Legal Operating Agreement Document for the State of Ohio

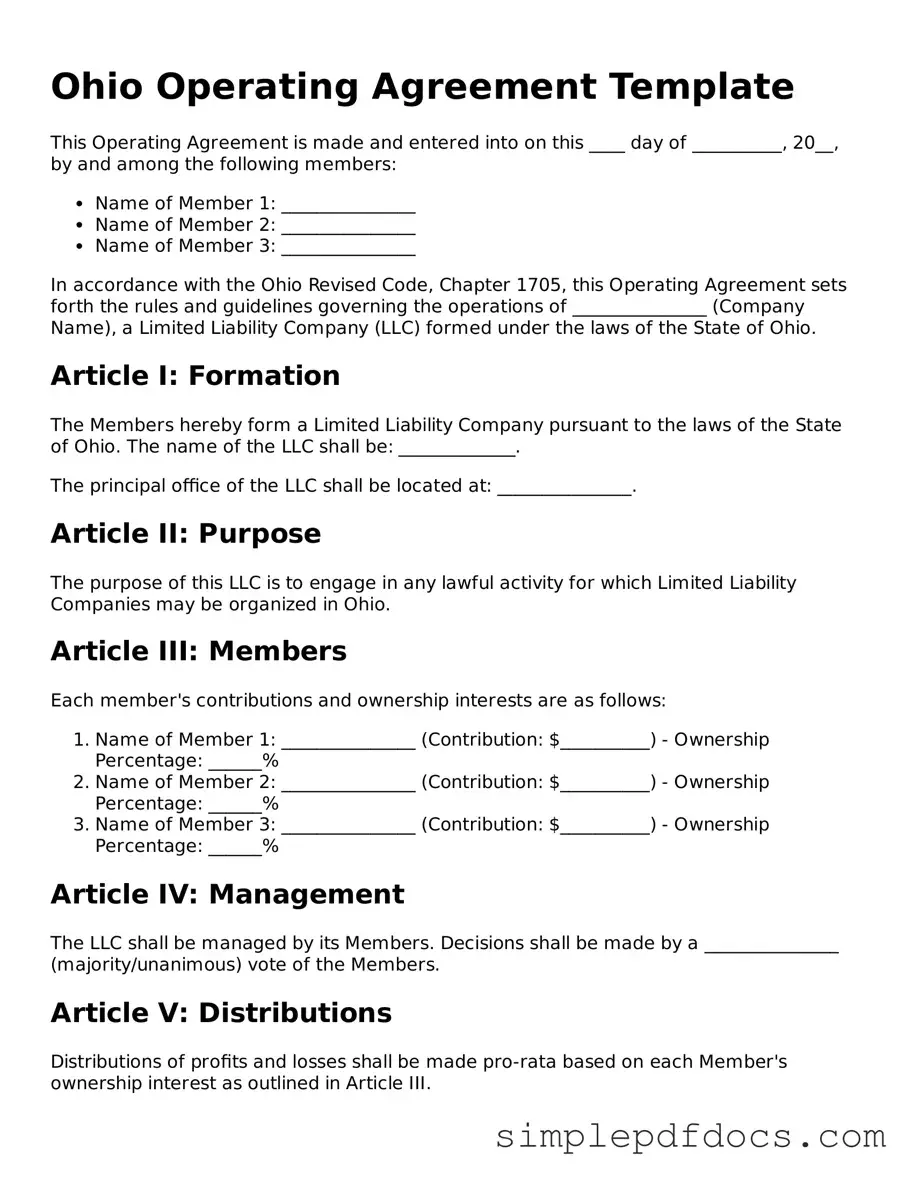

When forming a limited liability company (LLC) in Ohio, one of the most critical documents to prepare is the Operating Agreement. This essential form serves as the backbone of your business structure, outlining the roles, responsibilities, and rights of each member involved. It provides clarity on how the LLC will be managed, detailing decision-making processes, profit distribution, and procedures for adding or removing members. Additionally, the Operating Agreement addresses potential scenarios such as member disputes or the dissolution of the company, ensuring that all parties are aware of their obligations and the procedures to follow. While Ohio does not mandate the creation of this document, having a well-drafted Operating Agreement can significantly enhance the credibility of your LLC and protect its members from personal liability. By establishing clear guidelines, the Operating Agreement not only fosters smoother operations but also serves as a valuable tool in legal disputes, should they arise. Understanding and completing this form is a crucial step for any entrepreneur looking to build a solid foundation for their business in Ohio.

Consider Other Common Operating Agreement Templates for Specific States

How to Write an Operating Agreement - The agreement often describes how the LLC will be dissolved if necessary.

If you're looking to understand more about a quitclaim deed's role in property transfers, this resource can guide you through the process and provide any necessary insights.

Creating an Operating Agreement - This document details the rights and responsibilities of LLC members.

Llc Template - An Operating Agreement can promote transparency among the members of the LLC.

PDF Details

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | The agreement is governed by Ohio Revised Code § 1705, which regulates LLCs in the state. |

| Members | All members of the LLC should be included in the agreement, detailing their rights and responsibilities. |

| Management Structure | The agreement can specify whether the LLC is member-managed or manager-managed. |

| Profit Distribution | It outlines how profits and losses will be distributed among members. |

| Amendments | The agreement should include procedures for making amendments to the document in the future. |

| Dispute Resolution | It may provide methods for resolving disputes among members, such as mediation or arbitration. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a set term. |

| Initial Contributions | Members' initial contributions to the LLC should be documented in the agreement. |

| Compliance | Having an operating agreement is not mandatory in Ohio, but it is highly recommended for legal clarity and protection. |

How to Write Ohio Operating Agreement

After obtaining the Ohio Operating Agreement form, you'll need to complete it accurately to establish the framework for your business operations. This document will outline the roles, responsibilities, and rights of the members involved in the business. Follow these steps to ensure that you fill out the form correctly.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal office address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Make sure to include their full legal names.

- Indicate the percentage of ownership for each member. This reflects their stake in the LLC.

- Outline the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Include details about how profits and losses will be distributed among the members.

- State the duration of the LLC. If it is perpetual, indicate that clearly.

- Describe the procedures for adding or removing members from the LLC.

- Include any additional provisions that are relevant to your specific business needs.

- Finally, ensure that all members sign and date the agreement to validate it.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, there are important dos and don'ts to keep in mind. Following these guidelines can help ensure that your form is completed accurately.

- Do read the instructions carefully before starting. Understanding the requirements will save you time and effort.

- Do provide accurate information. Ensure that names, addresses, and other details are correct to avoid future issues.

- Do have all members review the agreement. This promotes transparency and agreement among all parties involved.

- Do keep a copy for your records. Having a copy will be useful for future reference or in case of disputes.

- Don't rush through the form. Taking your time helps prevent mistakes that could delay processing.

- Don't leave any required fields blank. Missing information can lead to rejection of the form.

- Don't use vague language. Be clear and specific in your descriptions to avoid misunderstandings.

- Don't forget to sign the agreement. An unsigned document may not be considered valid.

Documents used along the form

An Ohio Operating Agreement is a crucial document for LLCs, outlining the management structure and operational guidelines of the business. When establishing an LLC in Ohio, several other forms and documents complement the Operating Agreement. Each of these documents serves a specific purpose, ensuring that the business operates smoothly and complies with state regulations.

- Articles of Organization: This foundational document is filed with the Ohio Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of its registered agent.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. It is necessary for opening a business bank account and hiring employees.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They outline each member's share in the business and can be important for legal and financial documentation.

- Bylaws: While not required for LLCs, bylaws can provide additional governance structure. They outline the rules for meetings, voting, and the roles of members or managers.

- Operating Procedures: This document details the day-to-day operational processes of the LLC. It can cover everything from financial management to employee responsibilities.

- Business Licenses and Permits: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level to operate legally.

- Annual Reports: Many states, including Ohio, require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the business.

- Florida Marriage Application: Before planning your wedding, ensure you are aware of necessary forms like the Florida Forms, which are essential for obtaining a marriage license in the state.

- Tax Forms: LLCs must file specific tax forms with both the state and federal government. These forms ensure compliance with tax obligations and can vary based on the LLC's structure.

- Member Agreements: These agreements outline the rights and responsibilities of each member, including profit distribution and decision-making processes, complementing the Operating Agreement.

Understanding these documents can greatly enhance the management and legal standing of an LLC in Ohio. Each form plays a vital role in ensuring that the business is compliant, well-organized, and positioned for success.