Attorney-Approved Operating Agreement Form

An Operating Agreement is a crucial document for any Limited Liability Company (LLC), serving as the backbone of its internal structure and operations. This form outlines the roles and responsibilities of the members, detailing how the business will be managed and how profits and losses will be distributed. It addresses important aspects such as decision-making processes, voting rights, and procedures for adding or removing members. Additionally, the Operating Agreement can specify how the company will handle disputes and what happens if a member decides to leave. By clearly defining these elements, the agreement helps prevent misunderstandings and provides a roadmap for the LLC's future. Whether you’re starting a new business or looking to formalize an existing one, having a well-drafted Operating Agreement is essential for ensuring smooth operations and protecting the interests of all members involved.

State-specific Operating Agreement Forms

Operating Agreement Document Categories

Check out Other Documents

Create Gift Certificate - This document can facilitate smoother financial transactions involving gifts.

Bill of Sale Para Imprimir - Buyers can use this form to establish a chain of ownership.

To ensure proper documentation, utilizing a reliable Employment Verification process can greatly assist both employers and employees. This verification method confirms vital details such as job status and salary, making it an indispensable part of many financial agreements. For more information, you may refer to the important Employment Verification form guidelines.

Horse Training Contract Template - There are inherent risks involved with horse training that Owners must acknowledge.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a document that outlines the ownership and operating procedures of a Limited Liability Company (LLC). |

| Purpose | This agreement serves to protect the members' interests and helps to prevent disputes by clearly defining roles and responsibilities. |

| Governing Law | The laws governing Operating Agreements vary by state. For example, in Delaware, it is governed by Title 6, Chapter 18 of the Delaware Code. |

| Member Rights | The agreement outlines the rights of each member, including voting rights and profit distribution. |

| Amendments | Members can amend the Operating Agreement as needed, but typically, a majority vote is required for any changes. |

| Management Structure | The document specifies whether the LLC will be managed by its members or by appointed managers. |

| Liability Protection | Having an Operating Agreement helps to establish the LLC as a separate legal entity, providing liability protection for its members. |

| Dispute Resolution | The agreement often includes procedures for resolving disputes among members, which can help avoid costly legal battles. |

| Not Required by All States | While it is highly recommended, not all states require an Operating Agreement for LLCs. However, it is beneficial for clarity and legal protection. |

How to Write Operating Agreement

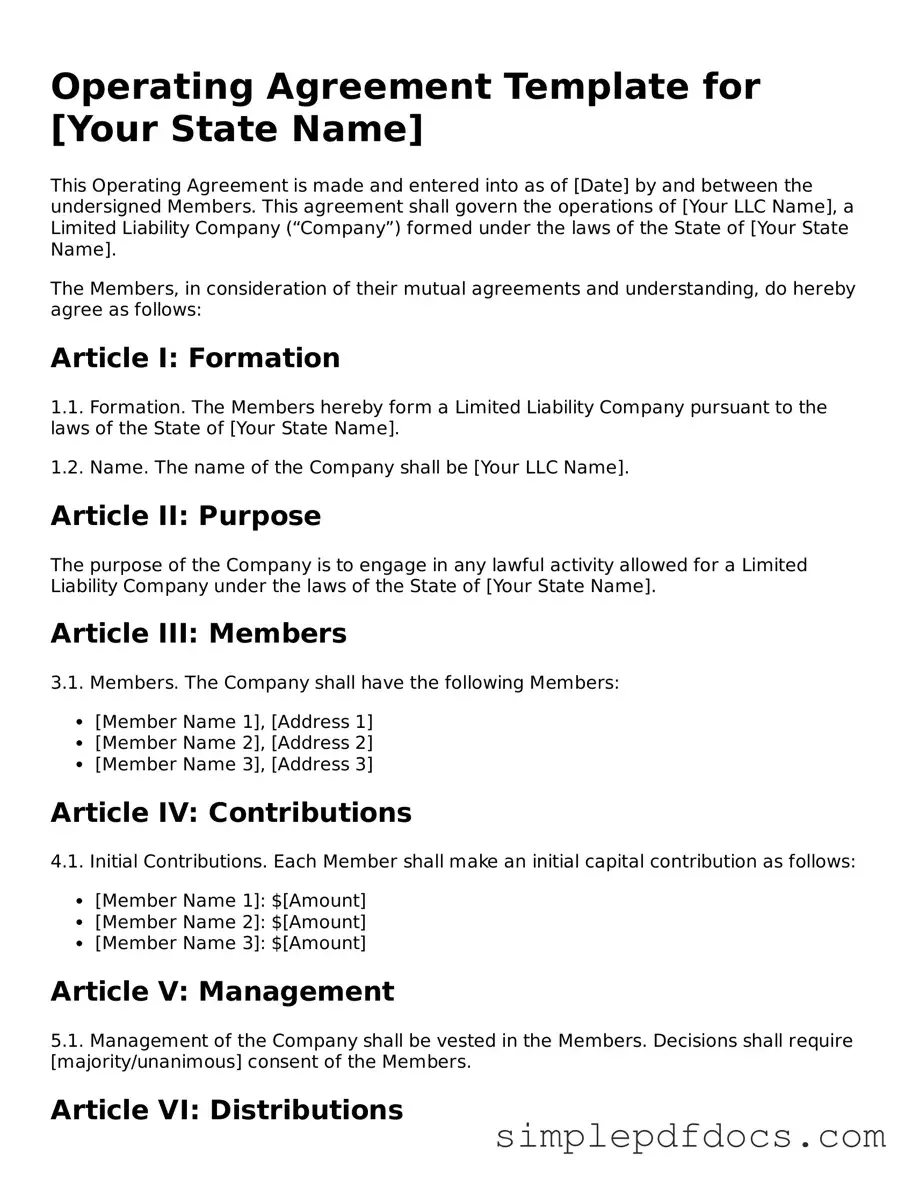

Filling out the Operating Agreement form is a crucial step in establishing the framework for your business. This document outlines the roles, responsibilities, and operational procedures of your company. Follow these steps carefully to ensure accuracy and completeness.

- Title the Document: Start by clearly labeling the document as "Operating Agreement." This sets the context for all parties involved.

- Provide Company Information: Enter the name of your business and its principal address. Make sure the name matches the one registered with the state.

- List Members: Identify all members of the LLC. Include full names and addresses for each individual or entity.

- Specify Ownership Percentages: Clearly state the ownership percentage for each member. This is crucial for profit distribution and decision-making.

- Define Management Structure: Indicate whether the LLC will be member-managed or manager-managed. Provide details about the roles and responsibilities of each member or manager.

- Outline Voting Rights: Describe how voting will occur among members. Specify the voting process and any required majority for decisions.

- Include Profit Distribution: State how profits and losses will be allocated among members. Be clear about the method of distribution.

- Set Terms for Meetings: Detail how often meetings will be held and the procedures for calling meetings. Include quorum requirements if applicable.

- Address Amendments: Specify how the Operating Agreement can be amended in the future. Outline the process for making changes.

- Sign and Date: Ensure all members sign and date the agreement. This formalizes the document and indicates consent to the terms outlined.

Dos and Don'ts

When filling out the Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about the members and their contributions.

- Do specify the management structure clearly to avoid confusion later.

- Do include provisions for handling disputes among members.

- Don't leave any required fields blank; this could lead to delays or issues.

- Don't use vague language; be specific in your terms and definitions.

- Don't forget to have all members sign the agreement to ensure it is legally binding.

Documents used along the form

An Operating Agreement is an essential document for LLCs, outlining the management structure and operational procedures. Alongside this agreement, several other forms and documents are often utilized to ensure comprehensive governance and compliance. Below is a list of some common documents that complement the Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create an LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Member Consent Forms: These forms are used to document the approval of decisions made by LLC members. They can cover various topics, including major business decisions or changes to the Operating Agreement.

- Bylaws: Although more common in corporations, bylaws can also be useful for LLCs. They outline the rules and procedures for the operation of the company, including meetings and voting rights.

- Bill of Sale: A Bill of Sale in Arizona is a legal document that records the transfer of ownership of personal property from one party to another. This form outlines key details such as the buyer's and seller's information, a description of the item, and the sale price. To ensure a smooth transfer, consider filling out the form by visiting Legal PDF Documents.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the business and can be important for record-keeping.

- Financial Statements: Regular financial statements, including balance sheets and income statements, provide transparency about the LLC's financial health. These documents are crucial for members to make informed decisions.

- Tax Forms: Depending on the LLC's structure, various tax forms may be required for state and federal compliance. These documents help report income, deductions, and other financial information to tax authorities.

Each of these documents plays a vital role in the overall management and compliance of an LLC. Together with the Operating Agreement, they help ensure that the business operates smoothly and adheres to legal requirements.