Legal Power of Attorney Document for the State of Ohio

In the realm of personal and financial planning, the Ohio Power of Attorney (POA) form plays a crucial role, empowering individuals to designate someone they trust to make decisions on their behalf. This legal document can be tailored to fit various needs, whether it’s for managing financial affairs, handling real estate transactions, or making healthcare decisions. Ohio residents can choose between a general power of attorney, which grants broad authority, and a limited power of attorney, which restricts the agent’s powers to specific tasks. Importantly, the form also allows for the inclusion of durable provisions, ensuring that the authority remains effective even if the principal becomes incapacitated. Understanding the nuances of this form is essential, as it not only provides peace of mind but also safeguards one’s interests in times of need. By designating an agent, individuals can ensure that their wishes are honored and that their affairs are managed according to their preferences, making the Ohio Power of Attorney a vital tool in effective personal and financial management.

Consider Other Common Power of Attorney Templates for Specific States

Tx Poa - This form gives your loved ones guidance during difficult times.

How to Get Power of Attorney in North Carolina - The agent's authority can extend to signing documents and making payments.

Free Power of Attorney Form Pennsylvania - The Power of Attorney serves as a safeguard, ensuring decisions reflect your wishes in challenging times.

When preparing for your wedding, it is important to familiarize yourself with the necessary documentation, including the Florida Marriage Application form. This form is essential for obtaining a marriage license in the state, which is limited to a validity period of 60 days. For more detailed information on how to complete this process, you can refer to Florida Forms.

Nys Power of Attorney Form - This form can help streamline estate planning and ensure that your affairs are in order.

PDF Details

| Fact Name | Description |

|---|---|

| Definition | The Ohio Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. |

| Governing Law | The form is governed by Ohio Revised Code Section 1337.01 to 1337.64. |

| Types of Powers | The form can grant general or specific powers, allowing the agent to handle financial, legal, or healthcare matters. |

| Durability | The Ohio Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, provided they are mentally competent. |

| Witness and Notary Requirements | For the form to be valid, it must be signed by the principal in the presence of a notary public and may also require witnesses. |

How to Write Ohio Power of Attorney

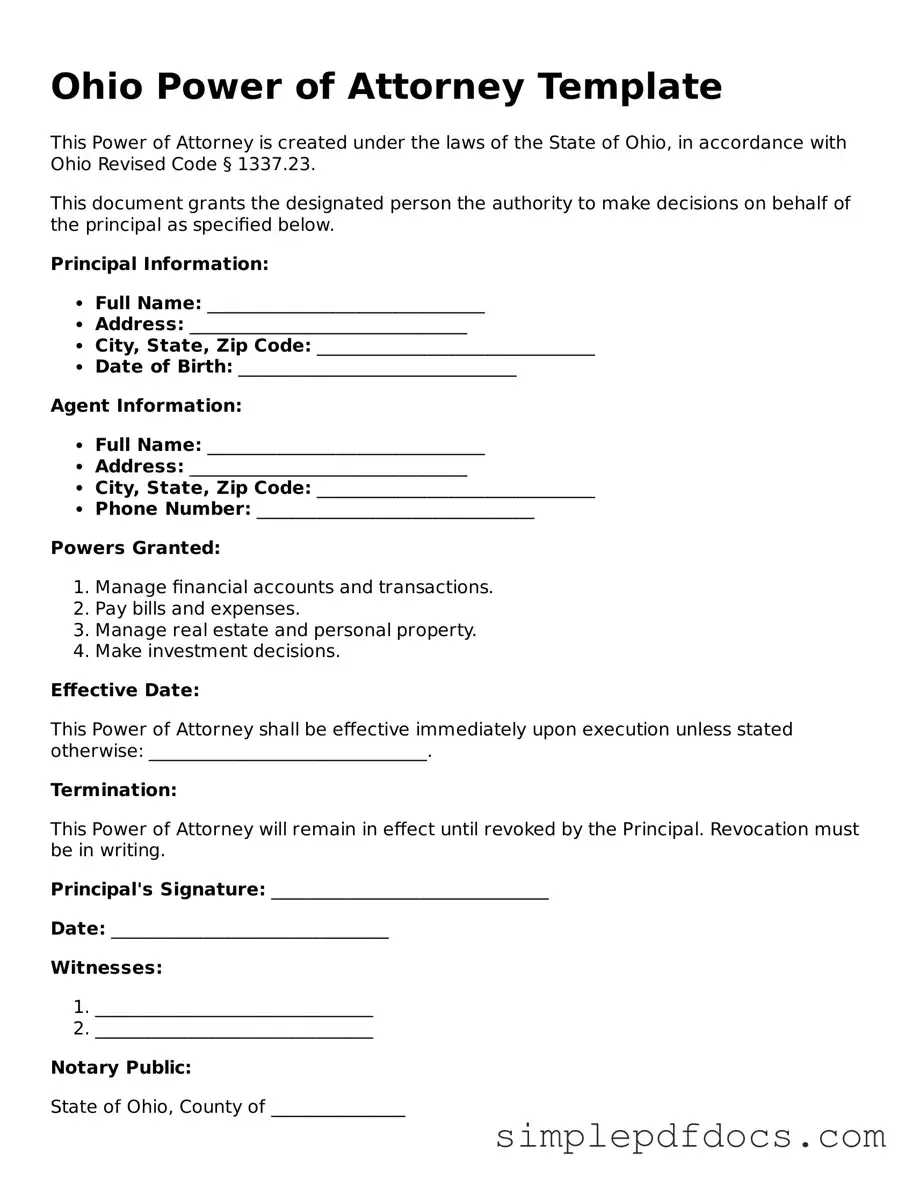

Filling out the Ohio Power of Attorney form is a crucial step in ensuring your financial and legal matters are managed according to your wishes. Once you have completed the form, it will need to be signed and possibly notarized, depending on your specific needs. Here are the steps to guide you through the process of filling out the form.

- Begin by obtaining the official Ohio Power of Attorney form. You can find it online or through local legal offices.

- Clearly print your name and address in the designated sections at the top of the form. Make sure this information is accurate.

- Identify the agent you are appointing. Write their full name, address, and relationship to you in the specified area.

- Decide on the powers you wish to grant your agent. You can choose to give them broad powers or limit their authority to specific tasks. Mark the appropriate boxes accordingly.

- Include any additional instructions or limitations you want to impose on the agent’s authority in the provided section. Be clear and concise.

- Indicate the effective date of the Power of Attorney. You can choose to make it effective immediately or at a later date.

- Sign and date the form in the presence of a notary public if required. Ensure that the notary completes their section properly.

- Make copies of the signed form for your records and for your agent, as they will need it to act on your behalf.

After completing these steps, ensure that your agent understands their responsibilities. It’s important to communicate openly about your wishes and any specific instructions you have provided in the form.

Dos and Don'ts

When filling out the Ohio Power of Attorney form, it's essential to follow certain guidelines to ensure the document is valid and effective. Here are seven important dos and don'ts:

- Do read the entire form carefully before starting to fill it out.

- Do clearly identify the principal and the agent with full names and addresses.

- Do specify the powers you are granting to the agent. Be as detailed as possible.

- Do sign the form in the presence of a notary public to ensure its validity.

- Don't leave any sections blank. Incomplete forms can lead to issues later.

- Don't use outdated forms. Always check for the most current version of the Power of Attorney form.

- Don't assume verbal agreements are sufficient. Everything must be documented in writing.

Documents used along the form

When preparing a Power of Attorney in Ohio, it is often beneficial to consider additional documents that can complement or enhance your estate planning. These forms can help ensure that your wishes are clearly communicated and legally binding. Below is a list of documents frequently used alongside the Ohio Power of Attorney form.

- Living Will: This document outlines your preferences for medical treatment in case you become unable to communicate your wishes. It specifies what types of life-sustaining measures you want or do not want.

- Health Care Proxy: A health care proxy designates an individual to make medical decisions on your behalf if you are unable to do so. This person is often a trusted family member or friend.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if you become incapacitated. It allows your agent to manage your financial affairs.

- Will: A will is a legal document that outlines how your assets should be distributed after your death. It can also name guardians for minor children.

- Florida Power of Attorney: In Florida, a power of attorney form is essential for allowing someone to act on your behalf in various matters. For detailed information, you can visit floridaforms.net/blank-power-of-attorney-form/.

- Trust: A trust can hold assets for your beneficiaries and can help avoid probate. It allows for more control over when and how your assets are distributed.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon your death.

- Real Estate Transfer Documents: These documents facilitate the transfer of property ownership and can be essential for estate planning, especially if real estate is involved.

- Authorization for Release of Medical Records: This form allows designated individuals to access your medical records, ensuring they can make informed decisions regarding your health care.

- Financial Power of Attorney: This document grants authority to someone to handle your financial matters, including banking, investments, and real estate transactions.

Each of these documents plays a vital role in comprehensive estate planning. By considering them alongside your Power of Attorney, you can ensure that your wishes are respected and that your loved ones are prepared to act in your best interests.