdf - It is important to choose an agent you trust to act in your best interest.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual (the principal) to appoint someone else (the agent) to manage their financial and legal affairs, even if the principal becomes incapacitated. |

| Governing Law | The Pennsylvania Durable Power of Attorney is governed by the Pennsylvania Consolidated Statutes, Title 20, Chapter 56. |

| Durability | This type of power of attorney remains effective even if the principal becomes mentally incompetent, unlike a regular power of attorney which becomes void under such circumstances. |

| Agent's Authority | The agent can be granted broad or limited powers, including managing bank accounts, selling property, and making healthcare decisions, depending on the principal's wishes. |

| Execution Requirements | In Pennsylvania, the form must be signed by the principal and witnessed by two individuals or notarized to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Importance of Choosing an Agent | Selecting a trustworthy agent is crucial, as they will have significant control over the principal's financial and legal matters. |

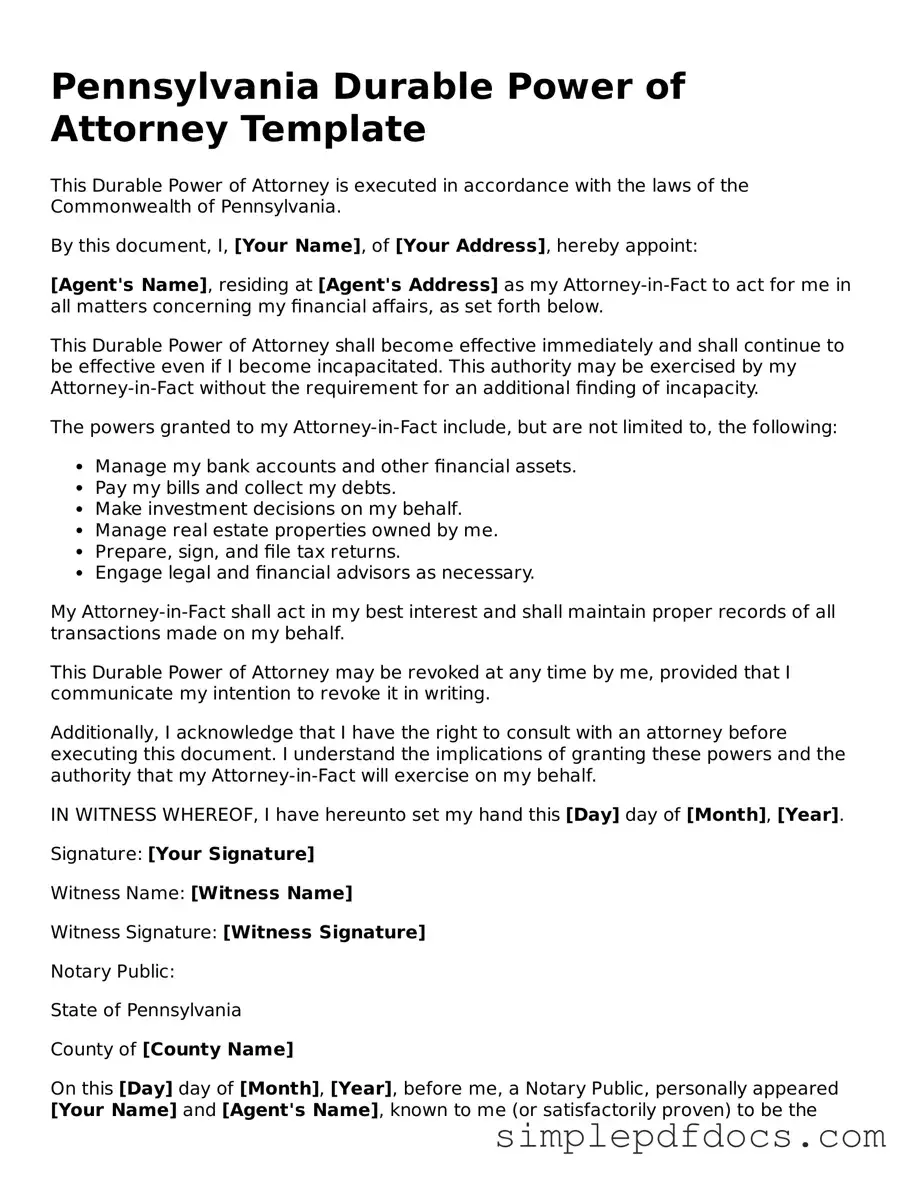

How to Write Pennsylvania Durable Power of Attorney

Filling out a Durable Power of Attorney form in Pennsylvania is an important step in planning for your future. This document allows you to designate someone to make decisions on your behalf if you become unable to do so. It’s essential to approach this process carefully to ensure your wishes are accurately reflected.

- Begin by downloading the Pennsylvania Durable Power of Attorney form from a reliable source or obtain a hard copy from an attorney.

- Read through the entire form to familiarize yourself with its sections and requirements.

- In the first section, fill in your name and address as the principal (the person granting authority).

- Next, identify the agent (the person you are appointing) by providing their name, address, and relationship to you.

- Specify the powers you wish to grant your agent. You can choose general powers or limit them to specific areas, such as financial or medical decisions.

- Consider adding any special instructions or limitations regarding your agent’s authority in the designated section.

- Sign and date the form in the presence of a notary public. This step is crucial for the document to be legally binding.

- Have the notary public sign and stamp the document, confirming its validity.

- Distribute copies of the completed form to your agent, your attorney, and any relevant financial institutions or healthcare providers.

Once you have completed these steps, you will have a valid Durable Power of Attorney in Pennsylvania. It’s advisable to review this document periodically and make updates as necessary to reflect any changes in your circumstances or preferences.

Dos and Don'ts

When completing the Pennsylvania Durable Power of Attorney form, it is essential to follow certain guidelines to ensure the document is valid and effective. Below are seven important dos and don'ts to consider.

- Do ensure you understand the powers you are granting to your agent.

- Do choose a trustworthy individual as your agent.

- Do clearly specify any limitations on the agent's authority.

- Do sign the document in the presence of a notary public.

- Don't use vague language that could lead to misinterpretation.

- Don't forget to date the document when signing.

- Don't neglect to provide copies to relevant parties after completion.

By following these guidelines, you can help ensure that your Durable Power of Attorney form serves its intended purpose effectively.

Documents used along the form

When creating a Pennsylvania Durable Power of Attorney (DPOA), individuals often consider additional forms and documents to ensure comprehensive planning for financial and healthcare decisions. Each of these documents serves a unique purpose and can provide clarity and direction in various situations.

- Health Care Power of Attorney: This document designates an individual to make medical decisions on behalf of someone if they become incapacitated. It focuses specifically on health-related matters, ensuring that medical preferences are respected.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in scenarios where they cannot communicate their preferences. It typically addresses end-of-life care and life-sustaining treatments.

- Last Will and Testament: This document specifies how a person's assets will be distributed upon their death. It appoints an executor and can also name guardians for minor children.

- Revocable Living Trust: A revocable living trust allows individuals to place their assets in a trust during their lifetime. It can help avoid probate and provides a plan for asset management if the individual becomes incapacitated.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow individuals to name beneficiaries directly. This ensures that assets pass directly to the named individuals without going through probate.

- Guardianship Documents: If someone needs to appoint a guardian for a minor child or an incapacitated adult, these documents outline the responsibilities and authority granted to the guardian.

- Trailer Bill of Sale: To ensure proper documentation when selling a trailer, refer to our essential trailer bill of sale resources for a smooth transaction.

- Financial Power of Attorney: While similar to a DPOA, this document specifically grants authority over financial matters, such as managing bank accounts, paying bills, and handling investments.

- Property Transfer Documents: These documents, including deeds and title transfers, allow individuals to transfer ownership of property while they are still alive, often as part of estate planning strategies.

- Advance Directive: An advance directive combines elements of a health care power of attorney and a living will. It provides guidance on medical decisions and appoints a representative to make choices on behalf of the individual.

These documents work in tandem with the Durable Power of Attorney to create a robust framework for managing personal and financial affairs. By thoughtfully considering each form, individuals can ensure that their wishes are honored and that their loved ones are supported during challenging times.