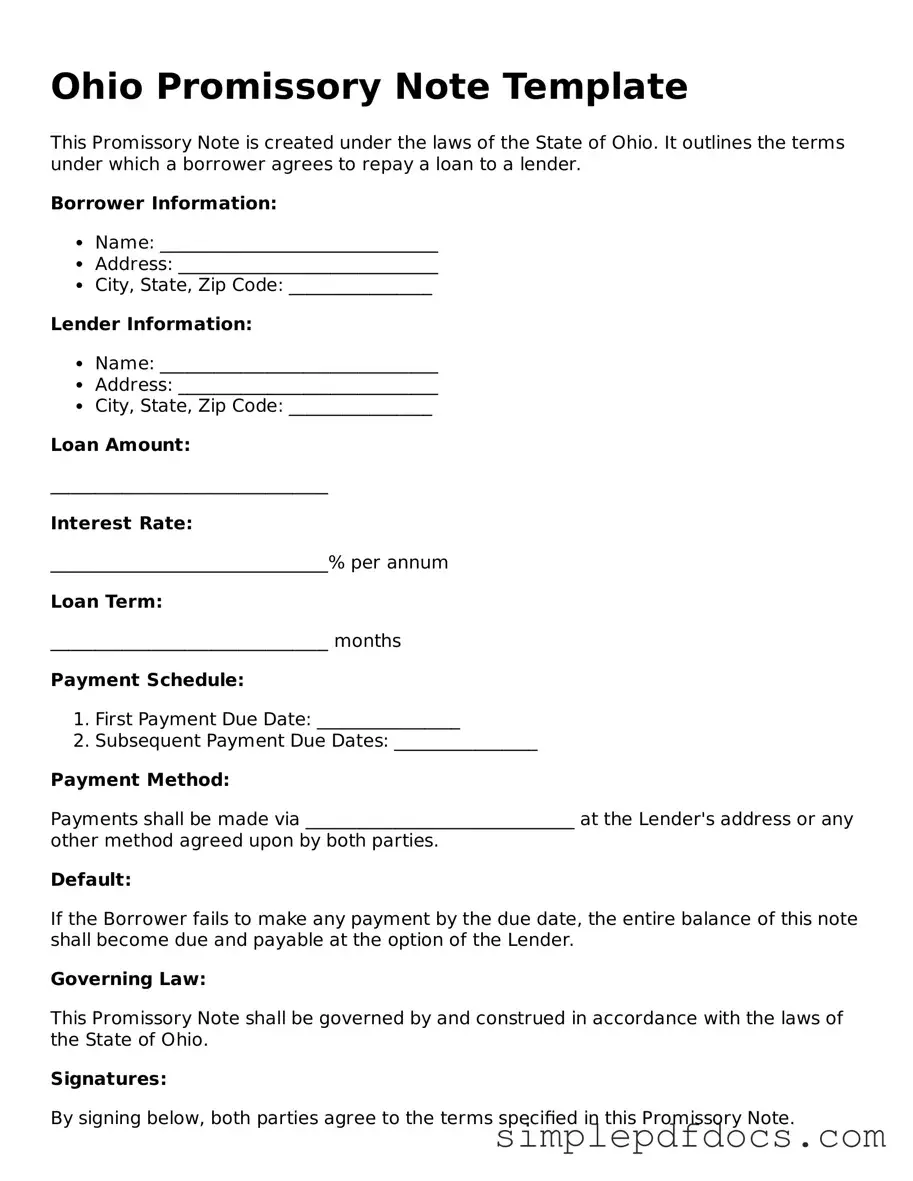

Legal Promissory Note Document for the State of Ohio

The Ohio Promissory Note form serves as a crucial financial instrument, facilitating the lending process between parties. This legally binding document outlines the borrower's promise to repay a specified sum of money to the lender, typically accompanied by interest. Key components of the form include the principal amount, the interest rate, the repayment schedule, and the maturity date. Additionally, it often specifies the consequences of default, ensuring that both parties understand their rights and obligations. The form may also include provisions for prepayment, allowing borrowers to pay off the debt early without penalties. By using this standardized form, individuals and businesses can streamline transactions, reduce misunderstandings, and create a clear record of the loan agreement. Understanding the nuances of the Ohio Promissory Note is essential for anyone involved in lending or borrowing money in the state.

Consider Other Common Promissory Note Templates for Specific States

Texas Promissory Note Requirements - Promissory notes can vary in complexity from simple one-page forms to detailed agreements.

Blank Promissory Note - A promissory note is an effective way to formalize personal loans between friends or family members.

Understanding the eviction process is essential for both landlords and tenants; by utilizing the Florida Notice to Quit form, landlords can ensure they are following proper protocol. This legal document outlines the specifics of the lease violation and directs tenants to make necessary corrections within a designated timeframe. For those looking to access the form, it can be found at https://floridaforms.net/blank-notice-to-quit-form/, which serves as an important resource in managing tenancy issues effectively.

Personal Loan Promissory Note - The document should be signed by both parties to be enforceable in court.

Create a Promissory Note - Clarifies the relationship between the borrower and lender.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | An Ohio Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party at a designated time. |

| Governing Law | The Ohio Promissory Note is governed by Ohio Revised Code, specifically sections 1303.01 to 1303.99, which outline the requirements and enforceability of promissory notes. |

| Parties Involved | The document typically involves two parties: the borrower (or maker) who promises to pay and the lender (or payee) who receives the payment. |

| Interest Rate | Interest can be included in the note, and it must be clearly stated. Ohio law allows for the inclusion of a specified interest rate. |

| Payment Terms | Payment terms, including the due date and method of payment, must be clearly defined to avoid confusion and ensure enforceability. |

| Signatures | For the note to be legally binding, it must be signed by the borrower. The lender’s signature is not typically required but can add an extra layer of verification. |

How to Write Ohio Promissory Note

Filling out the Ohio Promissory Note form is an important step in formalizing a loan agreement. After completing the form, it will serve as a legal document outlining the terms of the loan, including repayment details and interest rates. Ensure that all information is accurate and complete before signing.

- Begin by entering the date at the top of the form. This is the date when the note is created.

- Next, fill in the name and address of the borrower. This identifies the person or entity receiving the loan.

- In the next section, provide the lender's name and address. This identifies who is providing the loan.

- Specify the principal amount of the loan. This is the total amount that the borrower is borrowing.

- Indicate the interest rate. This is the percentage that will be charged on the borrowed amount.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable. Clearly state the terms to avoid confusion later.

- Provide any additional terms or conditions that may apply to the loan. This could include prepayment options or collateral details.

- Both the borrower and lender should sign and date the form at the bottom. This indicates agreement to the terms outlined in the note.

Once you have completed the form, make copies for both parties. It’s advisable to keep a record of this document for future reference, as it serves as proof of the loan agreement.

Dos and Don'ts

When filling out the Ohio Promissory Note form, it's crucial to approach the task with care. A promissory note is a legal document that outlines the terms of a loan between a lender and a borrower. Here are ten essential dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do clearly state the names and addresses of both the lender and the borrower.

- Do specify the loan amount in both numerical and written form.

- Do outline the interest rate and payment schedule in detail.

- Do include a clear description of any collateral, if applicable.

- Don't leave any sections blank; incomplete forms can lead to confusion.

- Don't use ambiguous language; clarity is key to avoid disputes.

- Don't forget to sign and date the document; an unsigned note is not enforceable.

- Don't overlook the importance of having a witness or notary public if required.

- Don't rush through the process; take your time to ensure accuracy.

By following these guidelines, you can help ensure that your Ohio Promissory Note is properly completed and legally binding. Remember, attention to detail can save you from potential headaches down the road.

Documents used along the form

The Ohio Promissory Note is a crucial document for establishing a borrower's promise to repay a loan. Several other forms and documents often accompany this note to ensure clarity and legal protection for both parties involved. Below are four commonly used documents that complement the Ohio Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract that details the rights and obligations of both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged as security. It provides the lender with a legal claim to the collateral in case of default, ensuring that they have recourse to recover their funds.

- Disclosure Statement: This document provides important information about the loan, such as the total cost of borrowing, interest rates, and any fees. It is designed to ensure that the borrower fully understands the financial implications of the loan before agreeing to the terms.

- Do Not Resuscitate Order: A Florida Do Not Resuscitate Order (DNRO) form is a legal document that allows individuals to express their wishes regarding resuscitation efforts in the event of a medical emergency. By completing this form, a person can ensure that healthcare providers respect their decision to forgo life-saving measures. Understanding the importance of this document can provide peace of mind during challenging times. For more information, you can visit Florida Forms.

- Amortization Schedule: This schedule outlines the repayment plan for the loan, detailing each payment's due date, principal amount, interest amount, and remaining balance. It helps both parties track the loan's progress over time and ensures transparency in the repayment process.

Utilizing these documents in conjunction with the Ohio Promissory Note can help prevent misunderstandings and provide a clear framework for the loan agreement. It is essential for both parties to understand their rights and responsibilities to ensure a smooth transaction.