Attorney-Approved Owner Financing Contract Form

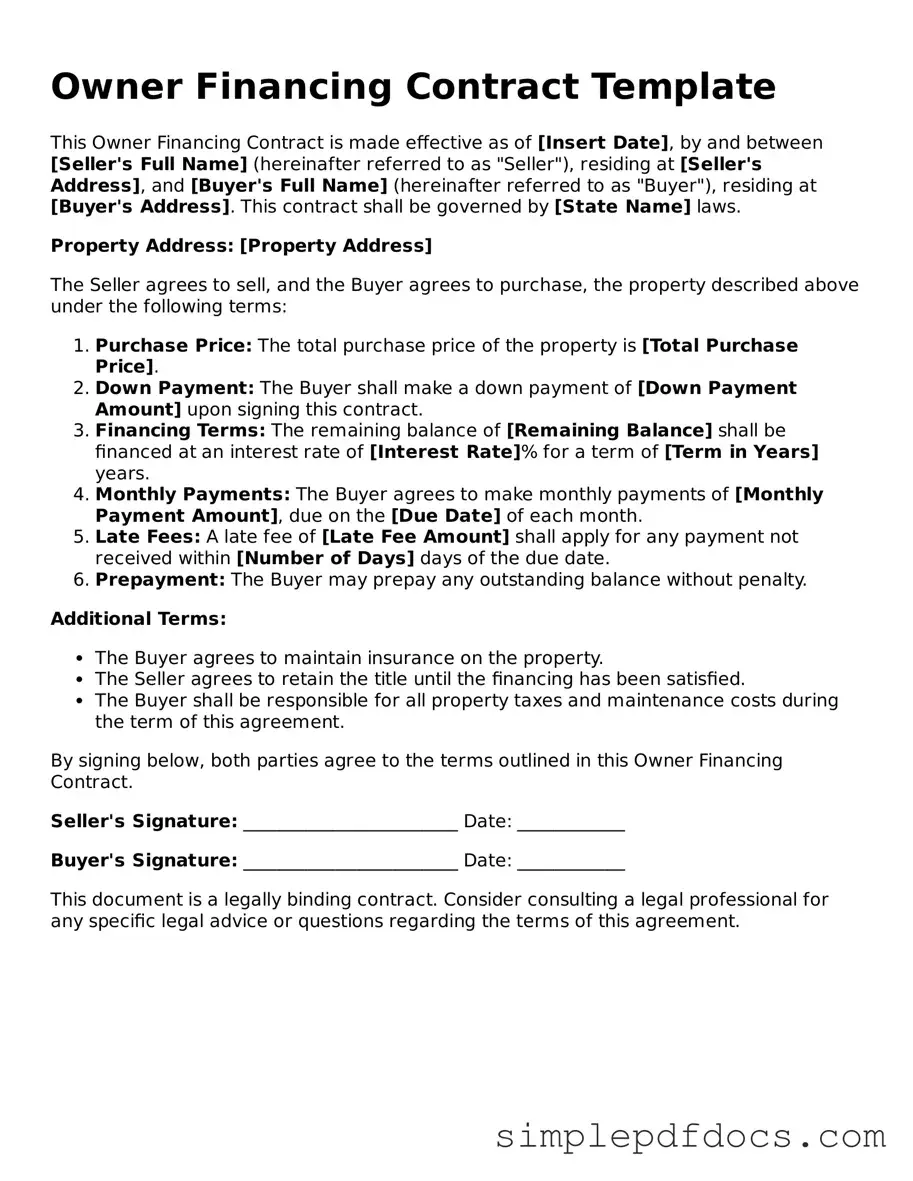

When navigating the world of real estate transactions, understanding the various financing options available is crucial. One such option is owner financing, a method that allows the seller to directly finance the purchase for the buyer, bypassing traditional lenders. This arrangement can be particularly beneficial for buyers who may face challenges securing a mortgage due to credit issues or other financial constraints. The Owner Financing Contract form serves as a vital tool in this process, outlining the terms of the agreement between the buyer and seller. Key elements of this form include the purchase price, down payment amount, interest rate, repayment schedule, and any contingencies that may apply. Additionally, it typically specifies the consequences of default and the rights of both parties involved. By clearly defining these aspects, the Owner Financing Contract helps to ensure a smooth transaction and protects the interests of everyone involved, making it an essential document for those considering this alternative financing route.

More Owner Financing Contract Types:

Purchase Agreement Addendum - The document can cover things like price adjustments or extended timelines.

For individuals navigating the property market in Colorado, understanding the "Real Estate Purchase Agreement" is vital. This contract lays out the essential details of the transaction, ensuring both parties are clear on the terms. For further information, you can refer to the comprehensive guide on the Real Estate Purchase Agreement.

Personal Guarantee Form - This form may also stipulate what happens in case of bankruptcy.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows a buyer to purchase property directly from the seller, bypassing traditional lenders. |

| Governing Laws | In the United States, owner financing contracts are governed by state-specific laws, which may vary significantly. It is essential to consult local regulations. |

| Advantages | This type of financing can benefit buyers with poor credit and sellers looking for a quicker sale. |

| Risks | Both parties face potential risks, such as default on payments or disputes over contract terms. Clear communication and thorough documentation are crucial. |

How to Write Owner Financing Contract

Filling out an Owner Financing Contract form is an important step in the process of securing financing for your property. This document will help you outline the terms and conditions of the agreement between the buyer and the seller. To ensure that all necessary information is accurately captured, follow the steps outlined below.

- Gather Necessary Information: Collect all relevant details about the property, including its address, legal description, and current market value.

- Identify the Parties: Clearly state the names and contact information of both the buyer and the seller. Make sure to include any additional parties involved in the transaction.

- Specify the Purchase Price: Indicate the total purchase price of the property. This should reflect any negotiations that have taken place between the buyer and seller.

- Detail Financing Terms: Outline the terms of the financing, including the down payment amount, interest rate, and repayment schedule. Be specific about whether the interest is fixed or variable.

- Include Contingencies: List any contingencies that must be met for the contract to be valid, such as inspections or financing approval.

- Sign and Date the Contract: Both parties must sign and date the contract to indicate their agreement to the terms. Ensure that all signatures are legible.

- Make Copies: After completing the form, make copies for both the buyer and seller. This ensures that each party has a record of the agreement.

Following these steps will help you complete the Owner Financing Contract form accurately and efficiently. Once the form is filled out and signed, you can move forward with the next steps in the financing process, ensuring that both parties are clear on their responsibilities and obligations.

Dos and Don'ts

When filling out an Owner Financing Contract form, it’s important to approach the task with care and attention to detail. Here are some key dos and don’ts to consider:

- Do read the entire contract thoroughly before filling it out. Understanding each section will help you make informed decisions.

- Do provide accurate information. Ensure that all names, addresses, and financial details are correct to avoid complications later.

- Do consult with a legal expert if you have questions. Seeking advice can clarify any uncertainties and protect your interests.

- Do keep copies of all documents. Having a record of what you submitted can be invaluable for future reference.

- Don’t rush through the form. Taking your time will help prevent mistakes that could lead to legal issues.

- Don’t leave any sections blank. Every part of the form should be completed to ensure it is legally binding.

- Don’t ignore the fine print. Terms and conditions often contain important information that could affect your agreement.

- Don’t sign without understanding your obligations. Make sure you are clear on what you are agreeing to before you put your signature down.

Documents used along the form

When engaging in owner financing for real estate transactions, several additional documents often accompany the Owner Financing Contract. Each of these documents serves a specific purpose, ensuring clarity and legal compliance for both parties involved. Below is a list of commonly used forms that help facilitate this type of financing.

- Promissory Note: This is a written promise from the buyer to repay the loan amount to the seller. It outlines the terms of repayment, including interest rates, payment schedule, and consequences of default.

- Deed of Trust: This document secures the promissory note by giving the seller a legal claim to the property until the buyer fully repays the loan. It involves a third party, known as a trustee, who holds the title until the loan is satisfied.

- Purchase Agreement: This contract details the terms of the sale between the buyer and seller, including the purchase price, contingencies, and other essential conditions. It lays the groundwork for the owner financing arrangement.

- Disclosure Statements: These documents inform the buyer about the property's condition and any potential issues. They may include information on lead paint, mold, or other hazards, ensuring that the buyer makes an informed decision.

- Amortization Schedule: This schedule outlines the breakdown of each payment over the life of the loan. It shows how much of each payment goes toward interest and how much reduces the principal balance, providing transparency for the buyer.

- Title Insurance Policy: This insurance protects the buyer and lender from potential disputes over property ownership. It ensures that the title is clear and that there are no outstanding claims against the property.

- Property Inspection Report: This document provides an assessment of the property's condition, often conducted by a professional inspector. It helps the buyer understand any necessary repairs or maintenance issues before finalizing the sale.

- Escrow Agreement: This agreement outlines the terms under which an escrow agent holds funds and documents until all conditions of the sale are met. It ensures that both parties fulfill their obligations before the transaction is completed.

- Real Estate Purchase Agreement: The All Minnesota Forms document is vital for outlining the obligations of both buyer and seller, ensuring each party's rights are protected in the transaction.

- Notice of Default: If the buyer fails to make payments as agreed, this document formally notifies them of their default. It often serves as a precursor to potential foreclosure proceedings.

Understanding these documents is crucial for both buyers and sellers engaged in owner financing. Each form plays a vital role in protecting the interests of the parties involved and ensuring a smooth transaction. By being aware of these additional forms, individuals can navigate the complexities of owner financing with greater confidence.