Legal Transfer-on-Death Deed Document for the State of Ohio

The Ohio Transfer-on-Death Deed form offers a straightforward way for property owners to transfer their real estate to beneficiaries without the need for probate. This legal tool allows individuals to retain full control of their property during their lifetime while designating who will inherit it after their death. By completing this form, property owners can ensure that their assets pass directly to their chosen heirs, simplifying the process and potentially saving time and money. Importantly, the deed must be properly executed and recorded to be effective, and it can be revoked or modified at any time before the owner's death. Understanding the nuances of this form is essential for anyone looking to plan their estate effectively in Ohio, as it provides a unique blend of flexibility and security in managing property transfers.

Consider Other Common Transfer-on-Death Deed Templates for Specific States

Where Can I Get a Tod Form - A Transfer-on-Death Deed allows property owners to transfer their property to beneficiaries upon their passing without the need for probate.

The process of eviction can be complex, and understanding the necessary legal documents is essential for both landlords and tenants. One critical aspect is the Florida Notice to Quit form, which landlords use to notify tenants of lease violations or non-renewal of tenancy. This form not only alerts tenants to the issues that need to be addressed but also provides them with the opportunity to respond within a designated timeframe. For more detailed information on this essential document, you can refer to the following link: https://floridaforms.net/blank-notice-to-quit-form/.

Problems With Transfer on Death Deeds in Virginia - Help your loved ones avoid estate complications by using a Transfer-on-Death Deed.

PDF Details

| Fact Name | Details |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to designate a beneficiary who will receive the property upon the owner's death, avoiding probate. |

| Governing Law | This deed is governed by Ohio Revised Code Section 5302.22, which outlines the requirements and procedures for creating a valid Transfer-on-Death Deed. |

| Execution Requirements | The deed must be signed by the owner in the presence of a notary public and recorded in the county where the property is located to be effective. |

| Revocation | The property owner can revoke the deed at any time before death by executing a new deed or a formal revocation document. |

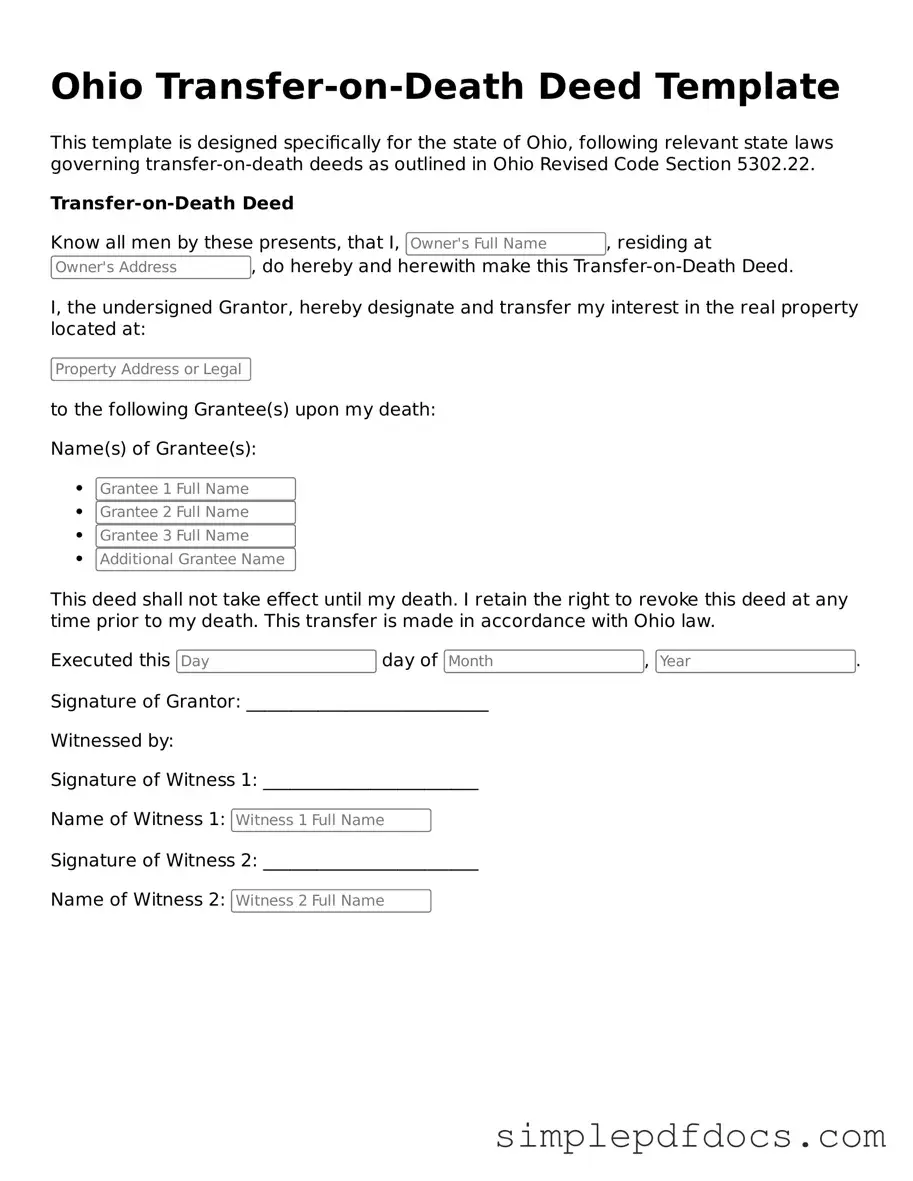

How to Write Ohio Transfer-on-Death Deed

Once you have the Ohio Transfer-on-Death Deed form in front of you, the next step is to carefully fill it out with accurate information. This form allows property owners to designate beneficiaries who will inherit their property upon their passing. It is important to ensure that all details are correct to avoid any complications in the future.

- Begin by entering the name of the property owner(s) in the designated section. This should be the person or people who currently own the property.

- Provide the address of the property. Make sure to include the full street address, city, state, and ZIP code.

- Next, identify the beneficiaries. List the names of the individuals or entities who will receive the property. You may include multiple beneficiaries if desired.

- For each beneficiary, include their address. This ensures that there is no confusion about who the intended recipients are.

- In the next section, you will need to sign and date the form. Ensure that the signature matches the name of the property owner(s) as listed at the top of the form.

- It is also necessary to have the deed notarized. Find a notary public to witness your signature. The notary will add their seal and signature to validate the document.

- Finally, file the completed deed with the county recorder’s office in the county where the property is located. This step is crucial for the deed to be legally effective.

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it's important to follow certain guidelines. Here are some things you should and shouldn't do:

- Do: Ensure that all names and property descriptions are accurate.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed deed for your records.

- Do: File the deed with the county recorder's office promptly.

- Don't: Forget to check for any specific local requirements.

- Don't: Leave any sections of the form blank; complete all necessary fields.

- Don't: Use white-out or erasers on the form; it can invalidate the deed.

- Don't: Delay in filing the deed, as timing can affect its validity.

Documents used along the form

The Ohio Transfer-on-Death Deed is a useful legal tool that allows property owners to designate a beneficiary who will receive their property upon their death, avoiding the probate process. However, there are several other documents and forms that often accompany this deed to ensure a smooth transition of property ownership. Below is a list of some common forms and documents that may be used alongside the Ohio Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed after their death. While a Transfer-on-Death Deed bypasses probate for the designated property, a will can address other assets and provide overall instructions for the estate.

- Affidavit of Death: This document serves as proof of a person's death. It may be required to formally transfer ownership of the property to the beneficiary named in the Transfer-on-Death Deed.

- Do Not Resuscitate Order: A legal document that allows individuals to communicate their wishes about resuscitation measures. Understanding this form's implications, such as the importance of a Florida Forms, can offer peace of mind in critical situations.

- Property Deed: The original deed to the property being transferred. This document provides legal evidence of ownership and is essential for the transfer process.

- Beneficiary Designation Forms: These forms may be used for other assets, such as bank accounts or retirement plans, allowing individuals to designate beneficiaries outside of the will or deed.

- Notice of Death: A formal notification to interested parties about the death of the property owner. This may be necessary to inform creditors or other beneficiaries of the estate.

- Title Search Report: A document that outlines the ownership history of the property. It helps verify that the property is free of liens or claims, ensuring a clear transfer to the beneficiary.

Understanding these accompanying documents can help streamline the process of transferring property through a Transfer-on-Death Deed in Ohio. Proper preparation and organization of all necessary paperwork can prevent complications and ensure that the wishes of the deceased are honored efficiently.