Legal Deed in Lieu of Foreclosure Document for the State of Pennsylvania

When facing the possibility of foreclosure, homeowners in Pennsylvania have options that can help them navigate this challenging situation. One such option is the Deed in Lieu of Foreclosure form. This legal document allows a homeowner to voluntarily transfer their property to the lender, effectively settling the mortgage debt without going through the lengthy foreclosure process. By choosing this route, homeowners can avoid the negative impact of foreclosure on their credit score and potentially expedite their transition out of the property. The form outlines essential details, including the property description, the parties involved, and any outstanding obligations. It serves as a mutual agreement, ensuring that both the homeowner and the lender understand their rights and responsibilities. Understanding the nuances of this form can empower homeowners to make informed decisions and seek a resolution that minimizes financial strain and emotional distress.

Consider Other Common Deed in Lieu of Foreclosure Templates for Specific States

Foreclosure Vs Deed in Lieu - Signing this deed can prevent the emotional stress of a public foreclosure sale.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The voluntary nature of a Deed in Lieu sets it apart from involuntary foreclosure processes.

To understand the implications of the Notice to Quit form, it's essential for both landlords and tenants to be aware of its provisions and requirements. For tenants facing potential eviction, knowing their rights and the process involved can help them navigate this challenging situation. Resources such as the floridaforms.net/blank-notice-to-quit-form can provide guidance on how to respond effectively to the notice and seek possible remedies.

Sale in Lieu of Foreclosure - This process can help the lender reduce the amount of time and effort spent on property recovery.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In Pennsylvania, the process is governed by state laws related to real estate and foreclosure, primarily under the Pennsylvania Consolidated Statutes. |

| Eligibility | Homeowners facing financial difficulties may qualify, but they must be in default or at risk of defaulting on their mortgage. |

| Benefits | This option can help homeowners avoid the lengthy and stressful foreclosure process, potentially preserving their credit score. |

| Process | The borrower must negotiate with the lender, complete the deed, and ensure all liens on the property are addressed. |

| Documentation | Required documents typically include the mortgage agreement, a hardship letter, and the deed itself. |

| Tax Implications | Homeowners should consult a tax professional, as there may be tax consequences related to forgiven debt. |

| Impact on Credit | While a deed in lieu is less damaging than foreclosure, it may still negatively affect a borrower’s credit score. |

| Alternatives | Other options include loan modifications, short sales, or filing for bankruptcy, which may be more suitable depending on the situation. |

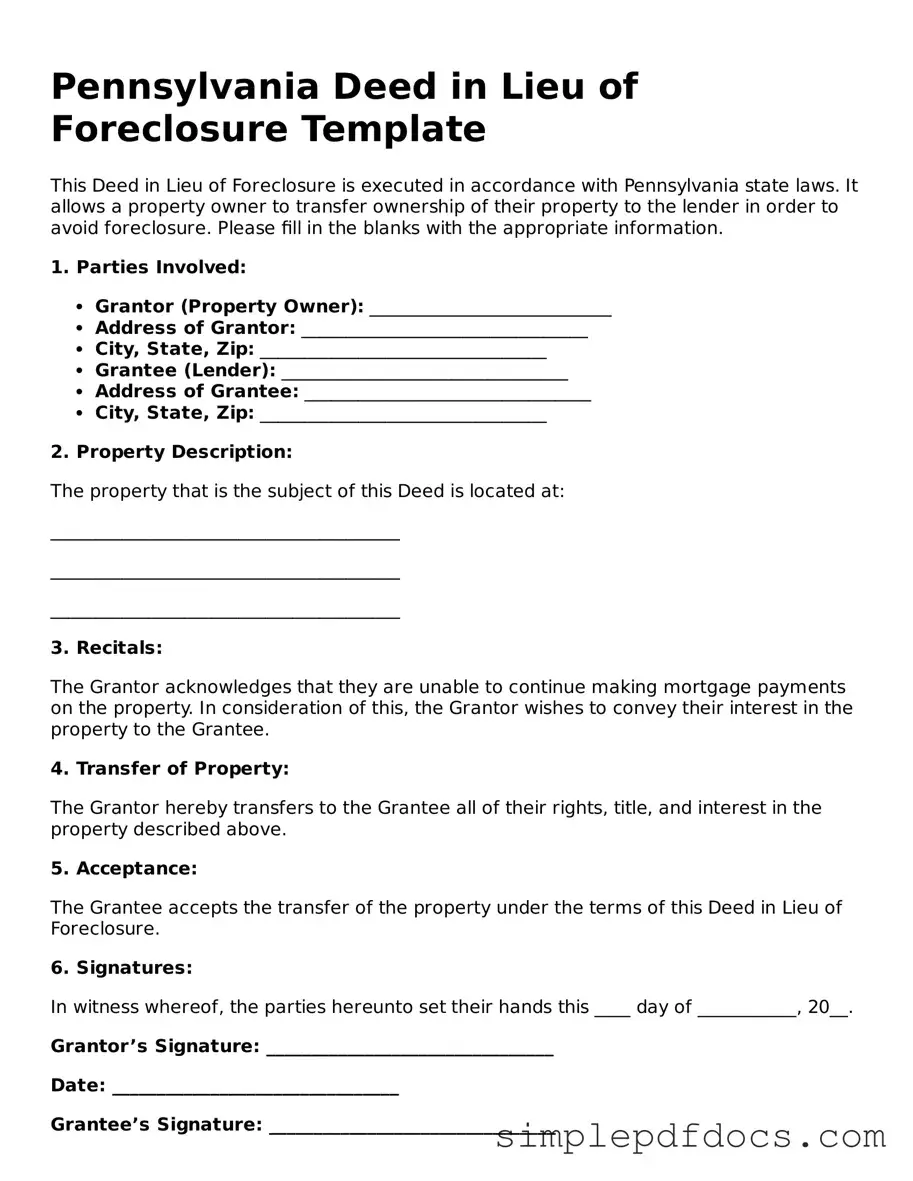

How to Write Pennsylvania Deed in Lieu of Foreclosure

Once you have gathered all necessary information and documents, you will need to complete the Pennsylvania Deed in Lieu of Foreclosure form. This form allows a homeowner to transfer property ownership to the lender as a way to avoid foreclosure. After filling out the form, it must be submitted to the appropriate parties for processing.

- Begin by downloading the Pennsylvania Deed in Lieu of Foreclosure form from a reliable source.

- At the top of the form, enter the date on which you are filling out the document.

- Provide the full name of the property owner(s). Ensure that all names are spelled correctly.

- Next, fill in the property address, including the city, state, and zip code.

- In the designated section, enter the name of the lender or financial institution receiving the deed.

- Include the legal description of the property. This can often be found on the property deed or through local property records.

- Sign and date the form where indicated. If there are multiple owners, all must sign the document.

- Have the signatures notarized. This step is essential for the document to be legally binding.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the lender, along with any additional documents they may require.

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it's essential to approach the process with care. Here are some important do's and don'ts to consider:

- Do ensure all information is accurate and up-to-date.

- Do include all necessary signatures from all parties involved.

- Do consult with a legal professional if you have any questions.

- Do provide a clear description of the property being conveyed.

- Don't rush through the form; take your time to review each section.

- Don't omit any required documentation that may accompany the deed.

- Don't ignore the potential tax implications of the transaction.

Following these guidelines can help ensure a smoother process when dealing with a deed in lieu of foreclosure in Pennsylvania.

Documents used along the form

A Deed in Lieu of Foreclosure can be a beneficial alternative for homeowners facing foreclosure in Pennsylvania. However, several other forms and documents are often used in conjunction with this process. Below is a list of important documents that may be required or helpful during this transition.

- Mortgage Agreement: This is the original contract between the borrower and the lender, outlining the terms of the loan and the rights and responsibilities of both parties.

- Motor Vehicle Bill of Sale: This essential document records the transfer of ownership of a motor vehicle, detailing specifics like the vehicle’s description and purchase price. For those in Texas, initiating this process is crucial; you can find the necessary form at https://texasformspdf.com/.

- Notice of Default: This document is issued by the lender when the borrower has failed to make mortgage payments. It formally notifies the borrower of their default status.

- Loan Modification Agreement: This agreement modifies the terms of the original mortgage to make payments more manageable for the borrower, potentially avoiding foreclosure.

- Release of Liability: This document releases the borrower from any future liability for the mortgage debt after the deed is transferred to the lender.

- Affidavit of Title: A sworn statement by the homeowner confirming their ownership of the property and that there are no undisclosed liens or claims against it.

- Property Inspection Report: A document that outlines the condition of the property. This report can help the lender assess the property's value before accepting the deed.

- Settlement Statement: This statement details the financial aspects of the transaction, including any costs associated with the deed in lieu process.

- Power of Attorney: This document allows another person to act on behalf of the homeowner, which can be useful if the homeowner is unable to complete the process themselves.

- Release of Mortgage: Once the deed is transferred, this document formally releases the mortgage lien from the property, clearing the title for the new owner.

Understanding these documents is crucial for homeowners considering a Deed in Lieu of Foreclosure. Each plays a significant role in ensuring a smooth transition and protecting the rights of all parties involved.