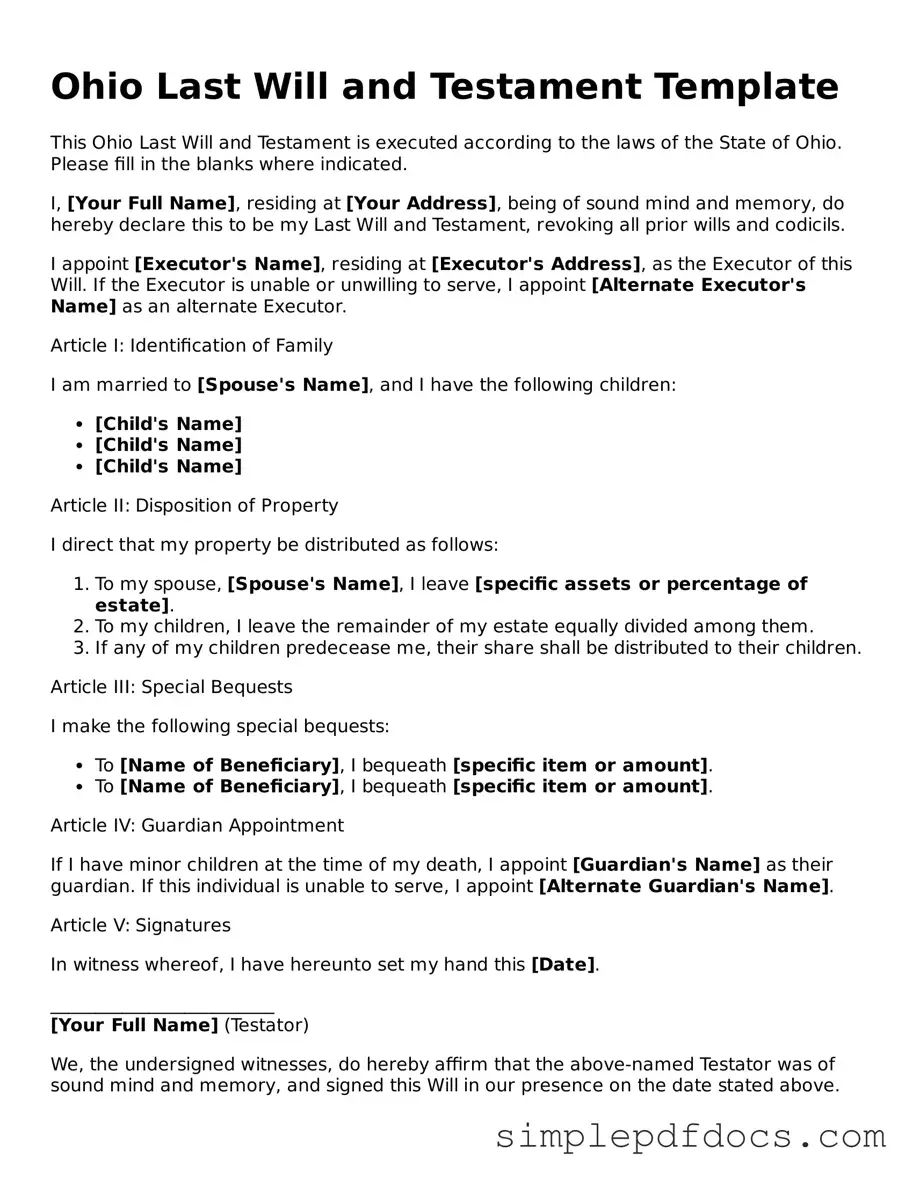

Legal Last Will and Testament Document for the State of Ohio

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Ohio, this legal document outlines how your assets will be distributed, who will manage your estate, and who will care for any minor children. The Ohio Last Will and Testament form allows you to specify your beneficiaries, designate an executor, and provide instructions for funeral arrangements. It is important to ensure that the will is signed and witnessed according to state laws to make it valid. Without a properly executed will, the state will decide how your assets are distributed, which may not align with your intentions. Understanding the key components of this form can help you take control of your legacy and provide peace of mind for both you and your loved ones.

Consider Other Common Last Will and Testament Templates for Specific States

North Carolina Will Template - Documents health care decisions if addressed within the will.

Can You Make a Will Yourself - This form provides structure and guidance for resolving your estate matters after your death, easing the burden on your family.

For those navigating the complexities of a tractor transaction, the important Tractor Bill of Sale requirements provide guidance to ensure proper documentation of the ownership transfer and to protect the interests of all parties involved.

Simple Last Will and Testament Sample - Encourages open discussions among family members about inheritance matters.

How to Make a Will in Pennsylvania - Safeguards personal legacies, ensuring stories and memories are honored.

PDF Details

| Fact Name | Description |

|---|---|

| Legal Requirement | In Ohio, a Last Will and Testament must be in writing, signed by the testator, and witnessed by at least two individuals who are not beneficiaries. |

| Governing Law | The Ohio Revised Code, specifically Section 2107.01, governs the creation and validity of wills in Ohio. |

| Revocation | A will can be revoked in Ohio by creating a new will, by physically destroying the existing will, or by a written declaration stating the intent to revoke. |

| Executor Appointment | The testator can name an executor in their will, who will be responsible for administering the estate according to the will's instructions. |

How to Write Ohio Last Will and Testament

Once you have gathered the necessary information, it’s time to fill out the Ohio Last Will and Testament form. Completing this form accurately is essential to ensure your wishes are honored. Follow these steps carefully to ensure everything is in order.

- Obtain the form: Download the Ohio Last Will and Testament form from a reliable source or visit your local probate court to get a physical copy.

- Enter your personal information: Fill in your full name, address, and date of birth at the top of the form.

- Designate an executor: Choose a trusted individual to act as your executor. Write their name and contact information in the designated section.

- List your beneficiaries: Clearly identify the individuals or organizations you wish to inherit your assets. Include their full names and relationship to you.

- Detail your assets: Provide a comprehensive list of your assets, including property, bank accounts, and personal belongings. Specify how you want these assets distributed among your beneficiaries.

- Include guardianship information: If you have minor children, designate a guardian for them. Make sure to include their name and relationship to your children.

- Sign the document: After reviewing the form for accuracy, sign and date it in the presence of witnesses.

- Obtain witness signatures: Have at least two witnesses sign the form. They should not be beneficiaries to avoid conflicts of interest.

- Store the will safely: Keep the completed document in a secure location, such as a safe or with a trusted family member or attorney.

Dos and Don'ts

When filling out the Ohio Last Will and Testament form, it's important to approach the task with care. Here are some guidelines to help ensure that your will is valid and reflects your wishes.

- Do: Clearly state your full name and address at the beginning of the document.

- Do: Identify your beneficiaries by full name and relationship to you.

- Do: Specify how you want your assets distributed among your beneficiaries.

- Do: Sign the will in the presence of at least two witnesses who are not beneficiaries.

- Do: Keep the original will in a safe place and inform your executor of its location.

- Do: Review and update your will periodically, especially after major life events.

- Don't: Use vague language that could lead to confusion about your intentions.

- Don't: Forget to date your will, as this helps establish its validity over any previous versions.

- Don't: Leave out important details, such as specific bequests or instructions for your funeral.

- Don't: Sign the will without the required witnesses present.

- Don't: Store the will in a location that is not easily accessible to your executor.

- Don't: Ignore state laws regarding wills, as they can vary and impact the validity of your document.

Documents used along the form

When preparing a Last Will and Testament in Ohio, several other documents can complement this essential legal instrument. These documents help clarify intentions, manage assets, and ensure that your wishes are respected after your passing. Here’s a list of some common forms and documents that are often used alongside a will.

- Living Will: This document outlines your preferences regarding medical treatment in situations where you may be unable to communicate your wishes. It typically addresses life-sustaining measures and end-of-life care.

- Vehicle Power of Attorney: This document allows individuals to designate someone else to handle their vehicle-related transactions, ensuring smooth operations in cases where they're unable to act themselves, such as buying or selling a vehicle. For more information, refer to Florida Forms.

- Durable Power of Attorney: This form allows you to designate someone to make financial or legal decisions on your behalf if you become incapacitated. It remains effective even if you lose the ability to make decisions.

- Health Care Power of Attorney: Similar to a durable power of attorney, this document specifically grants someone the authority to make medical decisions for you when you cannot do so yourself.

- Trust Document: A trust can manage your assets during your lifetime and after your death. It can help avoid probate and may provide specific instructions on how your assets should be distributed.

- Affidavit of Heirship: This document can help establish the heirs of an estate when someone dies without a will. It provides a sworn statement regarding the deceased’s family and property.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes or additions without creating an entirely new will, provided the changes are properly documented.

- Beneficiary Designation Forms: These forms are used for financial accounts, insurance policies, and retirement plans. They specify who will receive these assets upon your death, bypassing the will.

- Letter of Instruction: While not a legal document, this letter provides guidance to your loved ones about your wishes, funeral arrangements, and other personal matters that may not be covered in your will.

- Inventory of Assets: This document lists all of your assets and liabilities. It can be helpful for your executor to understand the estate’s value and manage the distribution of assets.

Understanding these documents can help you create a comprehensive estate plan that reflects your wishes and protects your loved ones. By considering these forms, you can ensure a smoother process during a difficult time for your family and friends.