Fill Your P 45 It Form

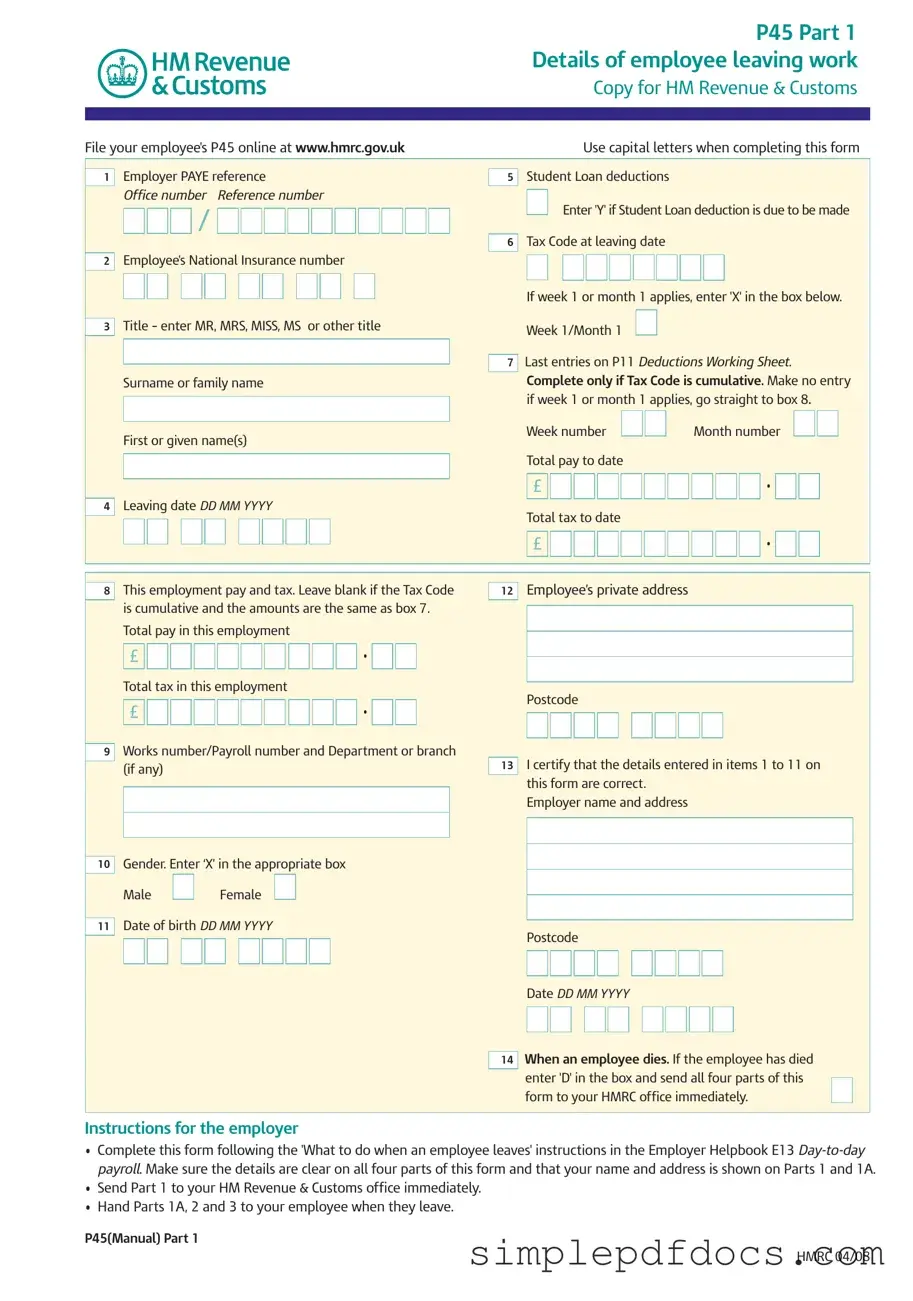

The P45 form is an essential document used in the UK employment system when an employee leaves a job. It consists of three parts: Part 1, Part 1A, and Parts 2 and 3. Each section serves a specific purpose, ensuring that both the employer and employee have the necessary information for tax and payroll purposes. Part 1 is sent directly to HM Revenue & Customs (HMRC) by the employer, while Part 1A is provided to the employee for their records. This part contains crucial details such as the employee's National Insurance number, leaving date, total pay, and tax deductions to date. Parts 2 and 3 are meant for the new employer, facilitating a smooth transition and helping to avoid tax code issues. The form also includes sections for student loan deductions and specific instructions for both employees and employers on how to complete and submit the form correctly. Understanding the P45 form is vital for ensuring compliance with tax regulations and for maintaining accurate payroll records.

More PDF Templates

Authorization Letter to Travel With a Minor - Can help avoid misunderstandings with travel authorities about a minor’s guardianship.

The Florida Articles of Incorporation form is a legal document that establishes a corporation in the state of Florida. This form outlines essential details about the corporation, including its name, purpose, and structure. Filing the Articles of Incorporation is a critical step in the process of forming a business entity in Florida, and additional information can be found at Florida Forms.

Dl 44 Form Pdf Dmv - Potential applicants for a commercial driver’s license must specify their intended class on the DL 44.

Puppy Health Guarantee Template - The breeder, Kimberly Seegmiller, ensures the puppy's health at the time of sale and encourages a vet check within 72 hours.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The P45 form is used to provide details about an employee who is leaving their job, including their pay and tax information. |

| Parts of the Form | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Completion Instructions | Employers must complete the form according to the instructions in the Employer Helpbook E13 and ensure clarity on all parts. |

| Submission Requirement | Part 1 must be sent to HM Revenue & Customs immediately after completion, while Parts 1A, 2, and 3 should be handed to the employee. |

| Tax Code Information | The form includes sections for entering the employee's tax code at the time of leaving, which affects how tax is calculated for future employment. |

| Student Loan Deductions | Employers must indicate if student loan deductions are applicable, which can affect the employee's tax liabilities. |

| Legal Governing Law | The P45 form is governed by UK tax law, specifically under the Income Tax (Earnings and Pensions) Act 2003. |

How to Write P 45 It

Filling out the P45 It form is a crucial step when an employee leaves a job. Completing this form accurately ensures that both the employer and the employee have the necessary information for tax purposes and future employment. Below are the steps to fill out the form correctly.

- Begin with Part 1 of the P45 form. Write the Employer PAYE reference in the designated box.

- Next, fill in the Office number and Reference number.

- Enter the Employee's National Insurance number.

- In the Title section, indicate whether the employee is MR, MRS, MISS, MS, or another title.

- Provide the Surname or family name of the employee.

- Fill in the First or given name(s).

- Record the Leaving date in the format DD MM YYYY.

- Indicate whether Student Loan deductions apply by entering 'Y' if necessary.

- Complete the Tax Code at leaving date.

- If applicable, mark the box for Week 1/Month 1 by entering 'X'.

- Provide the Total pay to date and Total tax to date in the respective boxes.

- Fill in the employee's private address and postcode.

- Complete the Works number/Payroll number and Department or branch if applicable.

- Mark the Gender by entering ‘X’ in the appropriate box for Male or Female.

- Enter the Date of birth in the format DD MM YYYY.

- Finally, certify that the details entered are correct by signing and dating the form.

After completing the P45 form, it is essential to send Part 1 to HM Revenue & Customs immediately. Ensure that Parts 1A, 2, and 3 are given to the employee. This will help facilitate a smooth transition for the employee into their next job or situation. Accurate completion of this form helps avoid tax complications for both parties.

Dos and Don'ts

Things You Should Do When Filling Out the P45 It Form:

- Use capital letters for all entries to ensure clarity.

- Double-check the employee's National Insurance number for accuracy.

- Certify that all details entered are correct before submitting.

- Send Part 1 to HM Revenue & Customs immediately after completion.

- Provide Parts 1A, 2, and 3 to the employee upon their departure.

Things You Shouldn't Do When Filling Out the P45 It Form:

- Do not leave any required fields blank; this can delay processing.

- Avoid using incorrect titles or misspelling the employee's name.

- Do not enter values in sections that are not applicable, such as cumulative tax codes if week 1 or month 1 applies.

- Do not alter any parts of the form once it has been completed.

- Refrain from sending incomplete forms to HMRC; ensure all necessary information is included.

Documents used along the form

The P45 form is an essential document for employees leaving a job in the UK, as it provides important details about their employment and tax contributions. Alongside the P45, there are several other forms and documents that are commonly used. Each of these documents serves a specific purpose, ensuring that both the employee and employer comply with tax regulations and employment laws. Below is a list of these documents, along with a brief description of each.

- P60: This form summarizes an employee's total pay and deductions for the entire tax year. It is issued by employers at the end of each tax year and is crucial for tax returns.

- P11D: Employers use this form to report any benefits and expenses provided to employees. It helps ensure that employees pay the correct amount of tax on non-cash benefits.

- P50: If an employee has stopped working and wants to claim a tax refund, they can use this form. It is especially useful for those who have overpaid tax during their employment.

- P85: For individuals leaving the UK to work abroad, this form is necessary to inform HM Revenue & Customs (HMRC) about their departure. It helps in managing their tax status while living overseas.

- P60U: This is a variation of the P60 form for employees who have received a tax refund. It details the refund and the tax year it pertains to.

- Jobseeker's Allowance Claim Form: If an employee is applying for Jobseeker's Allowance after leaving a job, this form is required to assess their eligibility for benefits.

- Employment Support Allowance (ESA) Claim Form: Similar to the Jobseeker's Allowance, this form is used by individuals who are unable to work due to illness or disability and are seeking financial support.

- Non-disclosure Agreement (NDA): This form is essential for protecting sensitive information in a business environment, ensuring confidentiality is maintained. For more details, visit floridaforms.net/blank-non-disclosure-agreement-form/.

- Self-Assessment Tax Return: For those who are self-employed or have additional income sources, this form is necessary to report earnings and calculate tax liabilities.

- Tax Credit Claim Form: Individuals who are eligible for tax credits can use this form to apply for financial assistance, which can help supplement their income.

Each of these documents plays a vital role in ensuring that employees and employers meet their tax obligations and navigate the complexities of employment changes. Understanding these forms can make transitions smoother and help avoid potential issues with tax authorities.