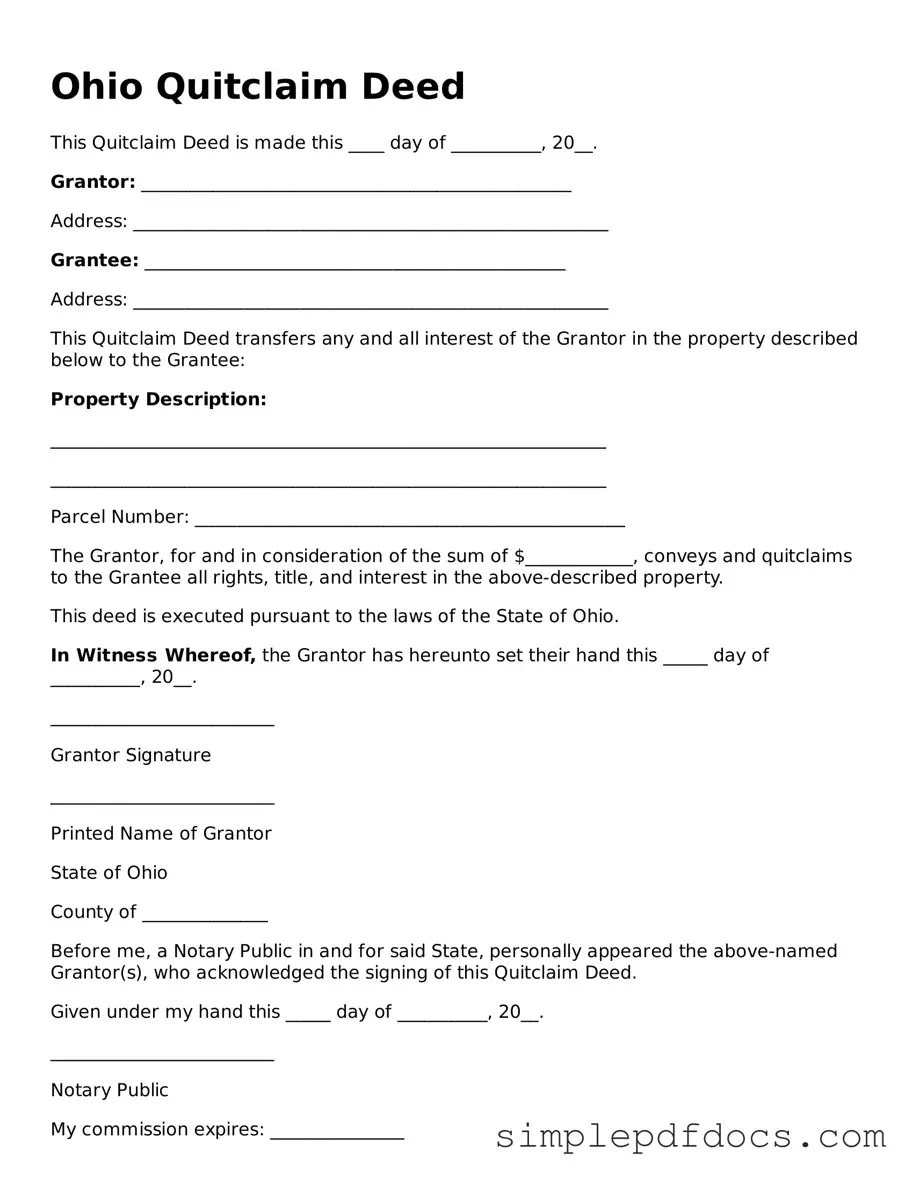

Legal Quitclaim Deed Document for the State of Ohio

In the realm of real estate transactions, the Ohio Quitclaim Deed serves as a valuable tool for property owners looking to transfer their interests in a property without the complexities often associated with traditional sales. This form simplifies the process, allowing one party, known as the grantor, to convey their rights to another party, the grantee, without making any guarantees about the property's title. It is particularly useful in situations such as transferring property between family members, clearing up title issues, or facilitating a divorce settlement. While the Quitclaim Deed does not provide any warranties regarding the property’s condition or any existing liens, it is a straightforward means of transferring ownership. Understanding the nuances of this form is essential for anyone involved in property transactions in Ohio, as it can help avoid potential disputes and ensure a smooth transfer of ownership. Additionally, proper completion and recording of the deed with the county recorder's office are crucial steps in the process, safeguarding the interests of both parties involved.

Consider Other Common Quitclaim Deed Templates for Specific States

Quitclaim Deed North Carolina - Preparation of the Quitclaim Deed can often be done without an attorney, though legal advice is recommended.

Quit Claim Deed Form Pennsylvania - Common in business partnerships when assets are shared.

For those seeking to comprehend the intricacies of a Quitclaim Deed, it's important to understand its function in real estate transactions. This vital legal document can be explored further through our guide on navigating the nuances of the Quitclaim Deed process, ensuring you are well-informed for your property transfer.

Where Do I Get a Quitclaim Deed Form - A Quitclaim Deed can be beneficial for removing liens or claims that may affect property ownership.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property title. |

| Governing Law | In Ohio, quitclaim deeds are governed by the Ohio Revised Code, specifically sections 5302.20 to 5302.24. |

| Use Cases | Quitclaim deeds are often used in situations like transferring property between family members, clearing up title issues, or during divorce settlements. |

| Requirements | To be valid in Ohio, a quitclaim deed must be in writing, signed by the grantor, and notarized. It should also include a legal description of the property. |

| Recording | While not mandatory, it is advisable to record the quitclaim deed with the county recorder’s office to provide public notice of the property transfer. |

| Limitations | Since a quitclaim deed does not guarantee that the grantor holds clear title, the grantee assumes the risk of any title issues that may arise. |

How to Write Ohio Quitclaim Deed

Once you have the Ohio Quitclaim Deed form ready, it’s time to fill it out accurately. Completing this form correctly is essential for a smooth transfer of property. Follow the steps below to ensure you provide all necessary information.

- Obtain the form: You can find the Ohio Quitclaim Deed form online or at your local county recorder’s office.

- Fill in the Grantor’s information: Write the full name and address of the person transferring the property. Ensure that the spelling is correct.

- Fill in the Grantee’s information: Provide the full name and address of the person receiving the property.

- Describe the property: Include a legal description of the property. This may involve the parcel number or a detailed description of the land.

- Include the consideration: State the amount of money or value exchanged for the property, if applicable.

- Sign the form: The Grantor must sign the form in front of a notary public. The notary will verify the identity of the Grantor.

- Submit the form: Take the completed Quitclaim Deed to the county recorder’s office for filing. There may be a fee for recording.

After completing these steps, the Quitclaim Deed will be filed with the county. This action officially records the transfer of property ownership. Keep a copy for your records, as it serves as proof of the transaction.

Dos and Don'ts

When filling out the Ohio Quitclaim Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid.

- Do provide accurate property details, including the legal description.

- Do include the names of all grantors and grantees clearly.

- Do sign the form in the presence of a notary public.

- Do check for any outstanding liens or encumbrances on the property.

- Do ensure that the form is completed in black ink for clarity.

- Don't leave any required fields blank; this can lead to delays.

- Don't use white-out or correction fluid on the form.

- Don't forget to pay any applicable filing fees when submitting the deed.

- Don't assume that verbal agreements are sufficient; all terms must be written.

Documents used along the form

When completing a property transfer in Ohio, several forms and documents may be necessary in addition to the Quitclaim Deed. Each of these documents serves a specific purpose in the transaction process. Below is a list of commonly used forms that may accompany the Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller has clear title to the property and provides protection against future claims.

- Property Transfer Tax Affidavit: This form is required to report the transfer of property and calculate any applicable transfer taxes.

- Marriage Application Form: For couples planning to marry, the Florida Forms should be a starting point, as they provide essential guidance on obtaining a marriage license in Florida.

- Title Search Report: A report that confirms the current ownership of the property and identifies any liens or encumbrances.

- Affidavit of Title: A sworn statement by the seller affirming their ownership and disclosing any potential issues with the title.

- Closing Statement: A summary of the financial aspects of the transaction, including costs, fees, and the final settlement amount.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions.

- Real Estate Purchase Agreement: A contract outlining the terms and conditions of the sale between the buyer and seller.

- Homeowner’s Association Documents: If applicable, these documents provide rules and regulations governing the property within an association.

- Disclosure Statements: These statements inform the buyer of any known issues with the property, such as structural problems or environmental hazards.

- Deed of Trust: This document secures a loan by placing a lien on the property, allowing the lender to take possession if the borrower defaults.

Understanding these documents can help ensure a smooth property transaction process in Ohio. Always consult with a qualified professional for guidance tailored to your specific situation.