Legal Articles of Incorporation Document for the State of Pennsylvania

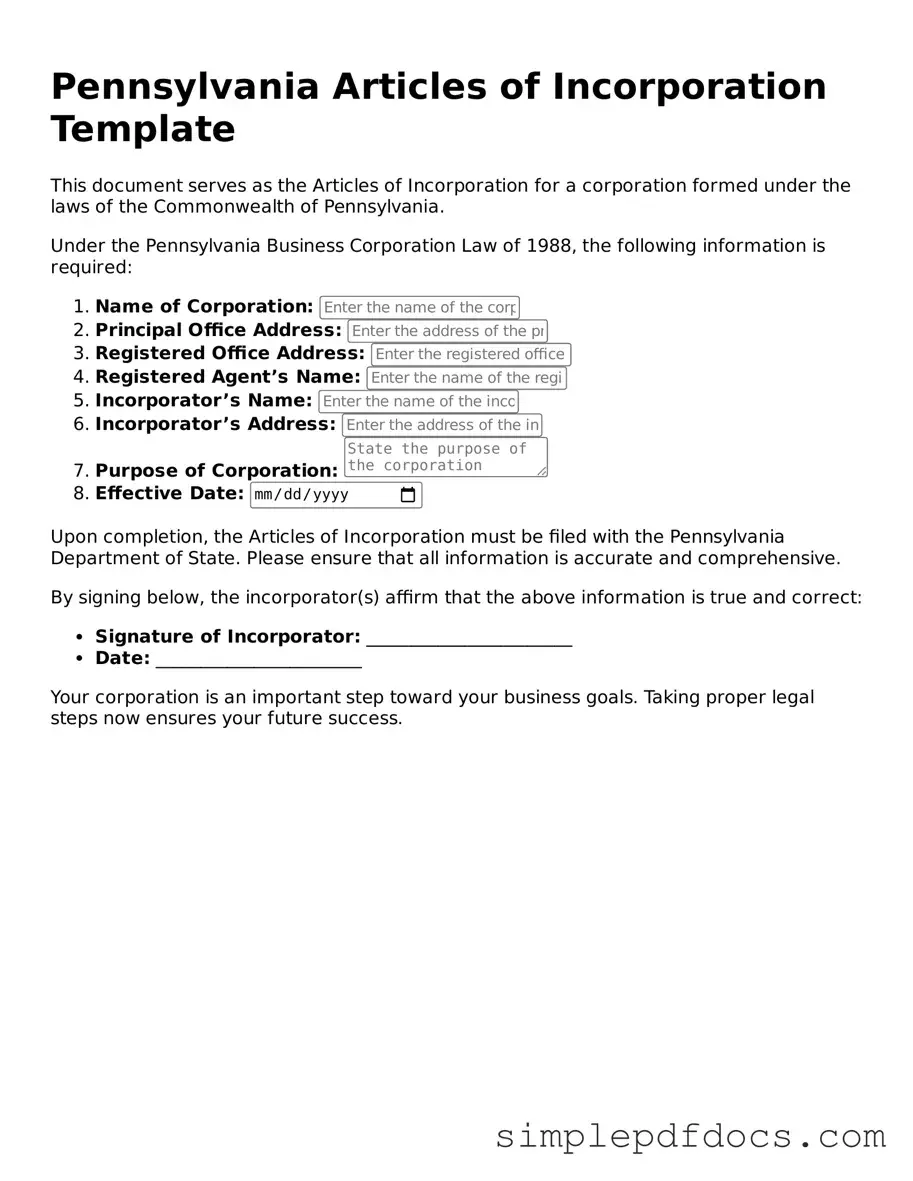

The Pennsylvania Articles of Incorporation form serves as a foundational document for establishing a corporation in the state. This form outlines essential information that defines the corporation's structure and purpose. Key aspects include the corporation's name, which must be unique and distinguishable from existing entities, ensuring clarity in the business landscape. Additionally, the form requires the designation of a registered office address, which serves as the official location for legal correspondence. The Articles also mandate the identification of the corporation's initial directors, providing a clear governance structure from the outset. Furthermore, the form includes provisions for the corporation’s purpose, which must align with state regulations and can range from general business activities to specific industry functions. Importantly, the Articles of Incorporation must be filed with the Pennsylvania Department of State, and the completion of this process marks a significant step in the journey of a new business entity. Overall, understanding the nuances of this form is crucial for entrepreneurs looking to navigate the legal landscape effectively and ensure compliance with state requirements.

Consider Other Common Articles of Incorporation Templates for Specific States

Ny Sos - Incorporation can provide personal liability protection for business owners.

A Florida Power of Attorney form is a legal document that grants someone the authority to act on another person's behalf in a variety of matters. This includes financial, legal, and health-related decisions. It plays a crucial role in ensuring that one's affairs are managed according to their wishes should they become unable to do so themselves. For those interested in creating this important document, a helpful resource can be found at floridaforms.net/blank-power-of-attorney-form/.

How to Incorporate in Nc - They often require the names and addresses of the initial directors.

Articles of Incorporation Ohio - Establishes a corporation's legal existence.

How Much Does a Llc Cost in Texas - Legal counsel is often advisable to navigate potential pitfalls in the Articles of Incorporation.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation establish a corporation in Pennsylvania, outlining its basic structure and purpose. |

| Governing Law | The Pennsylvania Business Corporation Law governs the Articles of Incorporation. |

| Filing Requirement | To legally form a corporation, the Articles of Incorporation must be filed with the Pennsylvania Department of State. |

| Information Included | The form requires details such as the corporation's name, registered office address, and the names of the incorporators. |

| Fees | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Approval Process | Once filed, the Department of State reviews the Articles. Approval leads to the official creation of the corporation. |

How to Write Pennsylvania Articles of Incorporation

After you have gathered the necessary information, you can begin filling out the Pennsylvania Articles of Incorporation form. This document is essential for officially establishing your corporation in the state. Make sure to have all relevant details at hand to streamline the process.

- Download the Articles of Incorporation form from the Pennsylvania Department of State's website.

- Start by entering the name of your corporation. Ensure it meets Pennsylvania’s naming requirements.

- Provide the address of your corporation's registered office in Pennsylvania.

- List the purpose of your corporation. This should be a brief statement of what your business will do.

- Indicate the number of shares the corporation is authorized to issue, along with their par value, if applicable.

- Include the names and addresses of the incorporators. These are the individuals who are forming the corporation.

- Sign and date the form. All incorporators must provide their signatures.

- Prepare your payment for the filing fee. Check the current fee on the Pennsylvania Department of State’s website.

- Submit the completed form and payment to the appropriate state office, either online or by mail.

Once you submit your Articles of Incorporation, the state will review your application. If everything is in order, you will receive confirmation of your corporation's formation. Keep this document safe, as you will need it for future business activities.

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below are five key dos and don'ts to consider.

- Do provide accurate and complete information in all sections of the form.

- Do include the name of the corporation, ensuring it is unique and complies with state naming rules.

- Do designate a registered agent who will receive legal documents on behalf of the corporation.

- Don't leave any required fields blank, as this may delay the processing of your application.

- Don't forget to review the form for errors before submission to avoid potential rejections.

By adhering to these guidelines, individuals can facilitate a smoother incorporation process in Pennsylvania.

Documents used along the form

When starting a business in Pennsylvania, filing the Articles of Incorporation is just one step in the process of establishing a corporation. Alongside this essential document, several other forms and documents are often required to ensure compliance with state regulations and to facilitate smooth operations. Below is a list of commonly used documents that accompany the Articles of Incorporation.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the responsibilities of directors and officers, the process for holding meetings, and other operational procedures.

- Florida Lottery DOL 129 Form: For retailers interested in selling lottery tickets in Florida, this application is vital for securing the necessary approval and permits. It requires detailed business information and ensures compliance with state regulations. For further details, refer to Florida Forms.

- Initial Report: In Pennsylvania, newly incorporated entities must file an initial report within 90 days of incorporation. This document provides updated information about the corporation's address, officers, and registered agent.

- Registered Agent Consent Form: This form confirms that the registered agent, who will receive legal documents on behalf of the corporation, has agreed to serve in this capacity. It is essential for ensuring that the corporation can be contacted for legal matters.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes and is required to hire employees. This application is submitted to the IRS and can often be completed online.

- Business License Applications: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level. These applications ensure that the business complies with industry regulations.

- Shareholder Agreements: If the corporation has multiple shareholders, this document outlines the rights and responsibilities of each shareholder. It can address issues such as profit distribution, decision-making processes, and exit strategies.

- Certificate of Good Standing: This document verifies that the corporation is legally registered and compliant with state regulations. It may be required for various business transactions or when applying for loans.

Understanding these accompanying documents is crucial for any entrepreneur looking to successfully navigate the incorporation process in Pennsylvania. Each form serves a unique purpose, contributing to the overall legal foundation of the business. By ensuring that all necessary documents are completed and filed correctly, business owners can focus on growing their enterprises with confidence.