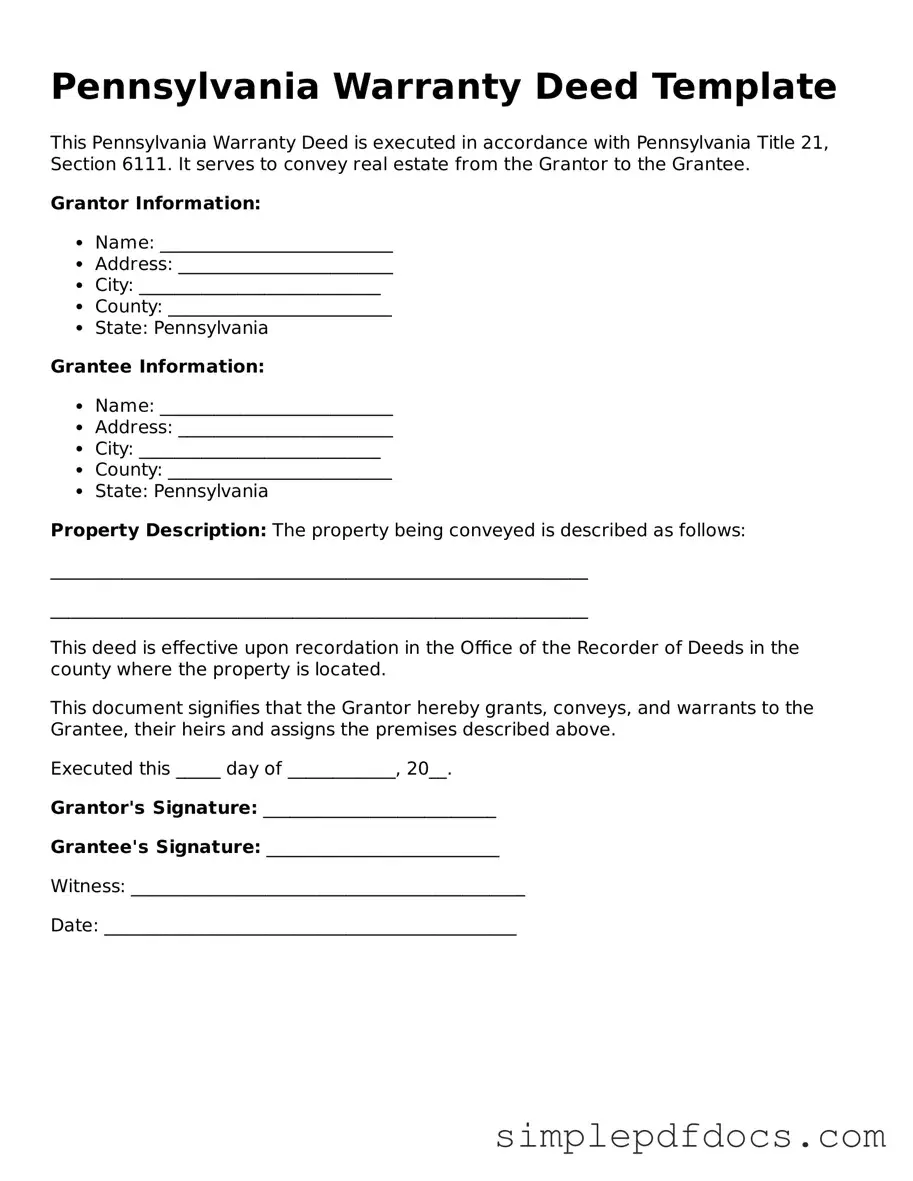

Legal Deed Document for the State of Pennsylvania

The Pennsylvania Deed form is a crucial document in real estate transactions within the state, facilitating the transfer of property ownership from one party to another. This form includes essential details such as the names of the grantor (the current owner) and grantee (the new owner), a legal description of the property, and the date of the transaction. Additionally, it may specify any conditions or restrictions associated with the transfer. Notably, the form requires signatures from both parties and, in some cases, witnesses or notarization to ensure its validity. Understanding the Pennsylvania Deed form is important for anyone involved in property transactions, as it outlines the rights and responsibilities of the parties and serves as a public record of ownership. Proper completion and filing of this document are necessary to protect the interests of all parties involved and to facilitate a smooth transfer process.

Consider Other Common Deed Templates for Specific States

Ohio Warranty Deed - In some cases, a special purpose deed may be used, such as for transfers between family members.

New York State Deed Form - The inclusion of a date on the Deed is important to establish when ownership changed hands.

To create a solid foundation for confidentiality in business relationships, utilizing a Florida Non-disclosure Agreement (NDA) is essential. This agreement not only emphasizes the importance of safeguarding sensitive information, but it also aligns with specific state regulations. For those looking to establish this level of protection, a comprehensive resource can be found at https://floridaforms.net/blank-non-disclosure-agreement-form, which provides a template to facilitate this crucial aspect of collaboration.

Texas Deed Forms - If you buy land, a deed proves your investment.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Deed is a legal document used to transfer ownership of real estate from one party to another. |

| Governing Laws | The Pennsylvania Deed is governed by the Pennsylvania Consolidated Statutes, Title 21, Chapter 1. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Special Purpose Deed. |

| Required Signatures | Both the grantor (seller) and the grantee (buyer) must sign the deed for it to be valid. |

| Notarization | The deed must be notarized to ensure its authenticity and legal standing. |

| Recording | To protect the rights of the new owner, the deed should be recorded in the county where the property is located. |

| Consideration | The deed must state the consideration, or payment, made for the transfer of property. |

| Property Description | A clear and accurate description of the property being transferred is essential for the deed. |

| Tax Implications | Transfer taxes may apply when a property changes hands in Pennsylvania, and these should be considered. |

| Legal Assistance | While individuals can prepare a deed, seeking legal advice is recommended to avoid potential issues. |

How to Write Pennsylvania Deed

After obtaining the Pennsylvania Deed form, the next step involves accurately completing it to ensure a smooth transfer of property ownership. This process requires careful attention to detail, as any errors may lead to complications in the future. Follow these steps to fill out the form correctly.

- Obtain the Form: Acquire the Pennsylvania Deed form from a reliable source, such as a local county office or an online legal document provider.

- Identify the Grantor: Clearly write the full name and address of the current property owner (the grantor) at the top of the form.

- Identify the Grantee: Enter the full name and address of the new property owner (the grantee) in the designated section.

- Describe the Property: Provide a detailed description of the property being transferred. This includes the address, parcel number, and any relevant legal descriptions.

- Include Consideration: Indicate the amount of money or other consideration being exchanged for the property. This is often a nominal amount, but it must be specified.

- Sign the Form: The grantor must sign the deed in the presence of a notary public. Ensure that the signature is clear and matches the name provided.

- Notarization: Have the notary public complete their section, which includes their signature and seal, confirming the authenticity of the grantor’s signature.

- Review for Accuracy: Double-check all information for accuracy and completeness before submitting the form.

- File the Deed: Submit the completed deed to the appropriate county office for recording. There may be a filing fee, so be prepared to pay this at the time of submission.

Dos and Don'ts

When filling out the Pennsylvania Deed form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to keep in mind:

- Do provide complete and accurate information about the property.

- Do include the correct names of all parties involved in the transaction.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand that may cause confusion.

Documents used along the form

When dealing with property transactions in Pennsylvania, several forms and documents often accompany the Pennsylvania Deed form. Each of these documents serves a specific purpose, ensuring that the transfer of property is legally sound and properly documented. Below is a list of commonly used forms that can enhance the clarity and legality of a property transaction.

- Title Search Report: This document provides a detailed history of the property’s ownership, revealing any liens, encumbrances, or claims against it. A title search helps ensure that the seller has the legal right to transfer ownership.

- Property Disclosure Statement: Sellers are often required to provide this statement, which outlines any known issues or defects with the property. It helps buyers make informed decisions and can protect sellers from future legal disputes.

- Settlement Statement (HUD-1): Used during the closing process, this document itemizes all the costs associated with the transaction, including fees, taxes, and other expenses. It ensures transparency for both the buyer and seller.

- Articles of Incorporation – This legal document is crucial for establishing a corporation in Florida, outlining necessary details such as its name, purpose, and structure. For further information, refer to Florida Forms.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. It can be crucial when the property owner is unable to be present for the signing.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no undisclosed claims against it. It provides additional assurance to the buyer.

- Mortgage Documents: If the property is being financed, various documents related to the mortgage, such as the promissory note and mortgage agreement, will be necessary. These outline the terms of the loan and the obligations of the borrower.

- Tax Certification: This document verifies that all property taxes have been paid up to date. It protects the buyer from inheriting any outstanding tax liabilities.

- Deed of Trust: In some cases, this document is used in place of a mortgage. It secures the loan with the property itself and outlines the responsibilities of both the borrower and lender.

Understanding these accompanying documents can streamline the property transfer process in Pennsylvania. Each plays a vital role in ensuring that all parties are protected and that the transaction proceeds smoothly.