Fill Your Payroll Check Form

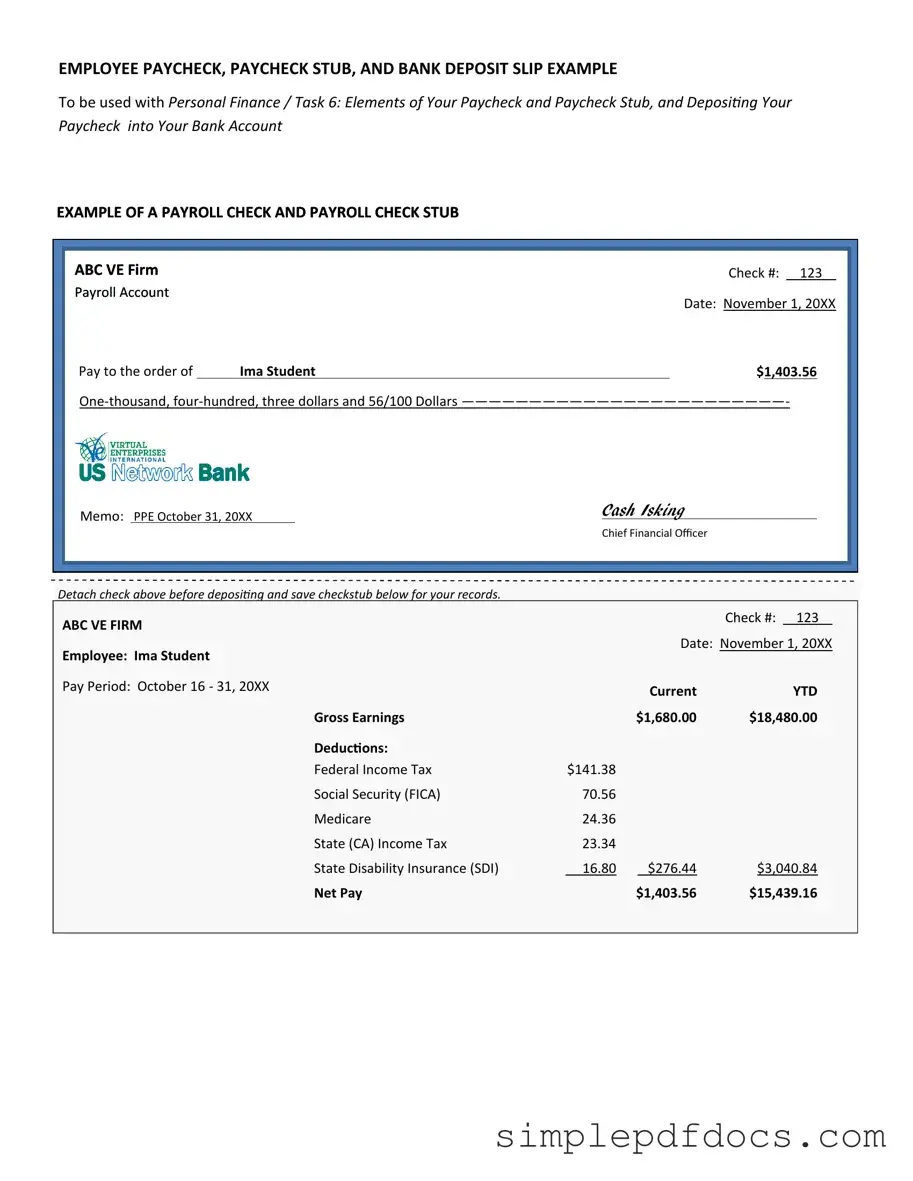

When managing employee compensation, a Payroll Check form plays a crucial role in ensuring that payments are accurate and timely. This form typically includes essential details such as the employee's name, identification number, and the pay period for which they are being compensated. It also outlines the gross pay, deductions for taxes and benefits, and the net pay that the employee will receive. Additionally, the form may provide space for the employer's signature, which serves as an acknowledgment of the payment. Understanding the components of a Payroll Check form is vital for both employers and employees, as it not only facilitates smooth payroll processing but also helps maintain clear records for tax purposes and financial accountability. By familiarizing yourself with this form, you can ensure compliance with labor laws and promote transparency in financial transactions.

More PDF Templates

Why Does Fedex Need a Signature - Delivery location preferences must be clearly marked on the form.

When engaging in activities that may pose certain risks, it's crucial to have a comprehensive understanding of liability and protection. A Florida Hold Harmless Agreement serves as an essential tool in this context, ensuring that one party is indemnified against any claims arising from the activities involved. To facilitate this process, it's helpful to reference essential resources, such as Florida Forms, which provide the necessary documentation to formalize such agreements effectively.

How to Become a Professional Cuddler - Connect with a diverse group of individuals who appreciate the art of cuddling.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Payroll Check form is used to document employee payments for work performed, ensuring accurate record-keeping for both employers and employees. |

| Components | This form typically includes employee information, payment amount, pay period, and employer details. |

| State-Specific Requirements | Some states require additional information on the Payroll Check form, such as tax withholding details. For example, California mandates specific deductions under the California Labor Code. |

| Frequency of Use | Employers must issue Payroll Check forms regularly, often bi-weekly or monthly, depending on their payroll schedule. |

| Record Retention | Employers are generally required to keep Payroll Check forms for a minimum of three years for tax and audit purposes. |

How to Write Payroll Check

Completing the Payroll Check form is an important step in ensuring that employees receive their rightful earnings. By following these steps, you can accurately fill out the form and help facilitate timely payments. Let's get started!

- Gather necessary information: Collect all relevant details such as employee name, employee ID, pay period dates, and the amount to be paid.

- Fill in employee details: Write the employee's full name and employee ID in the designated fields.

- Specify pay period: Enter the start and end dates for the pay period for which the employee is being compensated.

- Enter payment amount: Clearly write the total amount to be paid to the employee for that pay period.

- Include any deductions: If applicable, list any deductions that should be taken from the total payment.

- Review the form: Double-check all the information for accuracy. Ensure that names, dates, and amounts are correct.

- Sign and date: Provide your signature and the date at the bottom of the form to validate it.

After completing the form, it is important to submit it to the appropriate department or individual responsible for processing payroll. This ensures that the payment can be issued without delay.

Dos and Don'ts

When filling out the Payroll Check form, attention to detail is crucial. Here are some guidelines to help ensure accuracy and compliance.

- Do: Verify employee information, including name, address, and Social Security number, to ensure it matches official records.

- Do: Double-check the pay period dates to confirm they align with the company’s payroll schedule.

- Do: Calculate the total pay accurately, considering regular hours, overtime, and any deductions.

- Do: Keep a copy of the completed form for your records, ensuring a clear audit trail.

- Don't: Rush through the process; errors can lead to payment delays or incorrect amounts.

- Don't: Ignore company policies regarding overtime and deductions; compliance is essential.

- Don't: Forget to sign and date the form; an unsigned form may be deemed invalid.

- Don't: Leave any fields blank; incomplete forms can cause processing issues.

Documents used along the form

In the realm of payroll processing, several forms and documents work in conjunction with the Payroll Check form to ensure accurate and efficient management of employee compensation. Each document serves a specific purpose, contributing to the overall payroll system and compliance with regulations. Below is a list of commonly used forms and documents that are integral to payroll management.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It helps employers determine the appropriate amount of federal income tax to withhold from each paycheck.

- I-9 Form: This document verifies the identity and employment authorization of individuals hired for employment in the United States. Employers must retain this form for their records.

- Trailer Bill of Sale: To facilitate a smooth transaction, consider our informative Trailer Bill of Sale form guide to understand the requirements for trailer ownership transfer in Georgia.

- Payroll Register: A summary report that lists all employees, their hours worked, gross pay, deductions, and net pay for each pay period. It is essential for tracking payroll expenses.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their wages directly into their bank accounts, streamlining the payment process.

- Time Sheets: Employees fill out time sheets to record their hours worked. These documents are crucial for calculating pay accurately and ensuring compliance with labor laws.

- Employee Handbook: This comprehensive guide outlines company policies, procedures, and employee rights. It often includes information about payroll practices and benefits.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state income tax. Employees use it to indicate their state tax withholding preferences.

- Benefits Enrollment Form: Employees use this form to enroll in company-sponsored benefits, such as health insurance and retirement plans, which may affect payroll deductions.

- Termination Form: This document is completed when an employee leaves the company. It ensures that all final payments and benefits are processed correctly.

- Payroll Change Form: Any changes to an employee’s payroll information, such as salary adjustments or status changes, are documented through this form to maintain accurate records.

Understanding these documents is crucial for both employers and employees. Each form plays a vital role in ensuring that payroll processes run smoothly, maintaining compliance with legal requirements, and fostering a transparent work environment. Proper handling of these documents not only protects the interests of the organization but also supports the rights of employees.